Berkshire Hathaway 1998 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 1998 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4

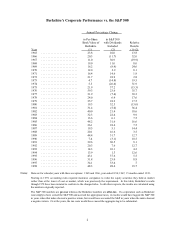

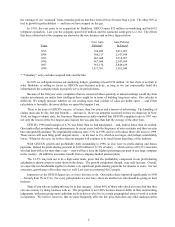

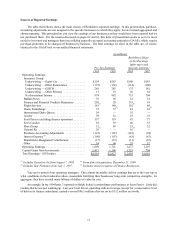

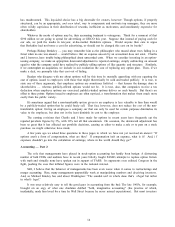

Pre-tax Earnings Per Share

Investments With All Income from

Year Per Share Investments Excluded

1968 ........................................... $ 53 $ 2.87

1978 ........................................... 465 12.85

1988 ........................................... 4,876 145.77

1998 ........................................... 47,647 474.45

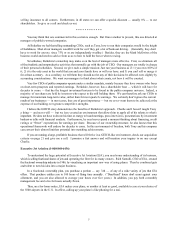

Here are the growth rates of the two segments by decade:

Pre-tax Earnings Per Share

Investments With All Income from

Decade Ending Per Share Investments Excluded

1978 ........................................... 24.2% 16.2%

1988 ........................................... 26.5% 27.5%

1998 ........................................... 25.6% 12.5%

Annual Growth Rate, 1968-1998 ...................... 25.4% 18.6%

During 1998, our investments increased by $9,604 per share, or 25.2%, but per-share operating earnings fell by

33.9%. General Re (included, as noted, on a pro-forma basis) explains both facts. This company has very large

investments, and these greatly increased our per-share investment figure. But General Re also had an underwriting loss

in 1998, and that hurt operating earnings. Had we not acquired General Re, per-share operating earnings would have

shown a modest gain.

Though certain of our acquisitions and operating strategies may from time to time affect one column more than the

other, we continually work to increase the figures in both. But one thing is certain: Our future rates of gain will fall far

short of those achieved in the past. Berkshire’s capital base is now simply too large to allow us to earn truly outsized

returns. If you believe otherwise, you should consider a career in sales but avoid one in mathematics (bearing in mind

that there are really only three kinds of people in the world: those who can count and those who can’t).

Currently we are working to compound a net worth of $57.4 billion, the largest of any American corporation

(though our figure will be eclipsed if the merger of Exxon and Mobil takes place). Of course, our lead in net worth does

not mean that Berkshire outranks all other businesses in value: Market value is what counts for owners and General

Electric and Microsoft, for example, have valuations more than three times Berkshire’s. Net worth, though, measures

the capital that managers must deploy, and at Berkshire that figure has indeed become huge.

Nonetheless, Charlie and I will do our best to increase intrinsic value in the future at an average rate of 15%, a

result we consider to be at the very peak of possible outcomes. We may have years when we exceed 15%, but we will

most certainly have other years when we fall far short of that — including years showing negative returns — and those

will bring our average down. In the meantime, you should understand just what an average gain of 15% over the next

five years implies: It means we will need to increase net worth by $58 billion. Earning this daunting 15% will require

us to come up with big ideas: Popcorn stands just won’t do. Today’s markets are not friendly to our search fo r

“elephants,” but you can be sure that we will stay focused on the hunt.

Whatever the future holds, I make you one promise: I’ll keep at least 99% of my net worth in Berkshire for as long

as I am around. How long will that be? My model is the loyal Democrat in Fort Wayne who asked to be buried in

Chicago so that he could stay active in the party. To that end, I’ve already selected a “power spot” at the office for my

urn.

* * * * * * * * * * * *

Our financial growth has been matched by employment growth: We now have 47,566 on our payroll, with the

acquisitions of 1998 bringing 7,074 employees to us and internal growth adding another 2,500. To balance this gain