AutoZone 2010 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2010 AutoZone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

and not previously included in gross income. If a deferred amount is required to be included in income under

Section 409A, the amount will be subject to income tax at regular income tax rates plus an additional

20 percent tax, as well as potential premium interest tax.

New Plan Benefits

Future benefits or amounts under the Plan are not currently determinable with respect to employees. The

following table sets forth the benefits or amounts that would have been received by or allocated to each of the

following non-employee directors for the fiscal year ending August 28, 2010, had the Plan and Program been

in effect on such date.

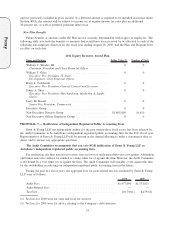

2011 Equity Incentive Award Plan

Name and Position Dollar Value ($) Number of Units

William C. Rhodes, III ................................. 0 0

Chairman, President and Chief Financial Officer

William T. Giles ..................................... 0 0

Executive Vice President, IT, Store

Development, Chief Financial Officer

Harry L. Goldsmith ................................... 0 0

Executive Vice President, General Counsel and Secretary

James A. Shea ....................................... 0 0

Executive Vice President, Merchandising, Marketing & Supply

Chain

Larry M. Roesel ...................................... 0 0

Senior Vice President, Commercial

Executive Group ...................................... 0 0

Non-Executive Director Group ........................... $1,865,000 10,610

Non-Executive Officer Employee Group .................... 0 0

PROPOSAL 3 — Ratification of Independent Registered Public Accounting Firm

Ernst & Young LLP, our independent auditor for the past twenty-three fiscal years, has been selected by

the Audit Committee to be AutoZone’s independent registered public accounting firm for the 2011 fiscal year.

Representatives of Ernst & Young LLP will be present at the Annual Meeting to make a statement if they so

desire and to answer any appropriate questions.

The Audit Committee recommends that you vote FOR ratification of Ernst & Young LLP as

AutoZone’s independent registered public accounting firm.

For ratification, the firm must receive more votes in favor of ratification than votes cast against. Abstentions

and broker non-votes will not be counted as voting either for or against the firm. However, the Audit Committee

is not bound by a vote either for or against the firm. The Audit Committee will consider a vote against the firm

by the stockholders in selecting our independent registered public accounting firm in the future.

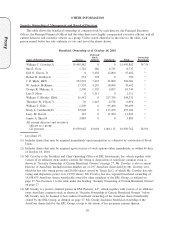

During the past two fiscal years, the aggregate fees for professional services rendered by Ernst & Young

LLP were as follows:

2010 2009

Audit Fees............................................... $1,477,000 $1,573,811

Audit-Related Fees ........................................ — —

Tax Fees ................................................ 110,750(1) 84,793(2)

(1) Tax fees for 2010 were for state and local tax services.

(2) Tax fees for 2009 were for advice relating to the Company’s debt structure.

24

Proxy