AutoZone 2010 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2010 AutoZone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

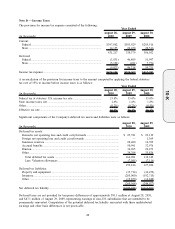

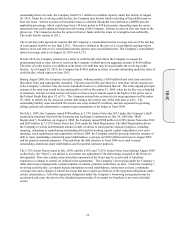

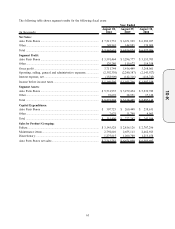

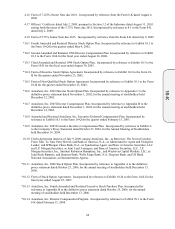

The following table sets forth the plans’ funded status and amounts recognized in the Company’s Consolidated

Balance Sheets:

(in thousands)

August 28,

2010

August 29,

2009

Change in Projected Benefit Obligation:

Projected benefit obligation at beginning of year........................................................ $185,590 $156,674

Interest cost ................................................................................................................... 11,315 10,647

Actuarial losses ............................................................................................................. 18,986 23,637

Benefits paid ................................................................................................................. (4,355) (5,368)

Benefit obligations at end of year ................................................................................ $211,536 $185,590

Change in Plan Assets:

Fair value of plan assets at beginning of year ............................................................. $115,313 $160,898

Actual return on plan assets ......................................................................................... 6,273 (40,235)

Employer contributions ................................................................................................. 12 18

Benefits paid ................................................................................................................. (4,355) (5,368)

Fair value of plan assets at end of year ....................................................................... $117,243 $115,313

Amount Recognized in the Statement of Financial Position:

Current liabilities........................................................................................................... $ (12) $ (17)

Long-term liabilities...................................................................................................... (94,281) (70,260)

Net amount recognized ................................................................................................. $ (94,293) $ (70,277)

Amount Recognized in Accumulated Other Comprehensive Loss and not yet

reflected in Net Periodic Benefit Cost:

Net actuarial loss........................................................................................................... $ (94,293) $ (70,277)

Accumulated other comprehensive loss ....................................................................... $ (94,293) $ (70,277)

Amount Recognized in Accumulated Other Comprehensive Loss and not yet

reflected in Net Periodic Benefit Cost and expected to be amortized in next

year’s Net Periodic Benefit Cost:

Net actuarial loss........................................................................................................... $ (10,252) $ (8,354)

Amount recognized ....................................................................................................... $ (10,252) $ (8,354)

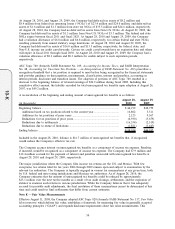

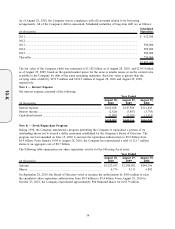

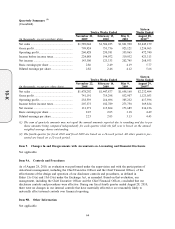

Net periodic benefit expense (income) consisted of the following:

(in thousands)

August 28,

2010

August 29,

2009

August 30,

2008

Year Ended

Interest cost ........................................................................................... $11,315 $ 10,647 $ 9,962

Expected return on plan assets ............................................................. (9,045) (12,683) (13,036)

Amortization of prior service cost ....................................................... — 60 99

Recognized net actuarial losses ............................................................ 8,135 73 97

Net periodic benefit expense (income) ................................................ $10,405 $ (1,903) $ (2,878)

The actuarial assumptions used in determining the projected benefit obligation include the following:

August 28,

2010

August 29,

2009

August 30,

2008

Year Ended

Weighted average discount rate ............................................................ 5.25% 6.24% 6.90%

Expected long-term rate of return on plan assets ................................ 8.00% 8.00% 8.00%

59

10-K