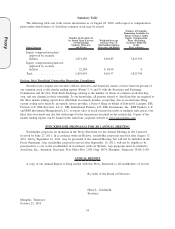

AutoZone 2010 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2010 AutoZone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6.4 Option Term. The term of each Option shall be set by the Administrator in its sole discretion;

provided, however, that the term (a) with respect to Incentive Stock Options shall not be more than ten

(10) years from the date of grant, or five (5) years from the date an Incentive Stock Option is granted to a

Greater Than 10% Stockholder and (b) with respect to Non-Qualified Stock Options shall not me more than

ten (10) years and one (1) day from the date of grant. The Administrator shall determine the time period,

including the time period following a Termination of Service, during which the Participant has the right to

exercise the vested Options, which time period may not extend beyond the stated term of the Option. Except

as limited by the requirements of Section 409A or Section 422 of the Code, the Administrator may extend the

term of any outstanding Option, and may extend the time period during which vested Options may be

exercised, in connection with any Termination of Service of the Participant, and, subject to Section 13.1

hereof, may amend any other term or condition of such Option relating to such a Termination of Service.

6.5 Option Vesting.

(a) The terms and conditions pursuant to which an Option vests in the Participant and becomes

exercisable shall be determined by the Administrator and set forth in the applicable Award Agreement. Such

vesting may be based on service with the Company or any Affiliate, any of the Performance Criteria, or any

other criteria selected by the Administrator. At any time after grant of an Option, the Administrator may, in its

sole discretion and subject to whatever terms and conditions it selects, accelerate the vesting of the Option.

(b) No portion of an Option which is unexercisable at a Participant’s Termination of Service shall

thereafter become exercisable, except as may be otherwise provided by the Administrator either in a Program,

the applicable Award Agreement or by action of the Administrator following the grant of the Option.

6.6 Substitute Awards. Notwithstanding the foregoing provisions of this Article 6 to the contrary, in the

case of an Option that is a Substitute Award, the price per share of the shares subject to such Option may be

less than the Fair Market Value per share on the date of grant, provided, however, that the excess of: (a) the

aggregate Fair Market Value (as of the date such Substitute Award is granted) of the Shares subject to the

Substitute Award, over (b) the aggregate exercise price thereof does not exceed the excess of: (x) the aggregate

Fair Market Value (as of the time immediately preceding the transaction giving rise to the Substitute Award)

of the shares of the predecessor entity that were subject to the grant assumed or substituted for by the

Company, over (y) the aggregate exercise price of such shares.

6.7 Substitution of Stock Appreciation Rights. The Administrator may provide in an applicable Program

or the applicable Award Agreement evidencing the grant of an Option that the Administrator, in its sole

discretion, shall have the right to substitute a Stock Appreciation Right for such Option at any time prior to or

upon exercise of such Option; provided, however, that such Stock Appreciation Right shall be exercisable with

respect to the same number of Shares for which such substituted Option would have been exercisable, and

shall also have the same exercise price and remaining term as the substituted Option.

ARTICLE 7.

EXERCISE OF OPTIONS

7.1 Partial Exercise. An exercisable Option may be exercised in whole or in part. However, an Option

shall not be exercisable with respect to fractional shares and the Administrator may require that, by the terms

of the Option, a partial exercise must be with respect to a minimum number of shares.

7.2 Manner of Exercise. All or a portion of an exercisable Option shall be deemed exercised upon

delivery of all of the following to the Secretary of the Company, or such other person or entity designated by

the Administrator, or his, her or its office, as applicable:

(a) A written or electronic notice complying with the applicable rules established by the Administra-

tor stating that the Option, or a portion thereof, is exercised. The notice shall be signed by the Participant

or other person then entitled to exercise the Option or such portion of the Option;

A-10

Proxy