AutoZone 2010 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2010 AutoZone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

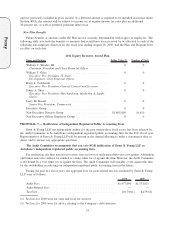

Report for a discussion of our accounting for share-based awards and the assumptions used. The aggregate

number of outstanding Stock Units held by each director at the end of fiscal 2010 are shown in the follow-

ing footnote 4. See “Security Ownership of Management and Board of Directors” on page 26 for more

information about our directors’ stock ownership.

(4) The “Option Awards” column represents the aggregate grant date fair value computed in accordance with

FASB ASC Topic 718 for stock options awarded under the AutoZone, Inc. 2003 Director Stock Option

Plan during fiscal 2010. See Note B, Share-Based Payments, to our consolidated financial statements in

our 2010 Annual Report for a discussion of our accounting for share-based awards and the assumptions

used. As of August 28, 2010, each non-employee director had the following aggregate number of outstand-

ing Stock Units and stock options:

Director

Stock

Units

(#)

Stock

Options*

(#)

William C. Crowley .............................................. — 9,526

SueE.Gove.................................................... 280 14,215

Earl G. Graves, Jr. ............................................... 3,349 21,000

Robert R. Grusky ................................................ 194 7,526

J.R. Hyde, III ................................................... 7,444 30,000

W. Andrew McKenna ............................................. 4,247 30,000

George R. Mrkonic, Jr. ............................................ 1,345 15,857

Luis P. Nieto .................................................... 1,023 7,412

Theodore W. Ullyot .............................................. 1,348 8,078

* Includes vested and unvested stock options.

Narrative Accompanying Director Compensation Table

Current Compensation Structure

Directors may select at the beginning of each calendar year between two pay alternatives. The first

alternative includes an annual retainer fee of $40,000 and a stock option grant. The second alternative includes

an annual retainer of $40,000, a supplemental retainer fee of $35,000, and a smaller stock option grant. The

second alternative was added in 2008 to make the director compensation package more attractive to potential

director candidates (and existing directors) who, in a given year, might prefer a higher percentage of fixed

compensation. Directors electing either alternative receive a significant portion of their compensation in

AutoZone common stock, since at least one-half of the base retainer and, if applicable, one-half of the

supplemental retainer must be paid in AutoZone common stock or stock units.

Annual Retainer Fees. Non-employee directors must choose each year between the two compensation

alternatives described above. A director electing the first alternative will receive an annual base retainer fee of

$40,000 (the “Base Retainer”). A director electing the second alternative will receive, in addition to the Base

Retainer, an annual supplemental retainer fee in the amount of $35,000 (the “Supplemental Retainer”), for a

total retainer of $75,000, but will receive a smaller annual stock option award under the Director Stock Option

Plan as explained below under “Director Stock Option Plan.” There are no meeting fees.

The chair of the Audit Committee receives an additional fee of $10,000 annually, and the chairs of the

Compensation Committee and the Nominating and Corporate Governance Committee each receive an

additional fee of $5,000 per year.

2003 Director Compensation Plan. Under the AutoZone, Inc. First Amended and Restated 2003 Director

Compensation Plan (the “2003 Director Compensation Plan”), a non-employee director may receive no more

than one-half of the annual fees in cash — the remainder must be taken in AutoZone common stock. The

director may elect to receive up to 100% of the fees in stock or to defer all or part of the fees in units with

value equivalent to the value of shares of AutoZone Common Stock (“Stock Units”). Unless deferred, the

14

Proxy