Aflac 2007 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2007 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36 There’s Only One Aflac

Currency Risk

The functional currency of Aflac Japan’s insurance

operation is the Japanese yen. All of Aflac Japan’s

premiums, claims and commissions are received or

paid in yen, as are most of its investment income and

other expenses. Furthermore, most of Aflac Japan’s

investments, cash and liabilities are yen-

denominated. When yen-denominated securities

mature or are sold, the proceeds are generally

reinvested in yen-denominated securities. Aflac

Japan holds these yen-denominated assets to fund

its yen-denominated policy obligations. In addition,

Aflac Incorporated has yen-denominated notes

payable and cross-currency swaps related to its

dollar-denominated senior notes.

Although we generally do not convert yen into

dollars, we do translate financial statement amounts

from yen into dollars for financial reporting

purposes. Therefore, reported amounts are affected

by foreign currency fluctuations. We report

unrealized foreign currency translation gains and

losses in other comprehensive income.

On a consolidated basis, we attempt to minimize the

exposure of shareholders’ equity to foreign currency

translation fluctuations. We accomplish this by

investing a portion of Aflac Japan’s investment

portfolio in dollar-denominated securities, by the

Parent Company’s issuance of yen-denominated debt

and by the use of cross-currency swaps (see the

Hedging Activities section of this MD&A for

additional information). As a result, the effect of

currency fluctuations on our net assets is mitigated. The dollar

values of our yen-denominated net assets, which are subject to

foreign currency translation fluctuations for financial reporting

purposes, are summarized as follows (translated at end-of-

period exchange rates) for the years ended December 31:

The following table demonstrates the effect of foreign

currency fluctuations by presenting the dollar values of our

yen-denominated assets and liabilities, and our consolidated

yen-denominated net asset exposure at selected exchange

rates as of December 31.

We are exposed to economic currency risk only when yen

funds are actually converted into dollars. This primarily occurs

when we repatriate funds from Aflac Japan to Aflac U.S.,

which is done annually. The exchange rates prevailing at the

time of repatriation will differ from the exchange rates

prevailing at the time the yen profits were earned. These

repatriations have not been greater than 80% of Aflac Japan’s

prior-year earnings determined in accordance with standards

established by the FSA. A portion of the repatriation may be

used to service Aflac Incorporated’s yen-denominated notes

payable with the remainder converted into dollars.

Interest Rate Risk

Our primary interest rate exposure is to the impact of changes

in interest rates on the fair value of our investments in debt

securities. We use modified duration analysis, which measures

price percentage volatility, to estimate the sensitivity of fair

values to interest rate changes on debt securities we own. For

example, if the current duration of a debt security is 10, then

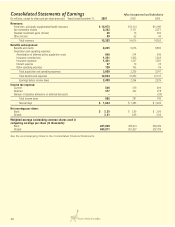

(In millions) 2007 2006

Aflac Japan yen-denominated net assets $ 2,415 $ 2,317

Parent Company yen-denominated net liabilities (1,496) (1,434)

Consolidated yen-denominated net assets subject

to foreign currency translation fluctuations $ 919 $ 883

Dollar Value of Yen-Denominated Assets and

Liabilities at Selected Exchange Rates

(In millions) 2007 2006

Yen/dollar exchange rates 99.15 114.15* 129.15 104.11 119.11* 134.11

Yen-denominated financial

instruments:

Assets:

Securities available for sale:

Fixed maturities $ 23,190 $ 20,143 $ 17,803 $ 21,712 $ 18,978 $ 16,856

Perpetual debentures 4,218 3,664 3,238 4,246 3,711 3,296

Equity securities 25 22 20 29 25 22

Securities held to maturity:

Fixed maturities 19,341 16,799 14,848 15,404 13,464 11,958

Perpetual debentures 4,588 3,985 3,522 4,565 3,990 3,544

Cash and cash equivalents 369 321 284 383 335 297

Other financial instruments 60 52 46 32 28 25

Subtotal 51,791 44,986 39,761 46,371 40,531 35,998

Liabilities:

Notes payable 1,169 1,015 898 1,117 976 868

Cross-currency swaps 560 487 430 534 467 414

Japanese policyholder

protection corporation 174 151 133 200 175 155

Subtotal 1,903 1,653 1,461 1,851 1,618 1,437

Net yen-denominated

financial instruments 49,888 43,333 38,300 44,520 38,913 34,561

Other yen-denominated

assets 6,310 5,480 4,844 5,550 4,852 4,309

Other yen-denominated

liabilities (55,140) (47,894) (42,331) (49,060) (42,882) (38,086)

Consolidated yen-denominated

net assets subject to foreign

currency fluctuation $ 1,058 $ 919 $ 813 $ 1,010 $ 883 $ 784

*Actual year-end exchange rate