Aflac 2007 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2007 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A Year of Excellent Investment Returns

for Aflac Shareholders

For the fifth year in a row, the stock market

posted gains, with the Standard & Poor’s

(S&P) 500 Index rising 3.5% for the year.

Insurance stocks, as measured by the

Standard & Poor’s Life and Health Insurance

Index, performed even better, increasing

9.5%. By comparison, Aflac shares

outperformed the broader market and its

peer group, increasing 36.2% from $46.00

at the end of 2006 to $62.63 at the end of

2007. Including reinvested cash dividends,

Aflac’s total return to shareholders was

38.2% in 2007. For the last five years, Aflac’s

total return has compounded annually at

17.1%. And over the last 10 years, our total

return to shareholders has compounded at

18.3% annually, compared with a 5.9%

compound annual return for the S&P 500.

Aflac’s shares have been a source of value to

investors for more than five decades.

Shareholders who invested in Aflac when

the company was founded in 1955 and who

exhibited patience and long-term vision

have been extremely well-rewarded for their

investment. The purchase of 100 Aflac

shares 52 years ago cost $1,110. After 28

stock dividends or stock splits, those 100

shares had increased to 187,980 shares at

the end of 2007, excluding reinvested cash

dividends. As of December 31, 2007, the

original investment would have been worth

$11.8 million. In addition, Aflac’s earliest

investors received $150,384 in cash

dividends in 2007 alone on their original

investment, or more than 135 times the

acquisition price of those original 100

shares.

A Stable Shareholder Base

Approximately 80,000 registered

shareholders owned Aflac shares at the end

of 2007. Institutional investors owned

approximately 68% of Aflac’s shares, with

the balance owned by individual investors.

Directors, employees and agents owned

about 5% of the company’s shares at the

end of 2007.

Committed to Shareholder Service

As a public company, we follow through on

our obligation to all members of the

investment community to provide

transparent and relevant disclosure of

information to help them gain a thorough

understanding of our operations. Our

Shareholder Services Department provides

stock transfer services and administers our

dividend reinvestment plan. On aflac.com,

we provide access to the conference calls we

conduct in conjunction with our quarterly

earnings releases, webcasts of analyst

meetings, our calendar of events, and an

e-mail alert notification service that can

automatically notify investors each time

Aflac issues a press release or files with the

United States Securities and Exchange

Commission (SEC). The Investors page of

aflac.com also provides a convenient way to

view, download and print annual and

quarterly reports, SEC filings, quarterly

statistical financial supplements, and

information about our commitment to

corporate responsibility.

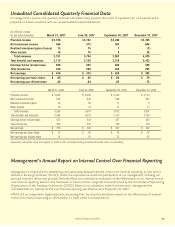

Investor Information

Year-end Five-Year 10-Year

Market Value 2007 Annual Annual

Symbol (In billions) Return* Return* Return*

Aflac AFL $ 30.5 38.2% 17.1% 18.3%

Lincoln National LNC 15.4 (10.2) 16.4 7.1

MetLife MET 44.9 5.7 19.1 **

Principal Financial PFG 17.8 18.8 19.5 **

Prudential Financial PRU 42.1 9.7 25.4 **

Torchmark TMK 5.7 (4.3) 11.6 6.2

Unum Group UNM 8.6 15.9 8.3 (6.1)

*Includes reinvested cash dividends **Not applicable

Peer Company

Comparison

Aflac’s total return to

shareholders compounded

at 18.3% annually over

the last 10 years.

75

Annual Report for 2007