AutoZone 2010 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2010 AutoZone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

life of the options to determine volatility. An increase in the expected volatility will increase compensa-

tion expense.

Risk-free interest rate — This is the U.S. Treasury rate for the week of the grant having a term equal to the

expected life of the option. An increase in the risk-free interest rate will increase compensation expense.

Expected lives — This is the period of time over which the options granted are expected to remain

outstanding and is based on historical experience. Separate groups of employees that have similar

historical exercise behavior are considered separately for valuation purposes. Options granted have a

maximum term of ten years or ten years and one day. An increase in the expected life will increase

compensation expense.

Forfeiture rate — This is the estimated percentage of options granted that are expected to be forfeited or

canceled before becoming fully vested. This estimate is based on historical experience at the time of

valuation and reduces expense ratably over the vesting period. An increase in the forfeiture rate will

decrease compensation expense. This estimate is evaluated periodically based on the extent to which

actual forfeitures differ, or are expected to differ, from the previous estimate.

Dividend yield — The Company has not made any dividend payments nor does it have plans to pay dividends

in the foreseeable future. An increase in the dividend yield will decrease compensation expense.

The weighted average grant date fair value of options granted was $40.75 during fiscal 2010, $34.06 during

fiscal 2009, and $30.28 during fiscal 2008. The intrinsic value of options exercised was $65 million in fiscal

2010, $29 million in fiscal 2009, and $29 million in fiscal 2008. The total fair value of options vested was

$21 million in fiscal 2010, $16 million in fiscal 2009 and $18 million in fiscal 2008.

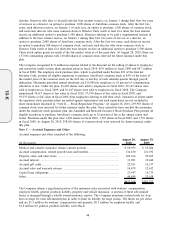

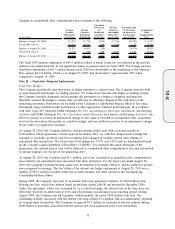

The Company generally issues new shares when options are exercised. The following table summarizes

information about stock option activity for the year ended August 28, 2010:

Number

of Shares

Weighted

Average

Exercise

Price

Weighted-

Average

Remaining

Contractual

Term

(in years)

Aggregate

Intrinsic Value

(in thousands)

Outstanding — August 29, 2009 ............................. 3,095,352 $ 98.73

Granted ................................................................ 496,580 143.49

Exercised.............................................................. (683,548) 79.08

Canceled .............................................................. (34,178) 116.49

Outstanding — August 28, 2010 ............................. 2,874,206 110.93 6.48 $298,115

Exercisable ............................................................... 1,509,720 94.12 5.08 181,970

Expected to vest ...................................................... 1,228,037 129.53 8.03 104,531

Available for future grants ...................................... 3,194,942

Under the AutoZone, Inc. 2003 Director Compensation Plan, a non-employee director may receive no more

than one-half of their director fees immediately in cash, and the remainder of the fees must be taken in

common stock. The director may elect to receive up to 100% of the fees in stock or defer all or part of the

fees in units (“Director Units”) with value equivalent to the value of shares of common stock as of the grant

date. At August 28, 2010, the Company has $4.1 million accrued related to 19,228 Director Units issued under

the current and prior plans with 76,415 shares of common stock reserved for future issuance under the current

plan. At August 29, 2009, the Company has $2.6 million accrued related to 17,506 Director Units issued under

the current and prior plans.

Under the AutoZone, Inc. 2003 Director Stock Option Plan (the “Director Stock Option Plan”), each non-

employee director receives an option grant on January 1 of each year, and each new non-employee director

receives an option to purchase 3,000 shares upon election to the Board of Directors, plus a portion of the annual

directors’ option grant prorated for the portion of the year actually served in office. Under the Director

Compensation Program, each non-employee director may choose between two pay options, and the number of

stock options a director receives under the Director Stock Option Plan depends on which pay option the director

47

10-K