Berkshire Hathaway 1998 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 1998 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

Management's Discussion (Continued)

Financial Products Risk

The finance and financial products operations are subject to market risk principally through General Re

Financial Products (“GRFP”). GRFP monitors its market risk on a daily basis across all swap and option products by

calculating the effect on operating results of potential changes in market variables over a one week period, based on

historical market volatility, correlation data and informed judgment. This evaluation is done on an individual trading

book basis, against limits set by individual book, to a 95% probability level. GRFP sets market risk limits for each type

of risk, and for an aggregate measure of risk, based on a 99% probability that movements in market rates will not affect

the results from operations in excess of the risk limit over a one week period. GRFP’s weekly aggregate market risk

limit is $15 million. Risk is measured primarily by Monte Carlo simulations to obtain the required degree of confidence.

In addition to these daily and weekly assessments of risk, GRFP prepares periodic stress tests to assess its exposure to

extreme movements in various market risk factors.

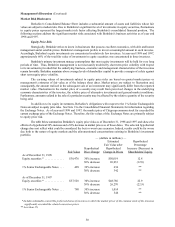

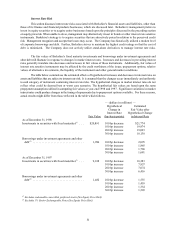

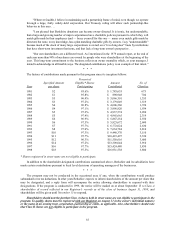

The table below shows the highest, lowest and average value at risk, as calculated using the above methodology,

by broad category of market risk to which GRFP is exposed.

— (dollars in millions) —

Foreign

Interest Rate Exchange Rate Equity All Risks

Highest ................................ $9 $7 $8 $13

Lowest ................................. 5 2 2 6

Average ................................ 7 4 5 9

GRFP evaluates and records a fair-value adjustment to recognize counterparty credit exposure and future costs

associated with administering each contract. The expected credit exposure for each trade is initially established on the

trade date and is determined through the use of a proprietary credit exposure model that is based on historical default

probabilities, market volatilities and, if applicable, the legal right of setoff. These exposures are continually monitored

and adjusted due to changes in the credit quality of the counterparty, changes in interest and currency rates or changes

in other factors affecting credit exposure. Since inception, GRFP has not experienced any credit losses.

Liquidity and Capital Resources

Berkshire's Consolidated Balance Sheet as of December 31, 1998, reflects continuing capital strength. In the

past three years, Berkshire shareholders' equity has increased from approximately $16.7 billion at December 31, 1995,

to approximately $57.4 billion at December 31, 1998. In that three-year period, realized and unrealized securities gains

increased equity capital by approximately $13.2 billion, and reinvested earnings, other than realized securities gains,

were about $3.4 billion.

Year 2000 Issue

Many computer systems in use today may be unable to correctly process data or may not operate at all after

December 31, 1999 because those systems recognize the year within a date only by the last two digits. Some computer

programs may interpret the year “00" as 1900, instead of as 2000, causing errors in calculations or the value “00" may

be considered invalid by the computer program, causing the system to fail. Year 2000 issues affect: (1) Information

Technology (IT) utilized in the Company’s widely diversified business information systems, including mainframe and

client server hardware and software applications, (2) non-IT systems utilized by the Company, such as communications,

facilities management, and manufacturing and service equipment containing embedded computer chips, and (3) IT and

non-IT systems of significant customers, suppliers, business partners and equity investees.

Berkshire and its subsidiaries could be adversely affected if Year 2000 issues are not resolved by Berkshire or

its significant customers, suppliers, business partners or equity investees before the Year 2000. Possible adverse

consequences include but are not limited to: (1) the inability to obtain products or services used in business operations,

(2) the inability to transact business with key customers, (3) the inability to execute transactions through the financial

markets, (4) the inability to manufacture or deliver goods or services sold to customers, (5) the decline in economic value

of one or more of Berkshire’s significant equity investees and (6) the occurrence of Year 2000 related losses under

property and casualty insurance and reinsurance contracts entered into by subsidiaries. Berkshire’s managemen t

believes that at least some minor disruptions due to Year 2000 issues will occur. On a worst case basis, if Berkshire,