AutoZone 2010 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2010 AutoZone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

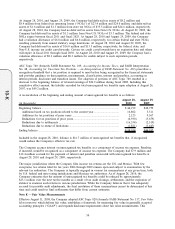

At August 28, 2010, and August 29, 2009, the Company had deferred tax assets of $8.2 million and

$8.4 million from federal tax operating losses (“NOLs”) of $23.4 million and $24.0 million, and deferred tax

assets of $1.6 million and $1.3 million from state tax NOLs of $35.5 million and $24.6 million, respectively.

At August 28, 2010, the Company had no deferred tax assets from Non-U.S. NOLs. At August 29, 2009, the

Company had deferred tax assets of $1.3 million from Non-U.S. NOLs of $3.3 million. The federal and state

NOLs expire between fiscal 2011 and fiscal 2025. At August 28, 2010 and August 29, 2009, the Company

had a valuation allowance of $6.8 million and $6.8 million, respectively, for certain federal and state NOLs

resulting primarily from annual statutory usage limitations. At August 28, 2010 and August 29, 2009, the

Company had deferred tax assets of $16.0 million and $13.5 million, respectively, for federal, state, and

Non-U.S. income tax credit carryforwards. Certain tax credit carryforwards have no expiration date and others

will expire in fiscal 2011 through fiscal 2030. At August 28, 2010 and August 29, 2009, the Company had a

valuation allowance of $0.3 million and $0.3 million for credits subject to such expiration periods,

respectively.

ASC Topic 740 (formerly FASB Statement No. 109, Accounting for Income Taxes, and FASB Interpretation

No. 48, Accounting for Uncertain Tax Positions — an Interpretation of FASB Statement No. 109) prescribes a

recognition threshold that a tax position is required to meet before being recognized in the financial statements

and provides guidance on derecognition, measurement, classification, interest and penalties, accounting in

interim periods, disclosure and transition issues. The adoption of portions of ASC Topic 740 resulted in a

decrease to the beginning balance of retained earnings of $26.9 million during fiscal 2008. Including this

cumulative effect amount, the liability recorded for total unrecognized tax benefits upon adoption at August 26,

2007, was $49.2 million.

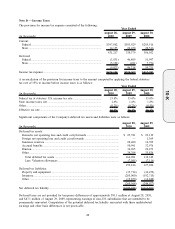

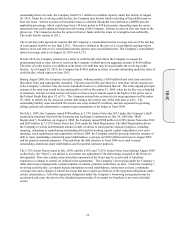

A reconciliation of the beginning and ending amount of unrecognized tax benefits is as follows:

(in thousands)

August 28,

2010

August 29,

2009

Beginning balance ......................................................................................................... $ 44,192 $40,759

Additions based on tax positions related to the current year .................................. 16,802 5,511

Additions for tax positions of prior years ................................................................ 2,125 9,567

Reductions for tax positions of prior years.............................................................. (6,390) (5,679)

Reductions due to settlements .................................................................................. (16,354) (2,519)

Reductions due to statue of limitations .................................................................... (1,821) (3,447)

Ending balance .............................................................................................................. $ 38,554 $44,192

Included in the August 28, 2010, balance is $16.7 million of unrecognized tax benefits that, if recognized,

would reduce the Company’s effective tax rate.

The Company accrues interest on unrecognized tax benefits as a component of income tax expense. Penalties,

if incurred, would be recognized as a component of income tax expense. The Company had $7.9 million and

$12.4 million accrued for the payment of interest and penalties associated with unrecognized tax benefits at

August 28, 2010 and August 29, 2009, respectively.

The major jurisdictions where the Company files income tax returns are the U.S. and Mexico. With few

exceptions, tax returns filed for tax years 2006 through 2009 remain open and subject to examination by the

relevant tax authorities. The Company is typically engaged in various tax examinations at any given time, both

by U.S. federal and state taxing jurisdictions and Mexican tax authorities. As of August 28, 2010, the

Company estimates that the amount of unrecognized tax benefits could be reduced by approximately

$23.1 million over the next twelve months as a result of tax audit closings, settlements, and the expiration of

statutes to examine such returns in various jurisdictions. While the Company believes that it has adequately

accrued for possible audit adjustments, the final resolution of these examinations cannot be determined at this

time and could result in final settlements that differ from current estimates.

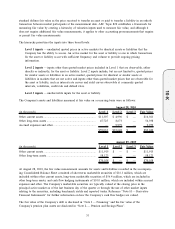

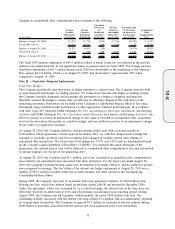

Note E — Fair Value Measurements

Effective August 31, 2008, the Company adopted ASC Topic 820 (formerly FASB Statement No. 157, Fair Value

Measurements) which defines fair value, establishes a framework for measuring fair value in generally accepted

accounting principles (“GAAP”) and expands disclosure requirements about fair value measurements. This

50

10-K