AutoZone 2010 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2010 AutoZone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

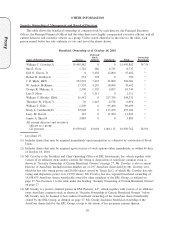

(2) As described in more detail on page 3, ESL has entered into an agreement with the Company that

addresses, among other items, appearances at meetings of stockholders for the purposes of having a quo-

rum, voting of ESL shares and the selection of nominees for the Company’s Board of Directors.

(3) The source of this information is the Schedule 13F filed with the Securities and Exchange Commission by

the T. Rowe Price Associates, Inc. on August 13, 2010, reporting beneficial ownership as of June 30,

2010.

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

This Compensation Discussion and Analysis provides a principles-based overview of AutoZone’s execu-

tive compensation program. It discusses our rationale for the types and amounts of compensation that our

executive officers receive and how compensation decisions affecting these officers are made. It also discusses

AutoZone’s total rewards philosophy, the key principles governing our compensation program, and the

objectives we seek to achieve with each element of our compensation program.

What are the Company’s key compensation principles?

Pay for performance. The primary emphasis of AutoZone’s compensation program is linking executive

compensation to business results and intrinsic value creation, which is ultimately reflected in increases in

stockholder value. Base salary levels are intended to be competitive in the U.S. marketplace for executives, but

the more potentially valuable components of executive compensation are annual cash incentives, which depend

on the achievement of pre-determined business goals, and to a greater extent, long-term compensation, which

is based on the value of our stock.

Attract and retain talented AutoZoners. The overall level and balance of compensation elements in our

compensation program are designed to ensure that AutoZone can retain key executives and, when necessary,

attract qualified new executives to the organization. We believe that a company which provides quality

products and services to its customers, and delivers solid financial results, will generate long-term stockholder

returns, and that this is the most important component of attracting and retaining executive talent.

What are the Company’s overall executive compensation objectives?

Drive high performance. AutoZone sets challenging financial and operating goals, and a significant

amount of an executive’s annual cash compensation is tied to these objectives and therefore “at risk” —

payment is earned only if performance warrants it.

Drive long-term stockholder value. AutoZone’s compensation program is intended to support long-term

focus on stockholder value, so it emphasizes long-term rewards. At target levels, the majority of an executive

officer’s total compensation package each year is the potential value of his or her stock options.

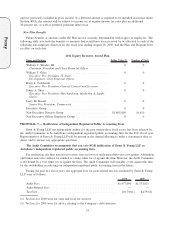

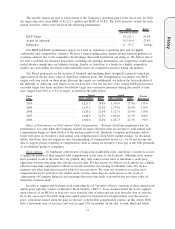

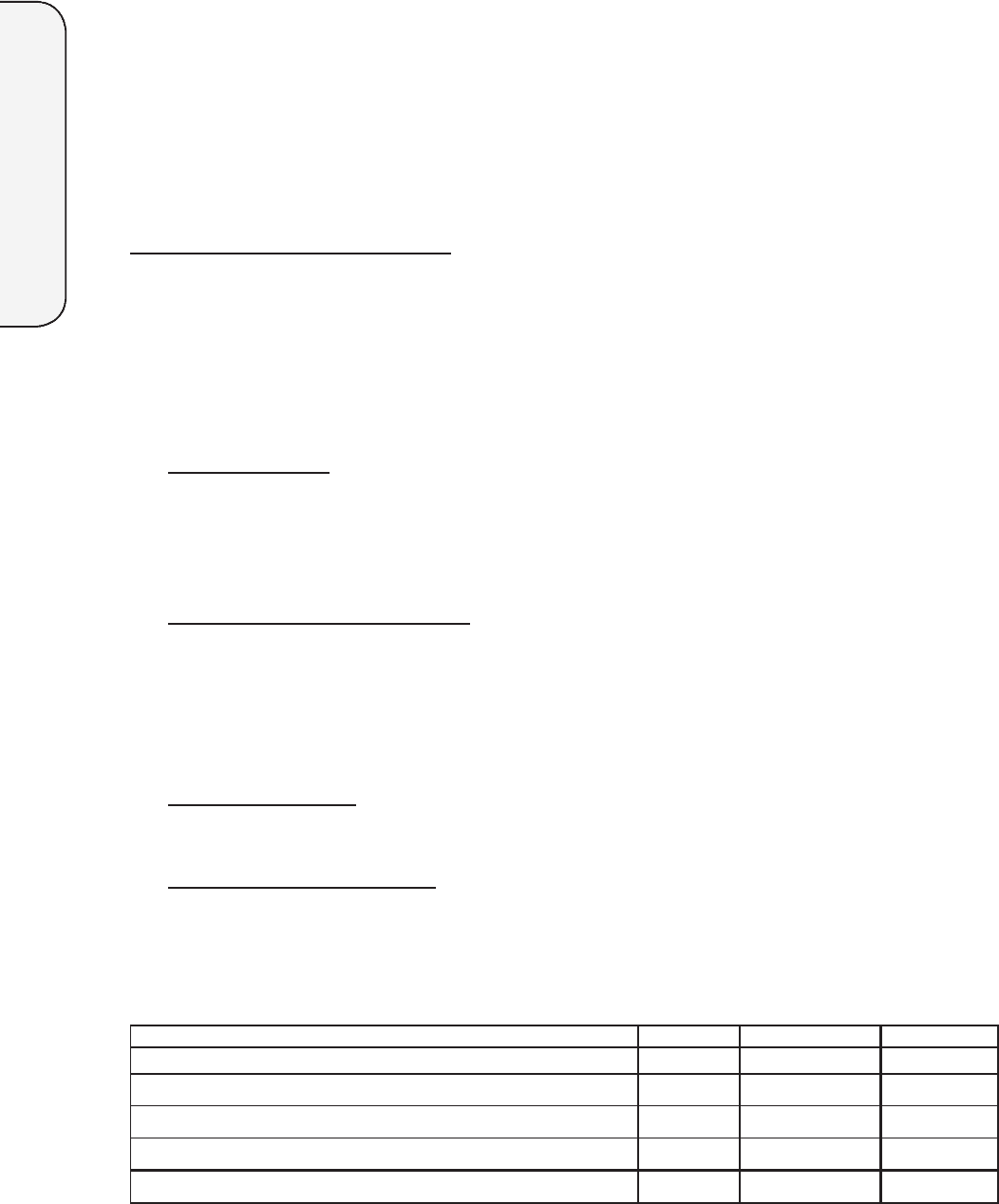

The table below illustrates how AutoZone’s compensation program weights the “at-risk” components of

its named executive officers’ 2010 total compensation (using actual base earnings + fiscal 2010 cash incentive

payment + Black-Scholes value of fiscal 2010 stock option grant):

Executive Base Salary Annual Incentive Stock Options

William C. Rhodes III 25% 43% 32%

William T. Giles 27% 34% 39%

James A. Shea 26% 34% 40%

Harry L. Goldsmith 26% 33% 41%

Larry M. Roesel 30% 30% 40%

28

Proxy