AutoZone 2010 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2010 AutoZone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Miles Driven

We believe that as the number of miles driven increases, consumers’ vehicles are more likely to need service and

maintenance, resulting in an increase in the need for automotive hard parts and maintenance items. Prior to the

recession, we had seen a close correlation between annual miles driven and our annual net sales; however, this

correlation has not existed in the recent short-term recessionary period. Since the beginning of the fiscal year and

through July 2010 (latest publicly available information), miles driven were relatively flat as compared to the

comparable prior year period. Throughout this period and contrary to the correlation experienced prior to the

recession, sales have grown at an increased rate, while miles driven have grown at a slower rate than what we

have historically experienced. We believe that the impact of changes in other factors, primarily an increase in

seven year old or older vehicles, more than offset the impact of miles driven. As the economy continues to

recover, we believe that annual miles driven will return to pre-recession low single digit growth rates, and the

correlation between annual miles driven and the annual sales growth of our industry should return.

Seven Year Old or Older Vehicles

Since 2008, new vehicle sales have been significantly lower than historical levels, which we believe contributed to

an increasing number of seven year old or older vehicles on the road. We estimate vehicles are driven an average

of approximately 12,500 miles each year. In seven years, the average miles driven equates to approximately

87,500 miles. Our experience is that at this point in a vehicle’s life, most vehicles are not covered by warranties

and increased maintenance is needed to keep the vehicle operating. According to data provided by the

Automotive Aftermarket Industry Association, the number of seven year old or older vehicles increased by

approximately 2.2% during the 2009 calendar year as compared to the 2008 calendar year. As the number of

seven year old or older vehicles on the road increases, we expect an increase in demand for the products that we

sell. In the near term, we expect this trend to continue, as consumers keep their cars longer in an effort to save

money during this uncertain economy.

Results of Operations

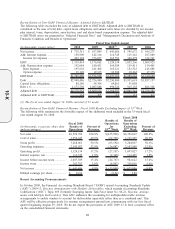

Fiscal 2010 Compared with Fiscal 2009

For the fiscal year ended August 28, 2010, we reported net sales of $7.363 billion compared with $6.817 billion

for the year ended August 29, 2009, an 8.0% increase from fiscal 2009. This growth was driven primarily by an

increase in domestic same store sales of 5.4% and sales from new stores of $203.4 million. The improvement in

same store sales was driven by an improvement in transaction count trends, while increases in average transaction

value remained generally consistent with our long-term trends. Higher transaction value is attributable to product

inflation due to both more complex, costly products and commodity price increases.

At August 28, 2010, we operated 4,389 domestic stores and 238 stores in Mexico, compared with 4,229 domestic

stores and 188 stores in Mexico at August 29, 2009. We reported a domestic retail sales increase of 6.9% and a

domestic commercial sales increase of 13.8% for fiscal 2010.

Gross profit for fiscal 2010 was $3.712 billion, or 50.4% of net sales, compared with $3.416 billion, or 50.1% of

net sales for fiscal 2009. The improvement in gross margin was primarily attributable to leveraging distribution

costs due to higher sales and operating efficiencies (19 basis points).

Operating, selling, general and administrative expenses for fiscal 2010 increased to $2.392 billion, or 32.5% of net

sales, from $2.240 billion, or 32.9% of net sales for fiscal 2009. The reduction in operating expenses, as a

percentage of sales, reflected leverage of store operating expenses due to higher sales, partially offset by higher

pension expense (17 basis points) and the continued investment in the hub store initiative (16 basis points).

Interest expense, net for fiscal 2010 was $158.9 million compared with $142.3 million during fiscal 2009. This

increase was due to higher average borrowing levels over the comparable prior year period. Average borrowings

for fiscal 2010 were $2.752 billion, compared with $2.460 billion for fiscal 2009 and weighted average borrowing

rates were 5.3% for fiscal 2010, compared to 5.4% for fiscal 2009.

Our effective income tax rate was 36.4% of pre-tax income for fiscal 2010 compared to 36.4% for fiscal 2009.

Net income for fiscal 2010 increased by 12.4% to $738.3 million, and diluted earnings per share increased 27.6%

to $14.97 from $11.73 in fiscal 2009. The impact of the fiscal 2010 stock repurchases on diluted earnings per

share in fiscal 2010 was an increase of approximately $0.74.

21

10-K