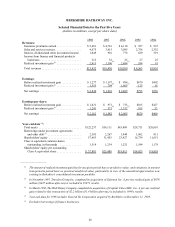

Berkshire Hathaway 1998 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 1998 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.13

At yearend, we held more than $15 billion in cash equivalents (including high-grade securities due in less

than one year). Cash never makes us happy. But it’s better to have the money burning a hole in Berkshire’ s

pocket than resting comfortably in someone else’s. Charlie and I will continue our search for large equit y

investments or, better yet, a really major business acquisition that would absorb our liquid assets. Currently,

however, we see nothing on the horizon.

Once we knew that the General Re merger would definitely take place, we asked the company to dispose of

the equities that it held. (As mentioned earlier, we do not manage the Cologne Re portfolio, which includes many

equities.) General Re subsequently eliminated its positions in about 250 common stocks, incurring $935 million

of taxes in the process. This “clean sweep” approach reflects a basic principle that Charlie and I employ in

business and investing: We don’t back into decisions.

Last year I deviated from my standard practice of not disclosing our investments (other than those we are

legally required to report) and told you about three unconventional investments we had made. There were several

reasons behind that disclosure. First, questions about our silver position that we had received from regulatory

authorities led us to believe that they wished us to publicly acknowledge this investment. Second, our holdings

of zero-coupon bonds were so large that we wanted our owners to know of this investment’s potential impact on

Berkshire’s net worth. Third, we simply wanted to alert you to the fact tha t we sometimes do make unconventional

commitments.

Normally, however, as discussed in the Owner’s Manual on page 61, we see no advantage in talking about

specific investment actions. Therefore — unless we again take a position that is particularly large — we will not

post you as to what we are doing in respect to any specific holding of an unconventional sort. We can report,

however, that we have eliminated certain of the positions discussed last year and added certain others.

Our never-comment-even-if-untrue policy in regard to investments may disappoint “piggybackers” but will

benefit owners: Your Berkshire shares would be worth less if we discussed what we are doing. Incidentally, we

should warn you that media speculation about our investment moves continues in most cases to be incorrect.

People who rely on such commentary do so at their own peril.

Accounting — Part 1

Our General Re acquisition put a spotlight on an egregious flaw in accounting procedure. Sharp-eyed

shareholders reading our proxy statement probably noticed an unusual item on page 60. In the pro-forma

statement of income — which detailed how the combined 1997 earnings of the two entities would have been

affected by the merger — there was an item stating that compensation expense would have been increased by $63

million.

This item, we hasten to add, does not signal that either Charlie or I have experienced a major personality

change. (He still travels coach and quotes Ben Franklin.) Nor does it indicate any shortcoming in General Re’s

accounting practices, which have followed GAAP to the letter. Instead, the pro-forma adjustment came about

because we are replacing General Re’s longstanding stock option plan with a cash plan that ties the incentiv e

compensation of General Re managers to their operating achievements. Formerly what counted for these managers

was General Re’s stock price; now their payoff will come from the business performance they deliver.

The new plan and the terminated option arrangement have matching economics, which means that the rewards

they deliver to employees should, for a given level of performance, be the same. But what these people could have

formerly anticipated earning from new option grants will now be paid in cash. (Options granted in past years

remain outstanding.)

Though the two plans are an economic wash, the cash plan we are putting in will produce a vastly different

accounting result. This Alice-in-Wonderland outcome occurs because existing accounting principles ignore the cost

of stock options when earnings are being calculated, even though options are a huge and increasing expense at a

great many corporations. In effect, accounting principles offer management a choice: Pay employees in one form

and count the cost, or pay them in another form and ignore the cost. Small wonder then that the use of options