AutoZone 2010 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2010 AutoZone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

At August 28, 2010, the Company had $3.3 million recorded in accumulated other comprehensive loss related

to net realized gains associated with terminated interest derivatives, which were designated as hedges. Net

gains are amortized into earnings over the remaining life of the associated debt. For the fiscal years ended

August 28, 2010, and August 29, 2009, the Company reclassified $612 thousand of net gains from

accumulated other comprehensive loss to interest expense in each year.

Derivatives not designated as Hedging Instruments

The Company is dependent upon diesel fuel to operate its vehicles used in the Company’s distribution network

to deliver parts to its stores and unleaded fuel for delivery of parts from its stores to its commercial customers

or other stores. Fuel is not a material component of the Company’s operating costs; however, the Company

attempts to secure fuel at the lowest possible cost and to reduce volatility in its operating costs. Because

unleaded and diesel fuel include transportation costs and taxes, there are limited opportunities to hedge this

exposure directly.

The Company had no fuel hedges during fiscal 2010. During fiscal year 2009, the Company used a

derivative financial instrument based on the Reformulated Gasoline Blendstock for Oxygen Blending index to

economically hedge the commodity cost associated with its unleaded fuel. The fuel swap did not qualify for

hedge accounting treatment and was executed to economically hedge a portion of unleaded fuel purchases.

The notional amount of the contract was 2.5 million gallons and terminated August 31, 2009. The loss on the

fuel contract for fiscal 2009 was $2.3 million.

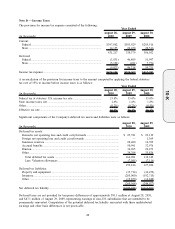

Note I — Financing

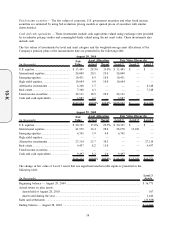

The Company’s long-term debt consisted of the following:

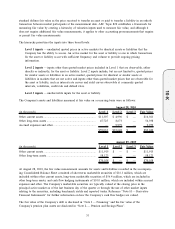

(in thousands)

August 28,

2010

August 29,

2009

4.75% Senior Notes due November 2010, effective interest rate of 4.17% ................ $ 199,300 $ 199,300

5.875% Senior Notes due October 2012, effective interest rate of 6.33%.................. 300,000 300,000

4.375% Senior Notes due June 2013, effective interest rate of 5.65% ....................... 200,000 200,000

6.5% Senior Notes due January 2014, effective interest rate of 6.63% ...................... 500,000 500,000

5.75% Senior Notes due January 2015, effective interest rate of 5.89% .................... 500,000 500,000

5.5% Senior Notes due November 2015, effective interest rate of 4.86% .................. 300,000 300,000

6.95% Senior Notes due June 2016, effective interest rate of 7.09% ......................... 200,000 200,000

7.125% Senior Notes due August 2018, effective interest rate of 7.28% ................... 250,000 250,000

Commercial paper, weighted average interest rate of 0.4% at August 28, 2010, and

0.5% at August 29, 2009 ........................................................................................... 433,000 277,600

$2,882,300 $2,726,900

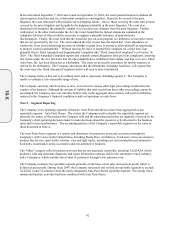

As of August 28, 2010, the commercial paper borrowings and the 4.75% Senior Notes due November 2010

mature in the next twelve months but are classified as long-term in the Company’s Consolidated Balance

Sheets, as the Company has the ability and intent to refinance them on a long-term basis. Specifically,

excluding the effect of commercial paper borrowings, the Company had $792.4 million of availability under

its $800 million revolving credit facility, expiring in July 2012 that would allow it to replace these short-term

obligations with long-term financing.

In addition to the long-term debt discussed above, the Company had $26.2 million of short-term borrowings

that are scheduled to mature in the next twelve months as of August 28, 2010. The short-term borrowings are

unsecured, peso denominated borrowings and accrue interest at 5.69% as of August 28, 2010.

In July 2009, the Company terminated its $1.0 billion revolving credit facility, which was scheduled to expire

in fiscal 2010, and replaced it with an $800 million revolving credit facility. This credit facility is available to

primarily support commercial paper borrowings, letters of credit and other short-term unsecured bank loans.

This facility expires in July 2012, may be increased to $1.0 billion at AutoZone’s election and subject to bank

credit capacity and approval, may include up to $200 million in letters of credit, and may include up to

$100 million in capital leases each fiscal year. After reducing the available balance by commercial paper

borrowings and certain

54

10-K