AutoZone 2010 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2010 AutoZone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

were approximately 30,000 shares excluded at August 29, 2009, and approximately 31,000 shares excluded at

August 30, 2008.

Share-Based Payments: Share-based payments include stock option grants and certain other transactions

under the Company’s stock plans. The Company recognizes compensation expense for its share-based

payments based on the fair value of the awards. See “Note B — Share-Based Payments” for further discussion.

Recent Accounting Pronouncements: In October 2009, the Financial Accounting Standards Board (“FASB”)

issued Accounting Standards Update (“ASU”) 2009-13, Revenue Arrangements with Multiple Deliverables,

which amends Accounting Standards Codification (“ASC”) Topic 605 (formerly Emerging Issues Task Force

Issue No. 00-21, Revenue Arrangements with Multiple Deliverables). This ASU addresses the accounting for

multiple-deliverable revenue arrangements to enable vendors to account for deliverables separately rather than

as a combined unit. This ASU will be effective prospectively for revenue arrangements entered into

commencing with the Company’s first fiscal quarter beginning August 29, 2010. The Company does not

expect the provisions of ASU 2009-13 to have a material effect on the consolidated financial statements.

Note B — Share-Based Payments

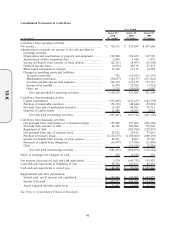

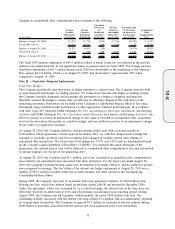

Total share-based compensation expense (a component of operating, selling, general and administrative

expenses) was $19.1 million related to stock options and share purchase plans for fiscal 2010, $19.1 million

for fiscal 2009, and $18.4 million for fiscal 2008. As of August 28, 2010, share-based compensation expense

for unvested awards not yet recognized in earnings is $16.9 million and will be recognized over a weighted

average period of 2.5 years. Tax deductions in excess of recognized compensation cost are classified as a

financing cash inflow.

AutoZone grants options to purchase common stock to certain of its employees and directors under various

plans at prices equal to the market value of the stock on the date of grant. Options have a term of 10 years or

10 years and one day from grant date. Director options generally vest three years from grant date. Employee

options generally vest in equal annual installments on the first, second, third and fourth anniversaries of the

grant date. Employees and directors generally have 30 days after the service relationship ends, or one year

after death, to exercise all vested options. The fair value of each option grant is separately estimated for each

vesting date. The fair value of each option is amortized into compensation expense on a straight-line basis

between the grant date for the award and each vesting date. The Company has estimated the fair value of all

stock option awards as of the date of the grant by applying the Black-Scholes-Merton multiple-option pricing

valuation model. The application of this valuation model involves assumptions that are judgmental and highly

sensitive in the determination of compensation expense.

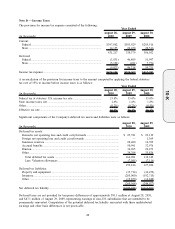

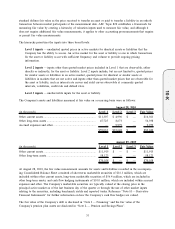

The following table presents the weighted average for key assumptions used in determining the fair value of

options granted and the related share-based compensation expense:

August 28,

2010

August 29,

2009

August 30,

2008

Year Ended

Expected price volatility ....................................................................... 31% 28% 24%

Risk-free interest rates .......................................................................... 1.8% 2.4% 4.1%

Weighted average expected lives in years............................................ 4.3 4.1 4.0

Forfeiture rate........................................................................................ 10% 10% 10%

Dividend yield....................................................................................... 0% 0% 0%

The following methodologies were applied in developing the assumptions used in determining the fair value of

options granted:

Expected price volatility — This is a measure of the amount by which a price has fluctuated or is expected to

fluctuate. The Company uses actual historical changes in the market value of our stock to calculate the

volatility assumption as it is management’s belief that this is the best indicator of future volatility. We calculate

daily market value changes from the date of grant over a past period representative of the expected

46

10-K