Berkshire Hathaway 1998 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 1998 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

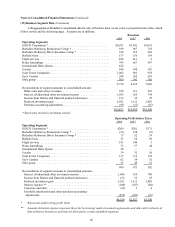

Notes to Consolidated Financial Statements (Continued)

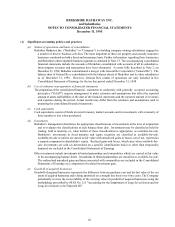

(8) Income taxes (Continued)

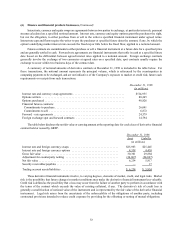

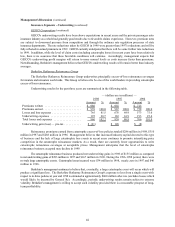

Charges for income taxes are reconciled to hypothetical amounts computed at the federal statutory rate in the table

shown below (in millions):

1998 1997 1996

Earnings before income taxes ..................................... $4,314 $2,827 $3,706

Hypothetical amounts applicable to above

computed at the federal statutory rate .............................. $1,510 $ 989 $1,297

Decreases, resulting from:

Tax-exempt interest income ..................................... (30) (36) (42)

Dividends received deduction .................................... (78) (104) (90)

Goodwill amortization ........................................... 39 29 22

State income taxes, less federal income tax benefit ..................... 20 21 17

Other differences, net ........................................... (4) (1) (7)

Total income taxes ............................................. $1,457 $ 898 $1,197

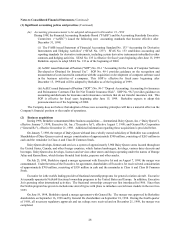

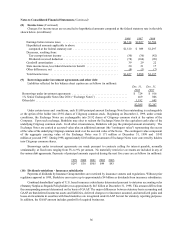

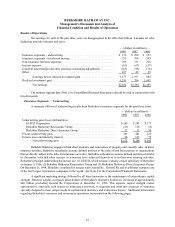

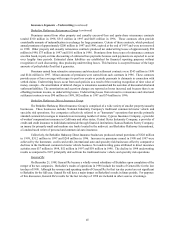

(9) Borrowings under investment agreements and other debt

Liabilities reflected for this balance sheet caption are as follows (in millions): Dec. 31, Dec. 31,

1998 1997

Borrowings under investment agreements ..................................... $ 724 $ 816

1% Senior Exchangeable Notes Due 2001 (“Exchange Notes”) ..................... 469 806

Other debt ............................................................. 1,192 645

$2,385 $2,267

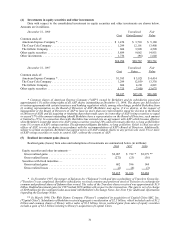

Under certain terms and conditions, each $1,000 principal amount Exchange Note then outstanding is exchangeable

at the option of the holder into 29.92 shares of Citigroup common stock. Beginning on December 2, 1999, under certain

conditions, the Exchange Notes are exchangeable into 29.92 shares of Citigroup common stock at the option of the

Company. Upon such exchange, Berkshire may elect to redeem the Exchange Notes for the equivalent cash value of the

underlying Citigroup common stock. In all other circumstances, Berkshire will pay the principal amount at maturity. The

Exchange Notes are carried at accreted value plus an additional amount (the "contingent value") representing the excess

of the value of the underlying Citigroup common stock over the accreted value of the Notes. The contingent value component

of the aggregate carrying value of the Exchange Notes was $ 171 million at December 31, 1998 and $343

million at year end 1997. During 1998, approximately $185 million par amount of Exchange Notes were converted by holders

into Citigroup common shares.

Borrowings under investment agreements are made pursuant to contracts calling for interest payable, normally

semiannually, at fixed rates ranging from 3% to 9% per annum. No materially restrictive covenants are included in any of

the various debt agreements. Payments of principal amounts expected during the next five years are as follows (in millions):

1999 2000 2001 2002 2003

$297 $30 $505 $49 $93

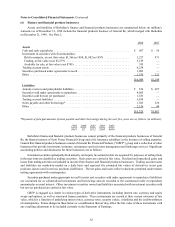

(10) Dividend restrictions - Insurance subsidiaries

Payments of dividends by Insurance Group members are restricted by insurance statutes and regulations. Without prior

regulatory approval in 1999, Berkshire can receive up to approximately $4 billion as dividends from insurance subsidiaries.

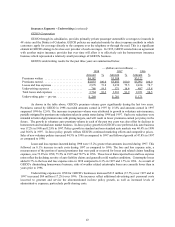

Combined shareholders' equity of U.S. based insurance subsidiaries determined pursuant to statutory accounting rules

(Statutory Surplus as Regards Policyholders) was approximately $45 billion at December 31, 1998. This amount differs from

the corresponding amount determined on the basis of GAAP. The major differences between statutory basis accounting and

GAAP are that deferred income tax assets and liabilities, deferred charges re reinsurance assumed, and unrealized gains and

losses on investments in securities with fixed maturities are recognized under GAAP but not for statutory reporting purposes.

In addition, the GAAP amount includes goodwill of acquired businesses.