Aflac 2007 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2007 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54 There’s Only One Aflac

that fair value is the relevant measurement attribute.

Accordingly, SFAS 157 does not require any new fair value

measurements. Where applicable, this standard codifies

related guidance within GAAP. SFAS 157 is effective for fiscal

years beginning after November 15, 2007, with earlier

application encouraged under limited circumstances. We do

not expect the adoption of this standard to have a material

effect on our financial position or results of operations.

In June 2006, the FASB issued FASB Interpretation No. 48

(FIN 48), Accounting for Uncertainty in Income Taxes, an

Interpretation of FASB Statement No. 109. The provisions of

FIN 48 clarify the accounting for uncertainty in income taxes

recognized in an enterprise’s financial statements in

accordance with SFAS No. 109, Accounting for Income Taxes.

FIN 48 prescribes a recognition threshold and measurement

attribute for the financial statement recognition and

measurement of a tax position taken or expected to be taken

in a tax return. The evaluation of a tax position in accordance

with FIN 48 is a two-step process. Under the first step, the

enterprise determines whether it is more likely than not that

a tax position will be sustained upon examination by taxing

authorities. The second step is measurement, whereby a tax

position that meets the more-likely-than-not recognition

threshold is measured to determine the amount of benefit to

recognize in the financial statements. The tax position is

measured at the largest amount of benefit that is greater than

50% likely of being realized upon ultimate settlement. FIN 48

also provides guidance on derecognition, classification, interest

and penalties, accounting in interim periods, disclosure, and

transition. FIN 48 is effective for fiscal years beginning after

December 15, 2006, with earlier application encouraged. We

adopted the provisions of this standard effective January 1,

2007. The adoption of this standard did not have any impact

on our financial position or results of operations (see Note 8).

In September 2005, the Accounting Standards Executive

Committee of the American Institute of Certified Public

Accountants (AICPA) issued Statement of Position (SOP) 05-1,

Accounting by Insurance Enterprises for Deferred Acquisition

Costs in Connection with Modifications or Exchanges of

Insurance Contracts (SOP 05-1). SOP 05-1 provides

accounting guidance on internal replacements of insurance

and investment contracts other than those specifically

described in SFAS No. 97, Accounting and Reporting by

Insurance Enterprises for Certain Long-Duration Contracts and

for Realized Gains and Losses from the Sale of Investments.

SOP 05-1 is effective for internal replacements occurring in

fiscal years beginning after December 15, 2006, with earlier

adoption encouraged. Retrospective application of this SOP

to previously issued financial statements is not permitted. We

adopted the provisions of this statement effective January 1,

2007. We have determined that certain of our policy

modifications in both the United States and Japan that were

previously accounted for as a continuation of existing

coverage will be considered internal replacements that are

substantially changed as contemplated by SOP 05-1 and will

be accounted for as the extinguishment of the affected

policies and the issuance of new contracts. The adoption of

this statement increased net earnings by $6 million, or $.01

per diluted share, and was insignificant to our financial

position and results of operations.

Recent accounting pronouncements not discussed above are

not applicable to our business.

Securities and Exchange Commission Guidance: In

September 2006, the Securities and Exchange Commission

(SEC) issued Staff Accounting Bulletin No. 108 (SAB 108). SAB

108 addresses quantifying the financial statement effects of

misstatements, specifically, how the effects of uncorrected

errors from prior years must be considered in quantifying

misstatements in current year financial statements. Under the

provisions of SAB 108, a reporting entity must quantify and

evaluate errors using a balance sheet approach and an income

statement approach. After considering all relevant quantitative

and qualitative factors, if either approach results in a

misstatement that is material, a reporting entity’s financial

statements must be adjusted. SAB 108 applies to SEC

registrants and is effective for fiscal years ending after

November 15, 2006. In the course of evaluating balance sheet

amounts in accordance with the provisions of SAB 108, we

identified the following amounts that we adjusted for as of

January 1, 2006: a tax liability in the amount of $87 million

related to deferred tax asset valuation allowances that were

not utilized; a tax liability in the amount of $45 million related

to various provisions for taxes that were not utilized; and a

litigation liability in the amount of $11 million related to

provisions for various pending lawsuits that were not utilized.

These liabilities were recorded in immaterial amounts prior to

2004 over a period ranging from 10 to 15 years. However,

using the dual evaluation approach prescribed by SAB 108,

correction of the above amounts would be material to 2006

earnings. In accordance with the provisions of SAB 108, the

following amounts, net of tax where applicable, have been

reflected as an opening adjustment to retained earnings as of

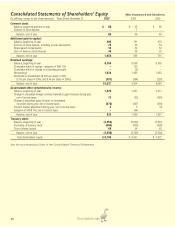

January 1, 2006: a reduction of tax liabilities in the amount of

$132 million; a reduction of litigation reserves in the amount

of $11 million; and a reduction in deferred tax assets in the

amount of $4 million. These three adjustments resulted in

a net addition to retained earnings in the amount of

$139 million.