AutoZone 2010 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2010 AutoZone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

option or stock appreciation right in exchange for cash or another award when the option or stock appreciation

right price per share exceeds the fair market value of the underlying shares.

In no event may an award be granted pursuant to the Plan on or after the tenth anniversary of the

Effective Date.

Why is stockholder approval of the Plan required?

Stockholder approval of the Plan is necessary in order for us to (1) meet the stockholder approval

requirements of the New York Stock Exchange, (2) take tax deductions for certain compensation resulting

from awards granted thereunder qualifying as QPBC and (3) grant ISOs thereunder.

What awards are currently contemplated under the Plan?

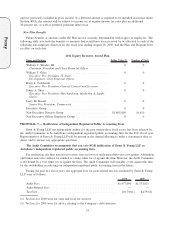

The Board has adopted the 2011 Director Compensation Program (the “Program”), subject to stockholder

approval of the Plan. Pursuant to the Program, as of January 1, 2011 and subject to stockholder approval of

the Plan, non-employee directors will receive their compensation in awards of Restricted Stock Units as

described immediately below, in lieu of cash compensation.

The Program provides that non-employee directors will receive an annual retainer fee of $200,000 (the

“Annual Retainer”), payable in Restricted Stock Units awarded under the Plan. The lead director and the chair

of the Audit Committee will receive an additional fee of $20,000 annually, the chairs of the Compensation

Committee and the Nominating and Corporate Governance Committee will each receive an additional fee of

$5,000 per year, and non-chair members of the Audit Committee will each receive an additional fee of $5,000

per year, all of which are also payable in Restricted Stock Units awarded under the Plan (such fees, together

with the Annual Retainer, are referred to herein as the “Retainer”).

The Restricted Stock Units to be awarded under the Plan in payment of the Retainer are contractual rights

to receive in the future a share of AutoZone common stock, and are described in more detail on page 19.

Under the Program, Restricted Stock Units will become fully vested on the date they are issued, and the

Restricted Stock Units will be paid in shares of AutoZone common stock as soon as practicable after the date

on which a non-employee director ceases to be a member of the AutoZone Board of Directors (so long as

such cessation of service also qualifies as a “separation from service” under Section 409A of the Code), to be

no later than the fifteenth day of the third month following the end of the tax year in which such cessation of

service occurs, unless the director has irrevocably elected in writing by December 31 of the year preceding the

grant to defer the payment.

The Retainer is payable in advance in equal quarterly installments on January 1, April 1, July 1, and

October 1 of each year. The number of Restricted Stock Units granted each quarter will be determined by

dividing one-fourth of the amount of the Retainer by the fair market value of the shares of our common stock

as of the grant date. If a non-employee director is elected to the Board after the beginning of a calendar

quarter or assumes one of the additional positions described above, he or she will receive a prorated Retainer

based on the number of days remaining in the calendar quarter in which the date of the Board election or

position appointment occurs.

What are the U.S. federal income tax consequences of the Plan?

The following is a general summary under current law of the material federal income tax consequences to

a non-employee director granted an award under the Plan. This summary deals with the general federal income

tax principles that apply and is provided only for general information. Some kinds of taxes, such as state, local

and foreign income taxes and federal employment taxes, are not discussed. Tax laws are complex and subject

to change and may vary depending on individual circumstances and from locality to locality. The summary

does not discuss all aspects of federal income taxation that may be relevant in light of a holder’s personal

circumstances. This summarized tax information is not tax advice and a holder of an award should rely on the

advice of his or her legal and tax advisors.

22

Proxy