AutoZone 2010 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2010 AutoZone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

standard defines fair value as the price received to transfer an asset or paid to transfer a liability in an orderly

transaction between market participants at the measurement date. ASC Topic 820 establishes a framework for

measuring fair value by creating a hierarchy of valuation inputs used to measure fair value, and although it

does not require additional fair value measurements, it applies to other accounting pronouncements that require

or permit fair value measurements.

The hierarchy prioritizes the inputs into three broad levels:

Level 1 inputs — unadjusted quoted prices in active markets for identical assets or liabilities that the

Company has the ability to access. An active market for the asset or liability is one in which transactions

for the asset or liability occur with sufficient frequency and volume to provide ongoing pricing

information.

Level 2 inputs — inputs other than quoted market prices included in Level 1 that are observable, either

directly or indirectly, for the asset or liability. Level 2 inputs include, but are not limited to, quoted prices

for similar assets or liabilities in an active market, quoted prices for identical or similar assets or

liabilities in markets that are not active and inputs other than quoted market prices that are observable for

the asset or liability, such as interest rate curves and yield curves observable at commonly quoted

intervals, volatilities, credit risk and default rates.

Level 3 inputs — unobservable inputs for the asset or liability.

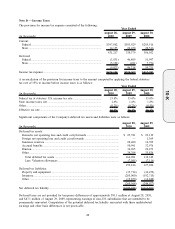

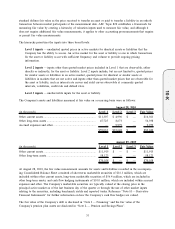

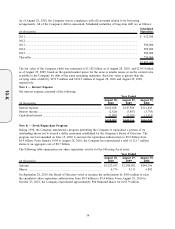

The Company’s assets and liabilities measured at fair value on a recurring basis were as follows:

(in thousands) Level 1 Level 2 Level 3 Fair Value

August 28, 2010

Other current assets....................................................................... $11,307 $ 4,996 $ — $16,303

Other long-term assets .................................................................. 47,725 8,673 — 56,398

Accrued expenses and other ......................................................... — 9,979 — 9,979

$59,032 $23,648 $ — $82,680

(in thousands) Level 1 Level 2 Level 3 Fair Value

August 29, 2009

Other current assets ....................................................................... $11,915 $ — $ — $11,915

Other long-term assets................................................................... 58,123 — — 58,123

$70,038 $ — $ — $70,038

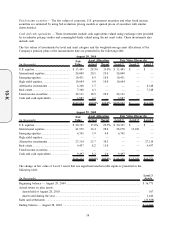

At August 28, 2010, the fair value measurement amounts for assets and liabilities recorded in the accompany-

ing Consolidated Balance Sheet consisted of short-term marketable securities of $16.3 million, which are

included within other current assets, long-term marketable securities of $56.4 million, which are included in

other long-term assets, and cash flow hedging instruments of $10.0 million, which are included within accrued

expenses and other. The Company’s marketable securities are typically valued at the closing price in the

principal active market as of the last business day of the quarter or through the use of other market inputs

relating to the securities, including benchmark yields and reported trades. Reference “Note H — Derivative

Financial Instruments” for further information on how the Company’s cash flow hedges are valued.

The fair value of the Company’s debt is disclosed in “Note I — Financing” and the fair value of the

Company’s pension plan assets are disclosed in “Note L — Pension and Savings Plans”.

51

10-K