Berkshire Hathaway 1998 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 1998 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24

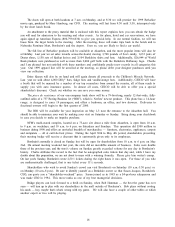

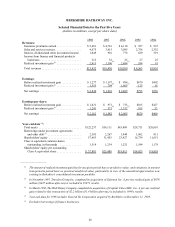

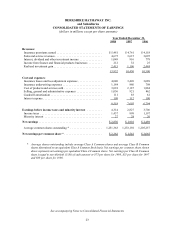

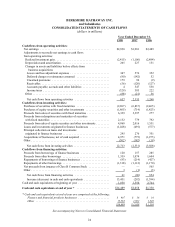

BERKSHIRE HATHAWAY INC.

and Subsidiaries

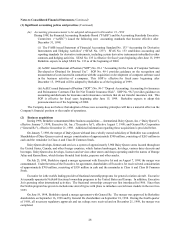

CONSOLIDATED STATEMENTS OF CASH FLOWS

(dollars in millions)

Year Ended December 31,

1998 1997 1996

Cash flows from operating activities:

Net earnings .............................................. $2,830 $1,901 $2,489

Adjustments to reconcile net earnings to cash flows

from operating activities:

Realized investment gain .................................... (2,415) (1,106) (2,484)

Depreciation and amortization ................................ 265 227 151

Changes in assets and liabilities before effects from

business acquisitions:

Losses and loss adjustment expenses .......................... 347 576 352

Deferred charges re reinsurance assumed ...................... (80) (142) 52

Unearned premiums ...................................... 179 90 (9)

Receivables ............................................. (56) (120) (127)

Accounts payable, accruals and other liabilities .................. 4 547 558

Income taxes ............................................ (329) 383 222

Other ................................................... (88) (21) 56

Net cash flows from operating activities ....................... 657 2,335 1,260

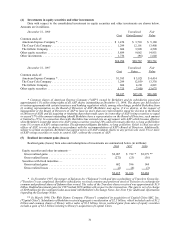

Cash flows from investing activities:

Purchases of securities with fixed maturities ...................... (2,697) (6,837) (2,465)

Purchases of equity securities and other investments ................ (1,865) (714) (1,423)

Proceeds from sales of securities with fixed maturities ............... 6,339 3,397 277

Proceeds from redemptions and maturities of securities

with fixed maturities ....................................... 2,132 779 792

Proceeds from sales of equity securities and other investments ......... 4,868 2,016 1,531

Loans and investments originated in finance businesses ............. (1,028) (491) (577)

Principal collection on loans and investments

originated in finance businesses ............................... 295 276 351

Acquisitions of businesses, net of cash acquired .................... 4,971 (775) (1,975)

Other .................................................... (302) (182) (19)

Net cash flows from investing activities ........................ 12,713 (2,531)(3,508)

Cash flows from financing activities:

Proceeds from borrowings of finance businesses ................... 120 157 285

Proceeds from other borrowings ............................... 1,339 1,074 1,604

Repayments of borrowings of finance businesses ................... (83) (214) (427)

Repayments of other borrowings ............................... (1,318) (1,112) (1,170)

Net proceeds from issuance of Class B Common Stock .............. — — 565

Other .................................................... 3 (1) (3)

Net cash flows from financing activities ....................... 61 (96) 854

Increase (decrease) in cash and cash equivalents ................. 13,431 (292) (1,394)

Cash and cash equivalents at beginning of year ..................... 1,058 1,350 2,744

Cash and cash equivalents at end of year * ...................... $14,489 $1,058 $1,350

* Cash and cash equivalents at end of year are comprised of the following:

Finance and financial products businesses ..................... $ 907 $ 56 $ 10

Other ................................................. 13,582 1,002 1,340

$14,489 $ 1,058 $ 1,350

See accompanying Notes to Consolidated Financial Statements