AutoZone 2010 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2010 AutoZone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Note L – Pension and Savings Plans

Prior to January 1, 2003, substantially all full-time employees were covered by a defined benefit pension plan.

The benefits under the plan were based on years of service and the employee’s highest consecutive five-year

average compensation. On January 1, 2003, the plan was frozen. Accordingly, pension plan participants will earn

no new benefits under the plan formula and no new participants will join the pension plan.

On January 1, 2003, the Company’s supplemental defined benefit pension plan for certain highly compensated

employees was also frozen. Accordingly, plan participants will earn no new benefits under the plan formula and

no new participants will join the pension plan.

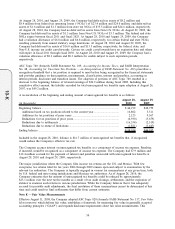

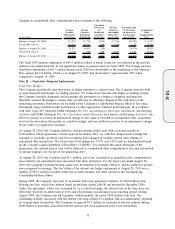

ASC Topic 715 (formerly SFAS No. 158, Employers' Accounting for Defined Benefit Pension and Other

Postretirement Plans, an amendment of FASB Statements No. 87, 88, 106, and 132(R)) requires plan sponsors of

defined benefit pension and other postretirement benefit plans to recognize the funded status of their

postretirement benefit plans in the statement of financial position, measure the fair value of plan assets and benefit

obligations as of the date of the fiscal year-end statement of financial position, and provide additional disclosures.

The Company adopted the recognition and disclosure provisions of ASC Topic 715 on August 25, 2007 and

adopted the measurement provisions of the standard on August 31, 2008.

The Company has recognized the unfunded status of the defined pension plans in its Consolidated Balance Sheets,

which represents the difference between the fair value of pension plan assets and the projected benefit obligations

of its defined benefit pension plans. The net unrecognized actuarial losses and unrecognized prior service costs are

recorded in accumulated other comprehensive loss. These amounts will be subsequently recognized as net

periodic pension expense pursuant to the Company’s historical accounting policy for amortizing such amounts.

Further, actuarial gains and losses that arise in subsequent periods and are not recognized as net periodic pension

expense in the same periods will be recognized as a component of other comprehensive income. Those amounts

will be subsequently recognized as a component of net periodic pension expense on the same basis as the amounts

previously recognized in accumulated other comprehensive loss.

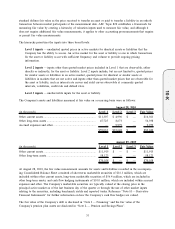

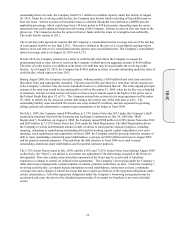

The Company’s investment strategy for pension plan assets is to utilize a diversified mix of domestic and

international equity and fixed income portfolios to earn a long-term investment return that meets the Company’s

pension plan obligations. The pension plan assets are invested primarily in listed securities, and the pension plans

hold only a minimal investment in AutoZone common stock that is entirely at the discretion of third-party pension

fund investment managers. The Company’s largest holding classes, U.S. equities and fixed income bonds, are

each invested with multiple managers, each holding diversified portfolios with complementary styles and

holdings. Accordingly, the Company does not have any significant concentrations of risk in particular securities,

issuers, sectors, industries or geographic regions. Alternative investment strategies, including private real estate,

are in the process of being liquidated and constitute less than 10% of the pension plan assets. The Company’s

investment managers are prohibited from using derivatives for speculative purposes and are not permitted to use

derivatives to leverage a portfolio.

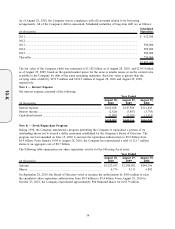

Following is a description of the valuation methodologies used for investments measured at fair value:

U.S., international, emerging, and high yield equities – These investments are commingled funds and are valued

using the net asset values, which are determined by valuing investments at the closing price or last trade reported

on the major market on which the individual securities are traded. These investments are subject to annual audits.

Alternative investments – This category represents a hedge fund of funds made up of 17 different hedge fund

managers diversified over 9 different hedge strategies. The fair value of the hedge fund of funds is determined

using valuations provided by the third party administrator for each of the underlying funds.

Real estate – The valuation of these investments requires significant judgment due to the absence of quoted

market prices, the inherent lack of liquidity and the long-term nature of such assets. These investments are valued

based upon recommendations of our investment manager incorporating factors such as contributions and

distributions, market transactions, and market comparables.

57

10-K