AutoZone 2010 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2010 AutoZone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

Financial Commitments

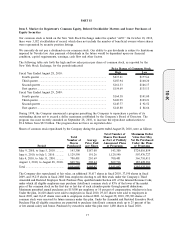

The following table shows our significant contractual obligations as of August 28, 2010:

(in thousands)

Total

Contractual

Obligations

Less than

1 year

Between

1-3 years

Between

4-5 years

Over

5 years

Payment Due by Period

Long-term debt

(1)

................................ $2,882,300 $ 632,300 $ 500,000 $1,000,000 $ 750,000

Interest payments

(2)

............................. 617,225 140,600 245,238 155,800 75,587

Operating leases

(3)

............................... 1,740,047 196,291 357,943 284,836 900,977

Capital leases

(4)

................................... 92,745 21,947 44,832 25,966 —

Self-insurance reserves

(5)

.................... 158,384 60,955 43,045 22,688 31,696

Construction commitments ................. 15,757 15,757 — — —

$5,506,458 $1,067,850 $1,191,058 $1,489,290 $1,758,260

(1) Long-term debt balances represent principal maturities, excluding interest.

(2) Represents obligations for interest payments on long-term debt.

(3) Operating lease obligations are inclusive of amounts accrued within deferred rent and closed store obliga-

tions reflected in our consolidated balance sheets.

(4) Capital lease obligations include related interest.

(5) We retain a significant portion of the risks associated with workers’ compensation, employee health, gen-

eral and product liability, property, and vehicle insurance. These amounts represent estimates based on

actuarial calculations. Although these obligations do not have scheduled maturities, the timing of future

payments are predictable based upon historical patterns. Accordingly, we reflect the net present value of

these obligations in our consolidated balance sheets.

We have pension obligations reflected in our consolidated balance sheet that are not reflected in the table

above due to the absence of scheduled maturities and the nature of the account. As of August 28, 2010, our

pension liability is $211.5 million and our pension assets are valued at $117.2 million. Amounts recorded in

accumulated other comprehensive loss are $94.3 million at August 28, 2010. These amounts will be amortized

into pension expense in the future, unless they are recovered in future periods through actuarial gains.

Additionally, our tax liability for uncertain tax positions, including interest and penalties, was $46.5 million at

August 28, 2010. Approximately $28.4 million is classified as current liabilities and $18.1 million is classified

as long-term liabilities. We did not reflect these obligations in the table above as we are unable to make an

estimate of the timing of payments due to uncertainties in the timing of the settlement of these tax positions.

Off-Balance Sheet Arrangements

The following table reflects outstanding letters of credit and surety bonds as of August 28, 2010:

(in thousands)

Total

Other

Commitments

Standby letters of credit .................................................................................................................. $ 107,554

Surety bonds .................................................................................................................................... 23,723

$ 131,277

A substantial portion of the outstanding standby letters of credit (which are primarily renewed on an annual

basis) and surety bonds are used to cover reimbursement obligations to our workers’ compensation carriers.

There are no additional contingent liabilities associated with them as the underlying liabilities are already

reflected in our consolidated balance sheet. The standby letters of credit and surety bonds arrangements expire

within one year, but have automatic renewal clauses.

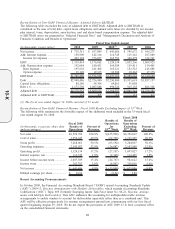

Reconciliation of Non-GAAP Financial Measures

“Selected Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of

Operations” include certain financial measures not derived in accordance with generally accepted accounting

principles (“GAAP”). These non-GAAP financial measures provide additional information for determining our

26