AutoZone 2010 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2010 AutoZone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

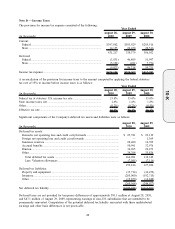

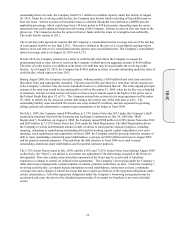

Note D — Income Taxes

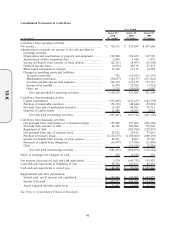

The provision for income tax expense consisted of the following:

(in thousands)

August 28,

2010

August 29,

2009

August 30,

2008

Year Ended

Current:

Federal ............................................................................................... $397,062 $303,929 $285,516

State ................................................................................................... 34,155 26,450 20,516

431,217 330,379 306,032

Deferred:

Federal ............................................................................................... (3,831) 46,809 51,997

State ................................................................................................... (5,192) (491) 7,754

(9,023) 46,318 59,751

Income tax expense............................................................................... $422,194 $376,697 $365,783

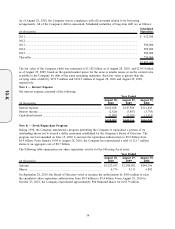

A reconciliation of the provision for income taxes to the amount computed by applying the federal statutory

tax rate of 35% to income before income taxes is as follows:

(in thousands)

August 28,

2010

August 29,

2009

August 30,

2008

Year Ended

Federal tax at statutory U.S. income tax rate....................................... 35.0% 35.0% 35.0%

State income taxes, net ......................................................................... 1.6% 1.6% 1.8%

Other...................................................................................................... (0.2%) (0.2%) (0.5%)

Effective tax rate ................................................................................... 36.4% 36.4% 36.3%

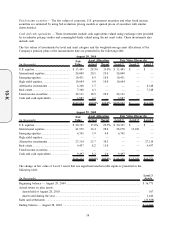

Significant components of the Company’s deferred tax assets and liabilities were as follows:

(in thousands)

August 28,

2010

August 29,

2009

Deferred tax assets:

Domestic net operating loss and credit carryforwards ............................................ $ 25,781 $ 23,119

Foreign net operating loss and credit carryforwards ............................................... — 1,369

Insurance reserves ..................................................................................................... 20,400 14,769

Accrued benefits ....................................................................................................... 50,991 32,976

Pension....................................................................................................................... 34,965 26,273

Other .......................................................................................................................... 34,764 35,836

Total deferred tax assets ....................................................................................... 166,901 134,342

Less: Valuation allowances ................................................................................... (7,085) (7,116)

159,816 127,226

Deferred tax liabilities:

Property and equipment ............................................................................................ (35,714) (36,472)

Inventory.................................................................................................................... (205,000) (192,715)

Other .......................................................................................................................... (19,850) (14,840)

(260,564) (244,027)

Net deferred tax liability............................................................................................... $(100,748) $(116,801)

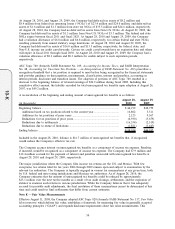

Deferred taxes are not provided for temporary differences of approximately $91.1 million at August 28, 2010,

and $47.1 million of August 29, 2009, representing earnings of non-U.S. subsidiaries that are intended to be

permanently reinvested. Computation of the potential deferred tax liability associated with these undistributed

earnings and other basis differences is not practicable.

49

10-K