Berkshire Hathaway 1998 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 1998 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45

Management's Discussion (Continued)

Insurance Segments - Underwriting (continued)

Berkshire Hathaway Reinsurance Group (continued)

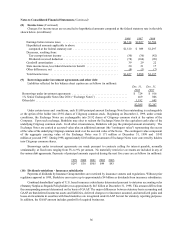

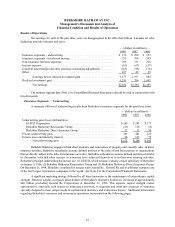

Premiums earned from other property and casualty excess-of-loss and quota-share reinsurance contracts

totaled $310 million in 1998, $513 million in 1997 and $485 million in 1996. These contracts often provide

considerable amounts of indemnification in exchange for large premiums. Certain of these contracts, which produced

annual premiums of approximately $200 million in 1997 and 1996, expired at the end of 1997 and were not renewed

in 1998. Other property and casualty reinsurance contracts produced net underwriting losses of approximately $86

million in 1998, $73 million in 1997 and $101 million in 1996. Premiums from these types of reinsurance contracts

are often based, in part, on time discounting of estimated loss payments because such payments are expected to occur

over lengthy time periods. Estimated claim liabilities are established for financial reporting purposes without

recognition of such discounting, thus producing underwriting losses. This business is accepted because of the large

amounts of policyholder float that it generates.

Premiums earned from retroactive reinsurance and structured settlement contracts were $343 million in 1998

and $144 million in 1997. Minor amounts of premiums were earned from such contracts in 1996. These contracts

provide excess of loss coverage with respect to past loss events or periodic payments to claimants in connection with

settled claims. Underwriting losses occur from such policies as a result of the recurring recognition of time value of

money concepts—the amortization of deferred charges re reinsurance assumed and the accretion of discounted structured

settlement liabilities. The amortization and accretion charges are reported as losses incurred, and because there is no

offsetting premium income, as underwriting losses. Underwriting losses from retroactive reinsurance and structured

settlement contracts were $90 million in 1998, $82 million in 1997 and $74 million in 1996.

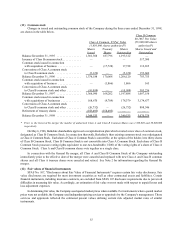

Berkshire Hathaway Direct Insurance Group

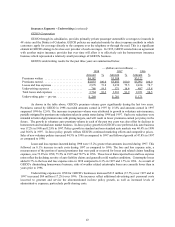

The Berkshire Hathaway Direct Insurance Group is comprised of a wide variety of smaller property/casualty

businesses. These businesses include: National Indemnity Company's traditional commercial motor vehicle and

specialty risk operations; five companies collectively referred to as "homestate" operations that provide primarily

standard commercial coverages to insureds in an increasing number of states; Cypress Insurance Company, a provider

of workers' compensation insurance in California and other states; Central States Indemnity Company, a provider of

credit card credit insurance to individuals nationwide through financial institutions; Kansas Bankers Surety Company,

an insurer for primarily small and medium size banks located in the midwest; and Berkshire Hathaway International,

a London-based writer of personal and commercial auto insurance.

Collectively, the Berkshire Hathaway Direct Insurance businesses produced earned premiums of $328 million

in 1998, $312 million in 1997 and $268 million in 1996. Increases in premiums earned in 1998 and 1997 were

achieved by the homestate, credit card credit, international auto and specialty risk businesses offset by comparative

declines in the traditional commercial motor vehicle business. Net underwriting gains attributed to direct insurance

activities were $17 million in 1998, $52 million in 1997 and $59 million in 1996. The decline in 1998 underwriting

results as compared to 1997 principally derived from the traditional motor vehicle and specialty risk operations.

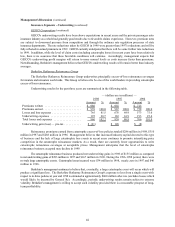

General Re

On December 21, 1998, General Re became a wholly owned subsidiary of Berkshire upon completion of the

merger of the two companies. Berkshire’s results of operations in 1998 include the results of General Re for the last

ten days of 1998. Although the revenues and operating results of General Re for that ten-day period are not significant

to Berkshire for the full year, General Re will have a major impact on Berkshire’s results in future periods. For purposes

of this discussion, General Re’s results for the last ten days of 1998 are included in other sources of earnings.