Berkshire Hathaway 1998 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 1998 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

Management's Discussion (continued)

Insurance Segments - Underwriting (continued)

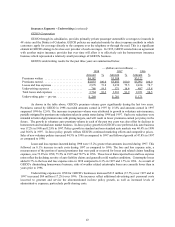

GEICO Corporation

GEICO through its subsidiaries, provides primarily private passenger automobile coverages to insureds in

48 states and the District of Columbia. GEICO policies are marketed mainly by direct response methods in which

customers apply for coverage directly to the company over the telephone or through the mail. This is a significant

element in GEICO’s strategy to be a low-cost provider of such coverages. In 1995, GEICO entered into an agreement

with another major insurance provider that over time will allow it to effectively exit the homeowners insurance

business which represented a relatively small percentage of GEICO’s business.

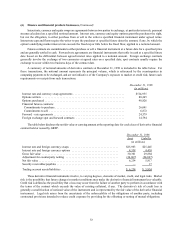

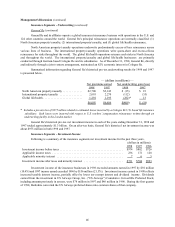

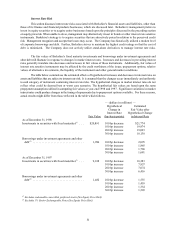

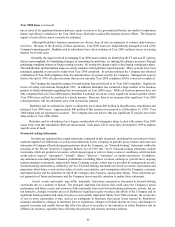

GEICO's underwriting results for the past three years are summarized below.

— (dollars are in millions) —

1998 1997 1996

Amount %Amount %Amount %

Premiums written ......................... $4,182 $3,588 $3,122

Premiums earned .......................... $4,033 100.0 $3,482 100.0 $3,092 100.0

Losses and loss expenses .................... 2,978 73.8 2,630 75.5 2,434 78.7

Underwriting expenses ..................... 786 19.5 571 16.4 487 15.8

Total losses and expenses ................... 3,764 93.3 3,201 91.9 2,921 94.5

Underwriting gain — pre-tax ................ $ 269 $ 281 $ 171

As shown in the table above, GEICO’s premium volume grew significantly during the last two years .

Premiums earned by GEICO in 1998 exceeded amounts earned in 1997 by 15.8% and amounts earned in 1997

surpassed 1996 by 12.6%. The increases in premium volume were attributed to growth in voluntary auto insurance,

partially mitigated by premium rate reductions taken in certain states during 1998 and 1997. Such rate reductions were

intended to better align premium rates with pricing targets, and will result in lower premiums earned per policy in the

future. The growth in voluntary auto premium volume in each of the past two years was also offset by declines in

homeowners and residual auto market business. In-force policy growth for GEICO's core preferred-risk auto business

was 17.2% in 1998 and 12.8% in 1997. Policy growth in standard and non-standard auto markets was 40.4% in 1998

and 36.6% in 1997. In-force policy growth reflects GEICO’s continued marketing efforts and competitive prices .

Sales of new voluntary policies increased 44.3% in 1998 as compared to 1997 and followed growth of 47.8% in 1997

as compared to 1996.

Losses and loss expenses incurred during 1998 were 13.2% greater than amounts incurred during 1997. This

followed an 8.1% increase in such costs during 1997 as compared to 1996. The loss and loss expense ratio, a

measurement of the portion of earned premiums that were paid or reserved for losses and related claims handling

expenses, was 73.8% in 1998, 75.5% in 1997 and 78.7% in 1996. These lower than expected loss and loss expense

ratios reflect the declining severity of auto liability claims and generally mild weather conditions. Catastrophe losses

added 0.7% to the loss and loss expense ratio in 1998 compared to 0.3% in 1997 and 1.7% in 1996. As a result of

GEICO’s diminishing homeowners business, risks of weather related catastrophe losses are currently lower than in

years prior to 1996.

Underwriting expenses in 1998 for GEICO's businesses increased $215 million (37.7%) over 1997 and in

1997 increased $84 million (17.2%) over 1996. The increases reflect additional advertising and personnel costs

incurred to generate and service the aforementioned in-force policy growth, as well as increased levels of

administrative expenses, particularly profit-sharing costs.