AutoZone 2010 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2010 AutoZone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

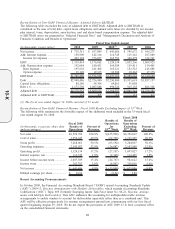

Reconciliation of Non-GAAP Financial Measure: Adjusted Debt to EBITDAR

The following table reconciles the ratio of adjusted debt to EBITDAR. Adjusted debt to EBITDAR is

calculated as the sum of total debt, capital lease obligations and annual rents times six; divided by net income

plus interest, taxes, depreciation, amortization, rent and share-based compensation expense. The adjusted debt

to EBITDAR ratios are presented in “Selected Financial Data” and “Management’s Discussion and Analysis of

Financial Condition and Results of Operations”:

(in thousands, except ratios) 2010 2009 2008

(1)

2007 2006

Fiscal Year Ended August

Net income ............................................. $ 738,311 $ 657,049 $ 641,606 $ 595,672 $ 569,275

Add: Interest expense ............................ 158,909 142,316 116,745 119,116 107,889

Income tax expense ........................... 422,194 376,697 365,783 340,478 332,761

EBIT ....................................................... 1,319,414 1,176,062 1,124,134 1,055,266 1,009,925

Add: Depreciation expense ................... 192,084 180,433 169,509 159,411 139,465

Rent expense ...................................... 195,632 181,308 165,121 152,523 143,888

Option expense .................................. 19,120 19,135 18,388 18,462 17,370

EBITDAR .............................................. $1,726,250 $1,556,938 $1,477,152 $1,385,662 $1,310,648

Debt ........................................................ $2,908,486 $2,726,900 $2,250,000 $1,935,618 $1,857,157

Capital lease obligations........................ 88,280 54,764 64,061 55,088 —

Rent x 6.................................................. 1,173,792 1,087,848 990,726 915,138 863,328

Adjusted debt ......................................... $4,170,558 $3,869,512 $3,304,787 $2,905,844 $2,720,485

Adjusted debt to EDITDAR .................. 2.4 2.5 2.2 2.1 2.1

(1) The fiscal year ended August 30, 2008 consisted of 53 weeks.

Reconciliation of Non-GAAP Financial Measure: Fiscal 2008 Results Excluding Impact of 53

rd

Week

The following table summarizes the favorable impact of the additional week included in the 53-week fiscal

year ended August 30, 2008:

(in thousands, except per share data

and percentages)

Fiscal 2008

Results of

Operations

Percent of

Revenue

Results of

Operations

for

53

rd

Week

Fiscal 2008

Results of

Operations

Excluding

53

rd

Week

Percent of

Revenue

Net sales .............................................. $6,522,706 100.0% $(125,894) $6,396,812 100.0%

Cost of sales ........................................ 3,254,645 49.9% (62,700) 3,191,945 49.9%

Gross profit ......................................... 3,268,061 50.1% (63,194) 3,204,867 50.1%

Operating expenses ............................. 2,143,927 32.9% (36,087) 2,107,840 32.9%

Operating profit .................................. 1,124,134 17.2% (27,107) 1,097,027 17.2%

Interest expense, net ........................... 116,745 1.8% (2,340) 114,405 1.8%

Income before income taxes............... 1,007,389 15.4% (24,767) 982,622 15.4%

Income taxes ....................................... 365,783 5.6% (8,967) 356,816 5.6%

Net income .......................................... $ 641,606 9.8% $ (15,800) $ 625,806 9.8%

Diluted earnings per share .................. $ 10.04 $ (0.24) $ 9.80

Recent Accounting Pronouncements

In October 2009, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update

(“ASU”) 2009-13, Revenue Arrangements with Multiple Deliverables, which amends Accounting Standards

Codification (“ASC”) Topic 605 (formerly Emerging Issues Task Force Issue No. 00-21, Revenue Arrange-

ments with Multiple Deliverables). This ASU addresses the accounting for multiple-deliverable revenue

arrangements to enable vendors to account for deliverables separately rather than as a combined unit. This

ASU will be effective prospectively for revenue arrangements entered into commencing with our first fiscal

quarter beginning August 29, 2010. We do not expect the provisions of ASU 2009-13 to have a material effect

on the consolidated financial statements.

28