Aflac 2007 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2007 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

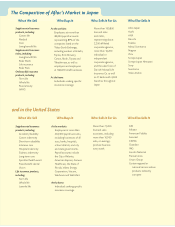

Aflac Japan’s Products –

There’s Only One Number One

Japan has grappled with financing health

care for an aging population for many years.

Due to the rapidly aging demographic, it is

not surprising that consumers have been

required to shoulder a larger financial

burden for health care. In fact, copayments

have tripled over the last 12 years for most

of the population, driving consumers to seek

private insurance to help bear rising out-of-

pocket expenses. Aflac’s product line

provides a means to fill that need.

We still believe there is a large and

underpenetrated market for cancer insurance

in Japan, and we are intent on maintaining

our leadership position. To that end, we

introduced a new product in September

2007 called Cancer Forte. This is the first

major revision we’ve made to our cancer

product since we introduced 21st Century

Cancer in 2001. Responding to requests for

enhanced outpatient coverage for cancer

treatment, Cancer Forte pays outpatient

benefits for 60 days, compared with 30 days

for our old product. It also incorporates two

new features that consumers should find

attractive. First, if a policyholder is diagnosed

with cancer for the first time, we pay that

policyholder a survivor annuity from the

second year through the fifth year after

diagnosis. This is in addition to the traditional

upfront first-occurrence benefit. The second

new benefit, “Premier Support,” arranges for

a third party to provide policyholders with

counseling and doctor referral services upon

their cancer diagnosis.

We believe the need for supplemental

medical products is also strong. In February

2002, we launched a stand-alone medical

product called EVER. Since that time, we

have expanded our suite of EVER product

offerings. We further broadened our medical

product portfolio in February 2007 with

EVER Paid Up, a product that allows

policyholders to choose to pay higher

premium payments on the front end so

they’ll be payment-free at either age 60 or

65. And in August 2007, we introduced

Gentle EVER, which helps consumers who

may have a health condition that would

exclude them from purchasing our other

EVER products. We determined that there’s

an attractive and eager market for this type

of medical product in Japan and believe

Gentle EVER will be an effective means for

10

10