AutoZone 2010 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2010 AutoZone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

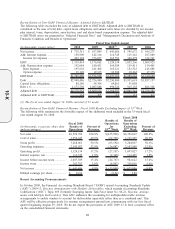

Fiscal 2009 Compared with Fiscal 2008

For the year ended August 29, 2009, we reported net sales of $6.817 billion compared with $6.523 billion for the

year ended August 30, 2008, a 4.5% increase from fiscal 2008. Excluding $125.9 million of sales from the 53rd

week included in the prior year, total company net sales increased 6.6%. This growth was driven primarily by an

increase in domestic same store sales of 4.4% and sales from new stores of $165.5 million. The improvement in

same store sales was driven by an improvement in transaction count trends, while increases in average transaction

value remained generally consistent with our long-term trends. Higher transaction value is attributable to product

inflation due to both more complex, costly products and commodity price increases.

At August 29, 2009, we operated 4,229 domestic stores and 188 stores in Mexico, compared with 4,092 domestic

stores and 148 stores in Mexico at August 30, 2008. Excluding the sales from the 53rd week in the prior year,

domestic retail sales increased 7.1% and domestic commercial sales increased 4.3%.

Gross profit for fiscal 2009 was $3.416 billion, or 50.1% of net sales, compared with $3.268 billion, or 50.1% of

net sales, for fiscal 2008. Gross profit as a percent of net sales was positively impacted by favorable distribution

costs from improved efficiencies and lower fuel costs. However, this favorability was largely offset by a shift in

mix to lower margin products.

Operating, selling, general and administrative expenses for fiscal 2009 increased to $2.240 billion, or 32.9% of net

sales, from $2.144 billion, or 32.9% of net sales for fiscal 2008. Leverage from increased sales was largely offset

by expenses associated with our continued enhancements to our hub stores (17 basis points), an acceleration of

our store maintenance program (9 basis points), and a continued expansion of our commercial sales force (7 basis

points).

Interest expense, net for fiscal 2009 was $142.3 million compared with $116.7 million during fiscal 2008. This

increase was due to higher average borrowing levels over the comparable prior year period and a higher

percentage of fixed rate debt. Average borrowings for fiscal 2009 were $2.460 billion, compared with $2.024

billion for fiscal 2008 and weighted average borrowing rates were 5.4% for fiscal 2009, compared to 5.2% for

fiscal 2008.

Our effective income tax rate was 36.4% of pre-tax income for fiscal 2009 compared to 36.3% for fiscal 2008.

Net income for fiscal 2009 increased by 2.4% to $657.0 million, and diluted earnings per share increased 16.8% to

$11.73 from $10.04 in fiscal 2008. The impact of the fiscal 2009 stock repurchases on diluted earnings per share

in fiscal 2009 was an increase of approximately $0.78. Excluding the additional week in the prior year, net income

for the year increased 5.0% over the previous year, while diluted earnings per share increased 19.7%.

Seasonality and Quarterly Periods

Our business is somewhat seasonal in nature, with the highest sales typically occurring in the spring and summer

months of February through September, in which average weekly per-store sales historically have been about 15%

to 25% higher than in the slower months of December and January. During short periods of time, a store’s sales

can be affected by weather conditions. Extremely hot or extremely cold weather may enhance sales by causing

parts to fail and spurring sales of seasonal products. Mild or rainy weather tends to soften sales, as parts failure

rates are lower in mild weather, with elective maintenance deferred during periods of rainy weather. Over the

longer term, the effects of weather balance out, as we have stores throughout the United States, Puerto Rico and

Mexico.

Each of the first three quarters of our fiscal year consisted of 12 weeks, and the fourth quarter consisted of 16

weeks in 2010, 16 weeks in 2009, and 17 weeks in 2008. Because the fourth quarter contains the seasonally high

sales volume and consists of 16 or 17 weeks, compared with 12 weeks for each of the first three quarters, our

fourth quarter represents a disproportionate share of the annual net sales and net income. The fourth quarter of

fiscal year 2010, containing 16 weeks, represented 33.2% of annual sales and 36.4% of net income; the fourth

quarter of fiscal 2009, containing 16 weeks, represented 32.7% of annual sales and 35.9% of net income; and the

fourth quarter of fiscal 2008, containing 17 weeks, represented 33.9% of annual sales and 38.0% of net income.

22

10-K