AutoZone 2010 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2010 AutoZone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

chooses. Directors who elect to be paid only the base retainer receive, on January 1 during their first two years

of services as a director, an option to purchase 3,000 shares of AutoZone common stock. After the first two

years, such directors receive, on January 1 of each year, an option to purchase 1,500 shares of common stock,

and each such director who owns common stock or Director Units worth at least five times the base retainer

receive an additional option to purchase 1,500 shares. Directors electing to be paid a supplemental retainer in

addition to the base retainer receive, on January 1 during their first two years of service as a director, an

option to purchase 2,000 shares of AutoZone common stock. After the first two years, such directors receive

an option to purchase 500 shares of common stock, and each such director who owns common stock or

Director Units worth at least five times the base retainer receive an additional option to purchase 1,500 shares.

These stock option grants are made at the fair market value as of the grant date. At August 28, 2010, there are

137,016 outstanding options with 210,484 shares of common stock reserved for future issuance under this

plan.

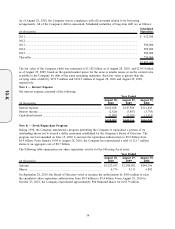

The Company recognized $1.0 million in expense related to the discount on the selling of shares to employees

and executives under various share purchase plans in fiscal 2010, $0.9 million in fiscal 2009 and $0.7 million

in fiscal 2008. The employee stock purchase plan, which is qualified under Section 423 of the Internal

Revenue Code, permits all eligible employees to purchase AutoZone’s common stock at 85% of the lower of

the market price of the common stock on the first day or last day of each calendar quarter through payroll

deductions. Maximum permitted annual purchases are $15,000 per employee or 10 percent of compensation,

whichever is less. Under the plan, 26,620 shares were sold to employees in fiscal 2010, 29,147 shares were

sold to employees in fiscal 2009, and 36,147 shares were sold to employees in fiscal 2008. The Company

repurchased 30,617 shares at fair value in fiscal 2010, 37,190 shares at fair value in fiscal 2009, and

39,235 shares at fair value in fiscal 2008 from employees electing to sell their stock. Issuances of shares under

the employee stock purchase plans are netted against repurchases and such repurchases are not included in

share repurchases disclosed in “Note K — Stock Repurchase Program.” At August 28, 2010, 293,983 shares of

common stock were reserved for future issuance under this plan. Once executives have reached the maximum

under the employee stock purchase plan, the Amended and Restated Executive Stock Purchase Plan permits all

eligible executives to purchase AutoZone’s common stock up to 25 percent of his or her annual salary and

bonus. Purchases under this plan were 1,483 shares in fiscal 2010, 1,705 shares in fiscal 2009, and 1,793 shares

in fiscal 2008. At August 28, 2010, 258,056 shares of common stock were reserved for future issuance under

this plan.

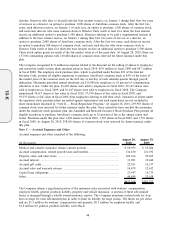

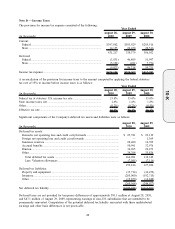

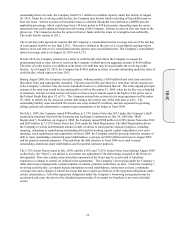

Note C — Accrued Expenses and Other

Accrued expenses and other consisted of the following:

(in thousands)

August 28,

2010

August 29,

2009

Medical and casualty insurance claims (current portion)............................................ $ 60,955 $ 65,024

Accrued compensation, related payroll taxes and benefits ......................................... 134,830 121,192

Property, sales, and other taxes .................................................................................... 102,364 92,065

Accrued interest ............................................................................................................ 31,091 32,448

Accrued gift cards ......................................................................................................... 22,013 16,337

Accrued sales and warranty returns ............................................................................. 14,679 12,432

Capital lease obligations ............................................................................................... 21,947 16,735

Other .............................................................................................................................. 44,489 25,038

$432,368 $381,271

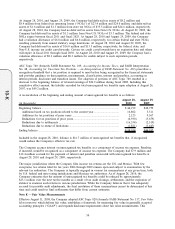

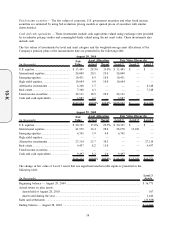

The Company retains a significant portion of the insurance risks associated with workers’ compensation,

employee health, general, products liability, property and vehicle insurance. A portion of these self-insured

losses is managed through a wholly owned insurance captive. The Company maintains certain levels for stop-

loss coverage for each self-insured plan in order to limit its liability for large claims. The limits are per claim

and are $1.5 million for workers’ compensation and property, $0.5 million for employee health, and

$1.0 million for general, products liability, and vehicle.

48

10-K