AutoZone 2010 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2010 AutoZone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

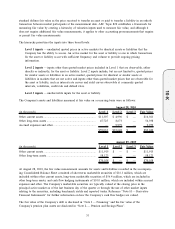

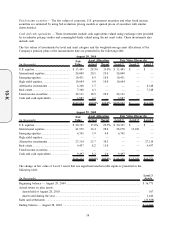

Future minimum annual rental commitments under non-cancelable operating leases and capital leases were as

follows at the end of fiscal 2010:

(in thousands)

Operating

Leases

Capital

Leases

2011..................................................................................................................................... $ 196,291 $21,947

2012..................................................................................................................................... 187,085 24,013

2013..................................................................................................................................... 170,858 20,819

2014..................................................................................................................................... 151,287 16,971

2015..................................................................................................................................... 133,549 8,995

Thereafter ............................................................................................................................ 900,977 —

Total minimum payments required .................................................................................... $1,740,047 92,745

Less: Interest ....................................................................................................................... (4,465)

Present value of minimum capital lease payments............................................................ $88,280

In connection with the Company’s December 2001 sale of the TruckPro business, the Company subleased

some properties to the purchaser for an initial term of not less than 20 years. The Company’s remaining

aggregate rental obligation at August 28, 2010 of $20.5 million is included in the above table, but the

obligation is entirely offset by the sublease rental agreement.

Note N — Commitments and Contingencies

Construction commitments, primarily for new stores, totaled approximately $15.8 million at August 28, 2010.

The Company had $107.6 million in outstanding standby letters of credit and $23.7 million in surety bonds as

of August 28, 2010, which all have expiration periods of less than one year. A substantial portion of the

outstanding standby letters of credit (which are primarily renewed on an annual basis) and surety bonds are

used to cover reimbursement obligations to our workers’ compensation carriers. There are no additional

contingent liabilities associated with these instruments as the underlying liabilities are already reflected in the

consolidated balance sheet. The standby letters of credit and surety bonds arrangements have automatic

renewal clauses.

Note O — Litigation

AutoZone, Inc. is a defendant in a lawsuit entitled “Coalition for a Level Playing Field, L.L.C., et al., v.

AutoZone, Inc. et al.,” filed in the U.S. District Court for the Southern District of New York in October 2004.

The case was filed by more than 200 plaintiffs, which are principally automotive aftermarket warehouse

distributors and jobbers, against a number of defendants, including automotive aftermarket retailers and

aftermarket automotive parts manufacturers. In the amended complaint, the plaintiffs allege, inter alia, that

some or all of the automotive aftermarket retailer defendants have knowingly received, in violation of the

Robinson-Patman Act (the “Act”), from various of the manufacturer defendants benefits such as volume

discounts, rebates, early buy allowances and other allowances, fees, inventory without payment, sham

advertising and promotional payments, a share in the manufacturers’ profits, benefits of pay on scan purchases,

implementation of radio frequency identification technology, and excessive payments for services purportedly

performed for the manufacturers. Additionally, a subset of plaintiffs alleges a claim of fraud against the

automotive aftermarket retailer defendants based on discovery issues in a prior litigation involving similar

claims under the Act. In the prior litigation, the discovery dispute, as well as the underlying claims, was

decided in favor of AutoZone and the other automotive aftermarket retailer defendants who proceeded to trial,

pursuant to a unanimous jury verdict which was affirmed by the Second Circuit Court of Appeals. In the

current litigation, plaintiffs seek an unspecified amount of damages (including statutory trebling), attorneys’

fees, and a permanent injunction prohibiting the aftermarket retailer defendants from inducing and/or

knowingly receiving discriminatory prices from any of the aftermarket manufacturer defendants and from

opening up any further stores to compete with plaintiffs as long as defendants allegedly continue to violate the

Act.

61

10-K