AutoZone 2010 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2010 AutoZone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

which are contractual rights to receive in the future a share of AutoZone common stock. Restricted Stock

Units become fully vested on the date they are issued and generally will become unrestricted as of the date

that a non-employee director ceases to be a director of the Company (the “Payment Date”). Restricted Stock

Units are paid in shares of AutoZone common stock as soon as practicable after the Payment Date, to be no

later than the fifteenth day of the third month following the end of the tax year in which such Payment Date

occurs, unless the director has elected to defer receipt.

The Retainer is payable in advance in equal quarterly installments on January 1, April 1, July 1, and

October 1 of each year. The number of Restricted Stock Units granted each quarter is determined by dividing

the amount of the Retainer by the fair market value of the shares as of the grant date.

If a non-employee director is elected to the Board after the beginning of a calendar quarter, he or she will

receive a prorated Retainer based on the number of days remaining in the calendar quarter in which the date

of the Board election occurs.

The 2011 Equity Plan is described in more detail in “PROPOSAL 2 — Approval of the AutoZone, Inc.

2011 Equity Incentive Award Plan” on page 16.

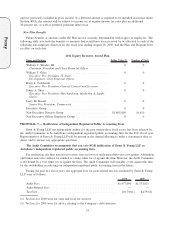

Predecessor Plans

The AutoZone, Inc. Second Amended and Restated Director Compensation Plan and the AutoZone, Inc.

Fourth Amended and Restated 1998 Director Stock Option Plan were terminated in December 2002 and were

replaced by the 2003 Director Compensation Plan and the 2003 Director Stock Option Plan. However, grants

made under those plans continue in effect under the terms of the grant made and are included in the aggregate

awards outstanding shown above.

Stock Ownership Requirement

The Board has established a stock ownership requirement for non-employee directors. Within three years

of joining the Board, each director must personally invest at least $150,000 in AutoZone stock. Shares and

Stock Units issued under the AutoZone, Inc. Second Amended and Restated Director Compensation Plan and

the 2003 Director Compensation Plan count toward this requirement.

PROPOSAL 2 — Approval of the AutoZone, Inc. 2011 Equity Incentive Award Plan

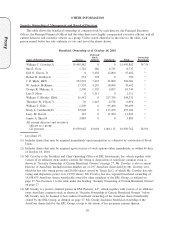

Our Board is recommending approval of the AutoZone, Inc. 2011 Equity Incentive Award Plan (the

“Plan”) for non-employee members of our Board, as well as employees of AutoZone and our subsidiaries and

affiliates. The Board adopted the Plan on October 17, 2010, subject to approval by our stockholders (the

“Effective Date”). If approved, the Plan will replace the Third Amended and Restated 1996 Stock Option Plan,

the 2006 Stock Option Plan, the First Amended and Restated 2003 Director Compensation Plan, the First

Amended and Restated 2003 Director Stock Option Plan, the Second Amended and Restated 1998 Director

Compensation Plan and the Fourth Amended and Restated 1998 Director Stock Option Plan (collectively, the

“Prior Plans”), and no further awards will be granted under the Prior Plans. Any awards under the Prior Plans

that are outstanding as of the date of stockholder approval (the “Stockholder Approval Date”) will continue to

be subject to the terms and conditions of the applicable Prior Plan. Unused shares from the 2006 Stock Option

Plan, the First Amended and Restated 2003 Director Compensation Plan and the First Amended and Restated

2003 Director Stock Option Plan and shares underlying awards outstanding under those plans as of the

Stockholder Approval Date that terminate, expire or lapse will be made available for awards made pursuant to

the Plan. In the event the Plan is not approved by the stockholders, awards will continue to be available for

issuance pursuant to the Prior Plans.

In accordance with New York Stock Exchange listing requirements, adoption of the Plan requires approval

by a majority of shares of votes cast on such proposal, provided that the total vote cast on the proposal

represents over 50% of the outstanding shares of Stock entitled to vote on the proposal. Abstentions will have

the effect of a vote against this proposal. Broker non-votes will not be counted as voting either for or against

the Plan.

16

Proxy