Aflac 2007 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2007 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

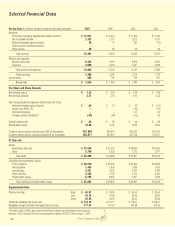

Despite that challenge, Aflac’s investment

portfolio continued to perform well. Some

Aflac Japan investment highlights for

2007 follow:

•Investments and cash increased 10.6% to

$48.5 billion at the end of 2007. In yen,

investments and cash were up 6.0%.

•Net investment income increased 6.7% to

$1.8 billion. In yen, net investment income

rose 8.0%.

•The average yield on new investments was

3.38% in 2007, compared with 3.33%

in 2006.

Aflac Japan’s overall credit quality remained

high. At the end of 2007, 82.2% of our

holdings were rated A or better on an

amortized cost basis. Only 1.9% of Aflac

Japan’s debt securities were rated below

investment grade at the end of 2007.

We believe that our conservative investment

approach serves our customers and

shareholders very well.

Fueling Future Growth

As we frame our strategies for the future,

we believe the competitive attributes that

have been the impetus behind our market

leadership will continue to serve us well.

With the demand for our medical products

improving in 2007, we are still convinced

of the basic need for our products as con-

sumers struggle to keep up with higher

out-of-pocket expenses for medical care.

To help us reach out to more potential poli-

cyholders in the Japanese market, we will:

•Enhance our product line – We will research

and develop innovative products and adapt

current products to match the evolving needs

of Japanese consumers to help them cope

with the increasing burden of out-of-pocket

health care costs.

•Promote our brand position – We will

capitalize on our market-leading status to

attract consumers and distinguish our

products while emphasizing the attributes

that led us to our number one position.

•Develop our distribution system – We will

focus on enhancing the productivity of our

sales force, while also developing the banking

and Japan Post channels to better reach new

customers.

•Boost operational efficiency – We will

streamline our business processes to increase

our core competitive advantage and provide

convenience for policyholders and consumers,

while investing in new technology.

15