Berkshire Hathaway 1998 Annual Report Download

Download and view the complete annual report

Please find the complete 1998 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BERKSHIRE HATHAWAY INC.

1998 ANNUAL REPORT

TABLE OF CONTENTS

Business Activities ...........................Inside Front Cover

Corporate Performance vs. the S&P 500 ...................... 2

Chairman's Letter* ....................................... 3

Selected Financial Data For The

Past Five Years ......................................20

Acquisition Criteria ......................................21

Independent Auditors' Report ...............................21

Consolidated Financial Statements ...........................22

Management's Discussion .................................42

Shareholder-Designated Contributions ........................54

Owner's Manual .........................................56

Combined Financial Statements — Unaudited —

for Berkshire Business Groups ............................65

Common Stock Data .....................................72

Directors and Officers of the Company ............Inside Back Cover

*Copyright © 1999 By Warren E. Buffett

All Rights Reserved

Table of contents

-

Page 1

BERKSHIRE HATHAWAY INC. 1998 ANNUAL REPORT TABLE OF CONTENTS Business Activities ...Inside Front Cover Corporate Performance vs. the S&P 500 ...2 Chairman's Letter* ...3 Selected Financial Data For The Past Five Years ...20 Acquisition Criteria ...21 Independent Auditors' Report ...21 Consolidated ... -

Page 2

...the United States and General Re Corporation, one of the four largest reinsurers in the world. Investment portfolios of insurance subsidiaries include meaningful equity ownership percentages of other publicly traded companies. Investments in excess of 5% of the investees outstanding capital stock at... -

Page 3

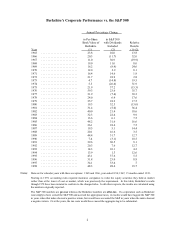

... Corporate Performance vs. the S&P 500 Annual Percentage Change in Per-Share Book Value of Berkshire (1) 23.8 20.3 11.0 19.0 16.2 12.0 16.4 21.7 14.7 15.5 21.9 59.3 31.9 24.0 35.7 19.3 31.4 40.0 32.3 13.6 48.2 26.1 19.5 20.1 44.4 17.4 39.6 20.3 14.3 13.9 43.1 31.8 34.1 48.3 in S&P 500 with Dividends... -

Page 4

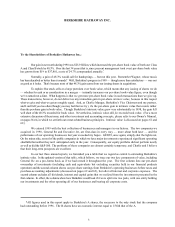

BERKSHIRE HATHAWAY INC. To the Shareholders of Berkshire Hathaway Inc.: Our gain in net worth during 1998 was $25.9 billion, which increased the per-share book value of both our Class A and Class B stock by 48.3%. Over the last 34 years (that is, since present management took over) per-share book ... -

Page 5

... Currently we are working to compound a net worth of $57.4 billion, the largest of any American corporation (though our figure will be eclipsed if the merger of Exxon and Mobil takes place). Of course, our lead in net worth does not mean that Berkshire outranks all other businesses in value: Market... -

Page 6

... gaining market share at an accelerating rate. This pace has been encouraged by our compensation policies. The direct writing of insurance - that is, without there being an agent or broker between the insurer and its policyholder - involves a substantial front-end investment. First-year business is... -

Page 7

... to what Berkshire is willing to invest in GEICO's new-business activity, as long as we can concurrently build th e infrastructure the company needs to properly serve its policyholders. Because of the first-year costs, companies that are concerned about quarterly or annual earnings would shy from... -

Page 8

... his time or energy to board meetings, press interviews, presentations by investment bankers or talks with financial analysts. Furthermore, he need never spend a moment thinking about financing, credit ratings or "Street" expectations for earnings per share. Because of our ownership structure, he... -

Page 9

... flight operation, and Rich's pilots - now numbering about 650 - receive extensive training at least twice a year from FlightSafety International, another Berkshire subsidiary and the world leader in pilot training. The bottom line on our pilots: I've sold the Berkshire plane and will now do all of... -

Page 10

... 12%. Over time, Ron and his team will maximize General Re's new potential. He and I have known each other fo r many years, and each of our companies has initiated significant business that it has reinsured with the other. Indeed, General Re played a key role in the resuscitation of GEICO from its... -

Page 11

... growth in float becomes a curse rather than a blessing. At Berkshire, the news is all good: Our average cost over the 32 years has been well under zero. In aggregate, we have posted a substantial underwriting profit, which means that we have been paid for holding a large and growing amount of money... -

Page 12

... Primary ...Net Investment Income ...Buffalo News ...Finance and Financial Products Businesses ...Flight Services ...Home Furnishings ...International Dairy Queen ...Jewelry ...Scott Fetzer (excluding finance operation) ...See's Candies ...Shoe Group ...General Re ...Purchase-Accounting Adjustments... -

Page 13

... a pro-forma calculation of a 1998 number seems relevant. We will resume the look-through calculation in next year's report. Investments Below we present our common stock investments. Those with a market value of more than $750 million are itemized. 12/31/98 Cost* Market (dollars in millions) $1,470... -

Page 14

...earnings are being calculated, even though options are a huge and increasing expense at a great many corporations. In effect, accounting principles offer management a choice: Pay employees in one form and count the cost, or pay them in another form and ignore the cost. Small wonder then that the use... -

Page 15

... to reported earnings, simply subtracting an amount equal to what the company could have realized by publicly selling options of like quantity and structure. Similarly, if we contemplate an acquisition, we include in our evaluation the cost of replacing any option plan. Then, if we make a deal, we... -

Page 16

...." In the acquisition arena, restructuring has been raised to an art form: Managements now frequently use mergers to dishonestly rearrange the value of assets and liabilities in ways that will allow them to both smooth and swell future earnings. Indeed, at deal time, major auditing firms sometimes... -

Page 17

... prime source for information about the company. While we continue to send an annual report to all shareholders, we now send quarterlies only to those who request them, letting others read these at our site. In this report, we again enclose a card that can be returned by those wanting to get printed... -

Page 18

... number of them through the General Re merger. We hope also that these new holders find that our owner's manual and annual reports offer them more insights and information about Berkshire than they garner about other companies from the investor relations departments that these corporations typically... -

Page 19

... meeting, these will make trips back to the hotels and to Nebraska Furniture Mart, Borsheim's and the airport. Even so, you are likely to find a car useful. The full line of Berkshire products will be available at Aksarben, and the more popular items will also be at Holiday. Last year we set sales... -

Page 20

... of my job. Debbie and Marc assembled the data for our annual report and oversaw the production and distribution of 165,000 copies. (This year the number will be 325,000.) Marc handled 95% of the details - and much of the substance - connected with our completing two major mergers. Kelly, Debbie... -

Page 21

BERKSHIRE HATHAWAY INC. Selected Financial Data for the Past Five Years (dollars in millions, except per share data) 1998 Revenues: Insurance premiums earned ...Sales and service revenues ...Interest, dividend and other investment income Income from finance and financial products businesses ...... -

Page 22

... 1997, and the related consolidated statements of earnings, changes in shareholders' equity, and cash flows for each of the three years in the period ended December 31, 1998. These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on... -

Page 23

BERKSHIRE HATHAWAY INC. and Subsidiaries CONSOLIDATED BALANCE SHEETS (dollars in millions except per share amounts) December 31, 1998 1997 ASSETS Cash and cash equivalents ...Investments: Securities with fixed maturities ...Equity securities and other investments ...Receivables ...Inventories ...... -

Page 24

BERKSHIRE HATHAWAY INC. and Subsidiaries CONSOLIDATED STATEMENTS OF EARNINGS (dollars in millions except per share amounts) Year Ended December 31, 1998 1997 1996 Revenues: Insurance premiums earned ...Sales and service revenues ...Interest, dividend and other investment income ...Income from ... -

Page 25

BERKSHIRE HATHAWAY INC. and Subsidiaries CONSOLIDATED STATEMENTS OF CASH FLOWS (dollars in millions) Year Ended December 31, 1998 1997 1996 Cash flows from operating activities: Net earnings ...Adjustments to reconcile net earnings to cash flows from operating activities: Realized investment gain ... -

Page 26

BERKSHIRE HATHAWAY INC. and Subsidiaries CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS' EQUITY (dollars in millions) Class A & B Common Stock $ 7 Balance December 31, 1995 ...Common stock issued in connection with acquisitions of businesses ...- Issuance of Class B Stock ...- Net earnings ...... -

Page 27

... TO CONSOLIDATED FINANCIAL STATEMENTS December 31, 1998 (1) Significant accounting policies and practices (a) Nature of operations and basis of consolidation Berkshire Hathaway Inc. ("Berkshire" or "Company") is a holding company owning subsidiaries engaged in a number of diverse business activities... -

Page 28

... structured settlements, is recognized as premiums earned at the inception of the contracts. Premiums earned are stated net of amounts ceded to reinsurers. Earned premiums ceded were $93 million in 1998, $86 million in 1997 and $79 million in 1996. Insurance premium acquisition costs Certain costs... -

Page 29

... 1998; Executive Jet, Inc. ("Executive Jet"), effective August 7, 1998; and General Re Corporation ("General Re"), effective December 21, 1998. Additional information regarding these acquisitions is provided below. On January 7, 1998, the merger of Dairy Queen with and into a wholly owned subsidiary... -

Page 30

... the closing prices of Berkshire Class A Common Stock for the 10-day period ending June 26, 1998, was approximately $22 billion. General Re is a holding company for global reinsurance and related risk management operations. It owns General Reinsurance Corporation and National Reinsurance Corporation... -

Page 31

Notes to Consolidated Financial Statements (Continued) Investments in securities with fixed maturities The amortized cost and estimated fair values of investments in securities with fixed maturities as of December 31, 1998 and 1997 are as follows (in millions): December 31, 1998 Amortized Cost Bonds... -

Page 32

... securities and other investments Data with respect to the consolidated investment in equity securities and other investments are shown below. Amounts are in millions. December 31, 1998 Cost Common stock of: American Express Company * ...The Coca-Cola Company ...The Gillette Company ...Other equity... -

Page 33

... business of Scott Fetzer Financial Group and a life insurance subsidiary in the business of selling annuities. General Re's financial products businesses consist of General Re Financial Products ("GRFP") group and a collection of other businesses that provide investment, insurance, reinsurance... -

Page 34

... Company's exposure to market or credit risk, future cash requirements or receipts from such transactions. December 31, 1998 (in millions) Interest rate and currency swap agreements ...Options written ...Options purchased ...Financial futures contracts: Commitments to purchase ...Commitments to sell... -

Page 35

...Financial Statements (Continued) (6) Finance and financial products businesses (Continued) With respect to Berkshire's life insurance business, annuity reserves and policy holder liabilities are carried at the present value of the actuarially determined ultimate payment amounts discounted at market... -

Page 36

... ...Deferred ... The Consolidated Statements of Earnings reflect charges for income taxes as shown below (in millions): 1998 $1,421 31 5 $1,457 Current ...Deferred ...$1,643 (186) $1,457 1997 $865 32 1 $898 $692 206 $898 1996 $1,170 26 1 $1,197 $ 819 378 $1,197 Federal ...State ...Foreign ... The... -

Page 37

Notes to Consolidated Financial Statements (Continued) (8) Income taxes (Continued) Charges for income taxes are reconciled to hypothetical amounts computed at the federal statutory rate in the table shown below (in millions): 1998 $4,314 $1,510 (30) (78) 39 20 (4) $1,457 1997 $2,827 $ 989 (36) (104... -

Page 38

... the General Re merger the number of authorized Class A and Class B Common Shares was 1,500,000 and 50,000,000 respectively. On May 6, 1996, Berkshire shareholders approved a recapitalization plan which created a new class of common stock, designated as Class B Common Stock. In connection therewith... -

Page 39

... financial products businesses ...$21,246 39,761 16,989 2,385 15,525 $10,298 36,248 1,249 2,267 1,067 Estimated Fair Value 1998 1997 $21,246 39,761 17,129 2,475 15,698 $10,298 36,248 1,367 2,262 1,149 (13) Quarterly data A summary of revenues and earnings by quarter for each of the last two years... -

Page 40

... Direct Insurance Group Buffalo News FlightSafety and Executive Jet ("Flight Services") Nebraska Furniture Mart, R.C. Willey Home Furnishings and Star Furniture Company ("Home Furnishings") International Dairy Queen Helzberg's Diamond Shops and Borsheim's ("Jewelry") Scott Fetzer Companies Business... -

Page 41

...earned Operating Profit before Taxes 1998 1997 1996 Operating Segments GEICO Corporation * ...Berkshire Hathaway Reinsurance Group * ...Berkshire Hathaway Direct Insurance Group * ...Buffalo News ...Flight services ...Home furnishings ...International Dairy Queen ...Jewelry ...Scott Fetzer Companies... -

Page 42

... of business acquisitions. GEICO Corporation ...Berkshire Hathaway Reinsurance Group ...Berkshire Hathaway Direct Insurance Group ...Buffalo News ...Flight services ...Home furnishings ...International Dairy Queen ...Jewelry ...Scott Fetzer Companies ...See's Candies ...Shoe group ...Reconciliation... -

Page 43

... Hathaway Reinsurance Group and (3) Berkshire Hathaway Direct Insurance Group. On December 21, 1998, Berkshire completed its merger with General Re. General Re and its affiliates comprise one of the four largest reinsurance companies in the world. See Note 2 to the Consolidated Financial Statements... -

Page 44

... align premium rates with pricing targets, and will result in lower premiums earned per policy in the future. The growth in voluntary auto premium volume in each of the past two years was also offset by declines in homeowners and residual auto market business. In-force policy growth for GEICO's core... -

Page 45

... profit margins will return to more normal levels as costs increase faster than premiums. Notwithstanding, Berkshire's management believes that GEICO's underwriting results will remain better than industry averages. Berkshire Hathaway Reinsurance Group The Berkshire Hathaway Reinsurance Group... -

Page 46

... personal and commercial auto insurance. Collectively, the Berkshire Hathaway Direct Insurance businesses produced earned premiums of $328 million in 1998, $312 million in 1997 and $268 million in 1996. Increases in premiums earned in 1998 and 1997 were achieved by the homestate, credit card credit... -

Page 47

... Re U.S. based life insurance subsidiary. Such losses were incurred with respect to U.S. workers' compensation reinsurance written through an underwriting facility in the London market. General Re's historical pre-tax net investment income in each of the years ending December 31, 1998 and 1997... -

Page 48

... Segment Buffalo News ...Flight Services ...Home Furnishings ...International Dairy Queen Jewelry ...Scott Fetzer Companies ...See's Candies ...Shoe Group ... 1998 $ 157 858 793 420 440 1,002 288 500 $4,458 1998 compared to 1997 Revenues from the eight identifiable non-insurance business segments... -

Page 49

... businesses under common management. Principal businesses in this group of companies sell products under the Kirby (home cleaning systems), Campbell Hausfeld (air compressors, paint sprayers and pressure washers) and World Book (encyclopedias and other educational products) names. Revenues... -

Page 50

Management's Discussion (Continued) Non-Insurance Business Segments (continued) 1998 compared to 1997 (continued) Scott Fetzer Companies (continued) The increase in revenues was primarily due to increases at Campbell Hausfeld somewhat offset by lower World Book revenues. Operating profits of $137 ... -

Page 51

...Note 9 to the Consolidated Financial Statements for information regarding the Exchange Notes. As of year-end 1998 and 1997, the market price of Citigroup common stock far exceeded the current exchange price of the Exchange Notes. Therefore, the fair values of the Exchange Notes are primarily subject... -

Page 52

... strives to maintain the highest credit ratings so that the cost of debt is minimized. The Company does not actively utilize stand-alone derivatives to manage interest rate risks. The fair values of Berkshire's fixed maturity investments and borrowings under investment agreements and other debt... -

Page 53

...: (1) the inability to obtain products or services used in business operations, (2) the inability to transact business with key customers, (3) the inability to execute transactions through the financial markets, (4) the inability to manufacture or deliver goods or services sold to customers, (5) the... -

Page 54

..., include, but are not limited to, changes in market prices of Berkshire's significant equity investees, the ability of the Company and its significant business partners and equity investees to successfully implement timely Year 2000 solutions, the occurrence of one or more catastrophic events, such... -

Page 55

... Berkshire should imitate more closely-held companies, not larger public companies. If you and I each own 50% of a corporation, our charitable decision making would be simple. Charities very directly related to the operations of the business would have first claim on our available charitable funds... -

Page 56

... 1979 annual report, at the end of each year more than 98% of our shares are owned by people who were shareholders at the beginning of the year. This long-term commitment to the business reflects an owner mentality which, as your manager, I intend to acknowledge in all feasible ways. The designated... -

Page 57

... the stocks of other major American corporations, even when the shares I own are excluded from the calculation. In effect, our shareholders behave in respect to their Berkshire stock much as Berkshire itself behaves in respect to companies in which it has an investment. As owners of, say, Coca-Cola... -

Page 58

... goal by directly owning a diversified group of businesses that generate cash and consistently earn above-average returns on capital. Our second choice is to own parts of similar businesses, attained primarily through purchases of marketable common stocks by our insurance subsidiaries. The price and... -

Page 59

... individual businesses, should generally aid you in making judgments about them. To state things simply, we try to give you in the annual report the numbers and other information that really matter. Charlie and I pay a great deal of attention to how well our businesses are doing, and we also work to... -

Page 60

...own portfolios through direct purchases in the stock market. Charlie and I are interested only in acquisitions that we believe will raise the per-share intrinsic value of Berkshire's stock. The size of our paychecks or our offices will never be related to the size of Berkshire's balance sheet. 9. We... -

Page 61

..., stock options, and convertible securities as well. We will not sell small portions of your company - and that is what the issuance of shares amounts to - on a basis inconsistent with the value of the entire enterprise. When we sold the Class B shares in 1996, we stated that Berkshire stock was... -

Page 62

... regularly report our per-share book value, an easily calculable number, though one of limited use. The limitations do not arise from our holdings of marketable securities, which are carried on our books at their current prices. Rather the inadequacies of book value have to do with the companies we... -

Page 63

... times this number, but we don't have final figures at this time. So the magnitude of these charges makes them a subject of importance to Berkshire. In our annual reports, therefore, we will sometimes talk of earnings that we will describe as "before purchase-accounting adjustments." The discussion... -

Page 64

...our 1983 Annual Report about the goodwill attributed to See's Candy, when I used that company as an example in a discussion of goodwill accounting. At that time, our balance sheet carried about $36 million of See's goodwill. We have since been charging about $1 million against earnings every year in... -

Page 65

...acquisition of new businesses is in prospect, the two will cooperate in making the decisions needed. Both executives will report to a board of directors who will be responsive to the controlling shareholder, whose interests will in turn be aligned with yours. Were we to need the management structure... -

Page 66

BERKSHIRE HATHAWAY INC. COMBINED FINANCIAL STATEMENTS BUSINESS GROUPS Berkshire's consolidated data is rearranged in the presentations on the following six pages into four categories, corresponding to the way Mr. Buffett and Mr. Munger think about Berkshire's businesses. The presentations may be ... -

Page 67

... credit card issuers nationwide and Kansas Bankers Surety Company is an insurer for primarily small and medium sized banks located in the midwest. On December 21, 1998, Berkshire completed its acquisition of General Re Corporation. General Re is a holding company for global reinsurance and related... -

Page 68

BERKSHIRE HATHAWAY INC. INSURANCE GROUP Balance Sheets (dollars in millions) December 31, 1998 1997 Assets Investments: Fixed maturities at market ...Equity securities and other investments at market: American Express Company ...The Coca-Cola Company ...The Walt Disney Company ...Freddie Mac ...The ... -

Page 69

... Buffalo News Campbell Hausfeld Carefree Cleveland Wood Products Dexter Shoe Companies Douglas Products Executive Jet Fechheimer Bros. Co. FlightSafety France H. H. Brown Shoe Co. Halex Helzberg's Diamond Shops International Dairy Queen Kingston Kirby Lowell Shoe, Inc. Meriam Nebraska Furniture Mart... -

Page 70

... 905 52 1,417 1,469 $2,374 Statements of Earnings (dollars in millions) 1998 Revenues: Sales and service revenues ...Interest income ...Cost and expenses: Cost of products and services sold ...Selling, general and administrative expenses ...Interest on debt ...Earnings from operations before income... -

Page 71

... Scott Fetzer Financial Group, Inc., Berkshire Hathaway Life Insurance Co. of Nebraska and General Re Financial Products make up Berkshire's finance and financial products businesses. Balance Sheets (dollars in millions) 1998 Assets Cash and cash equivalents ...Investment in securities with fixed... -

Page 72

BERKSHIRE HATHAWAY INC. NON-OPERATING ACTIVITIES These statements reflect the consolidated financial statement values for assets, liabilities, shareholders' equity, revenues and expenses that were not assigned to any Berkshire operating group in the unaudited, and not fully GAAP adjusted group ... -

Page 73

...owners. Price Range of Common Stock The Company's Class A and Class B Common Stock are listed for trading on the New York Stock Exchange, trading symbol: BRK.A and BRK.B. The following table sets forth the high and low sales prices per share, as reported on the New York Stock Exchange Composite List... -

Page 74

... of Financial Assets Letters from Annual Reports (1977 through 1998), quarterly reports, press releases and other information about Berkshire may be obtained on the Internet at www.berkshirehathaway.com. In addition, this site includes links to the home pages of many Berkshire subsidiaries. A two...