Berkshire Hathaway 1998 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 1998 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

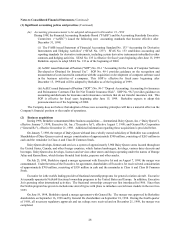

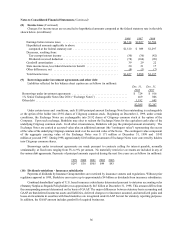

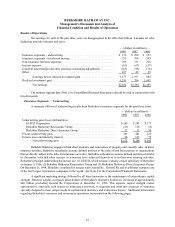

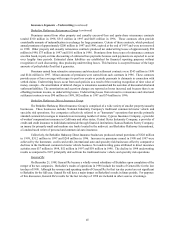

(11) Common stock

Changes in issued and outstanding common stock of the Company during the three years ended December 31, 1998,

are shown in the table below. Class B Common

$0.1667 Par Value

Class A Common, $5 Par Value (55,000,000 shares

(1,650,000 shares authorized*) authorized*)

Shares Treasury Shares Shares Issued and

Issued Shares Outstanding Outstanding

Balance December 31, 1995 ................ 1,381,308 187,796 1,193,512 —

Issuance of Class B common stock ............ — — — 517,500

Common stock issued in connection

with acquisition of business ............... —(17,728) 17,728 112,655

Conversions of Class A common stock

to Class B common stock ................. (5,120) — (5,120) 153,600

Balance December 31, 1996 ................ 1,376,188 170,068 1,206,120 783,755

Common stock issued in connection

with acquisition of business ............... —(1,866) 1,866 165

Conversions of Class A common stock

to Class B common stock and other ......... (10,098) — (10,098) 303,236

Balance December 31, 1997 ................ 1,366,090 168,202 1,197,888 1,087,156

Common stock issued in connection

with acquisitions of businesses ............. 168,670 (9,709) 178,379 3,174,677

Conversions of Class A common stock

to Class B common stock and other ......... (26,732) —(26,732) 808,546

Retirement of treasury shares ................ (158,493)(158,493) — —

Balance December 31, 1998 ................ 1,349,535 — 1,349,535 5,070,379

*Prior to the General Re merger the number of authorized Class A and Class B Common Shares was 1,500,000 and 50,000,000

respectively.

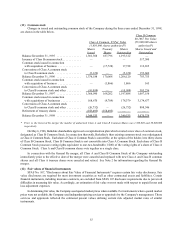

On May 6, 1996, Berkshire shareholders approved a recapitalization plan which created a new class of common stock,

designated as Class B Common Stock. In connection therewith, Berkshire's then existing common stock was redesignated

as Class A Common Stock. Each share of Class A Common Stock is convertible, at the option of the holder, into thirty shares

of Class B Common Stock. Class B Common Stock is not convertible into Class A Common Stock. Each share of Class B

Common Stock possesses voting rights equivalent to one-two-hundredth (1/200) of the voting rights of a share of Class A

Common Stock. Class A and Class B common shares vote together as a single class.

In connection with the General Re merger, all Class A and Class B Common Stock of the Company outstanding

immediately prior to the effective date of the merger were canceled and replaced with new Class A and Class B common

shares and all Class A treasury shares were canceled and retired. See Note 2 for information regarding the General Re

merger.

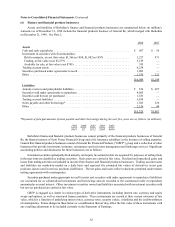

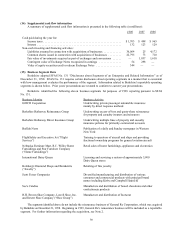

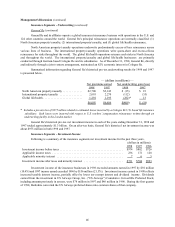

(12) Fair values of financial instruments

SFAS No. 107, "Disclosures about Fair Value of Financial Instruments" requires certain fair value disclosures. Fair

value disclosures are required for most investment securities as well as other contractual assets and liabilities. Certain

financial instruments, including insurance contracts, are excluded from SFAS 107 disclosure requirements due to perceived

difficulties in measuring fair value. Accordingly, an estimation of fair value was not made with respect to unpaid losses and

loss adjustment expenses.

In determining fair value, the Company used quoted market prices when available. For instruments where quoted market

prices were not available, the Company used independent pricing services or appraisals by the Company's management. Those

services and appraisals reflected the estimated present values utilizing current risk adjusted market rates of similar

instruments.