Aflac 2007 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2007 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Overcoming Obstacles

and Meeting Targets

Aflac Japan is no stranger to overcoming

challenges, and 2007 was no exception.

Following disappointing sales in 2006,

our primary task was to turn sales around

in 2007 despite a challenging market

environment. And like 2006, the market

was cluttered with competing medical

products. Consumer confidence also

remained weak in light of claims payment

errors that plagued the life insurance

industry. Reflecting this challenging

environment, sales declined in the first half

of the year. As we expected, sales turned

positive in the second half of the year, and

we again retained the distinction of being

the number one seller of both cancer life

and medical insurance policies in Japan.

Our persistency was again strong and

stable, and our new money investment

yields were ahead of target. Most

important, our financial performance

was consistent with our expectations.

Following are some financial highlights

from 2007:

•Premium income rose 4.3% to ¥1.1 trillion,

compared with ¥1.0 trillion in 2006.

•Total revenues increased 4.9% to ¥1.3 trillion,

compared with ¥1.2 trillion a year ago.

•Pretax operating earnings rose 11.8% from

¥192.1 billion in 2006 to ¥214.7 billion

in 2007.

The Impact of the

Yen/Dollar Exchange Rate

Aflac Japan collects premiums in yen, pays

benefits and expenses in yen and primarily

holds yen-denominated assets to support

yen-denominated liabilities. With the

exception of a limited number of trans-

actions, we do not convert yen into dollars.

Therefore, currency changes do not have a

material effect on Aflac in economic terms.

However, for financial reporting purposes,

we are required to translate Aflac Japan’s

income statement from yen into dollars

using an average exchange rate. And since

Aflac Japan is responsible for the majority of

consolidated revenues and pretax operating

earnings, fluctuations in the value of the yen

can significantly affect our results as reported

in dollars.

Translating Aflac Japan’s results from yen

into dollars means that growth rates are

magnified in dollar terms when the average

yen/dollar exchange rate is stronger than

the preceding year. Conversely, growth rates

in dollar terms are lower when the yen is

weaker to the dollar in comparison with the

preceding year. In 2007, the yen averaged

117.93 to the dollar, or 1.4% weaker than

the average of 116.31 in 2006, suppressing

our reported results in dollar terms.

•Premium income rose 3.1% to $9.0 billion, up

from $8.8 billion in 2006.

•Total revenues were up 3.7% to $10.9 billion,

compared with $10.5 billion in 2006.

•Pretax operating earnings increased 10.2% to

$1.8 billion from $1.7 billion in 2006.

Aflac Japan

8

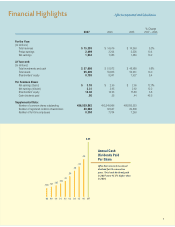

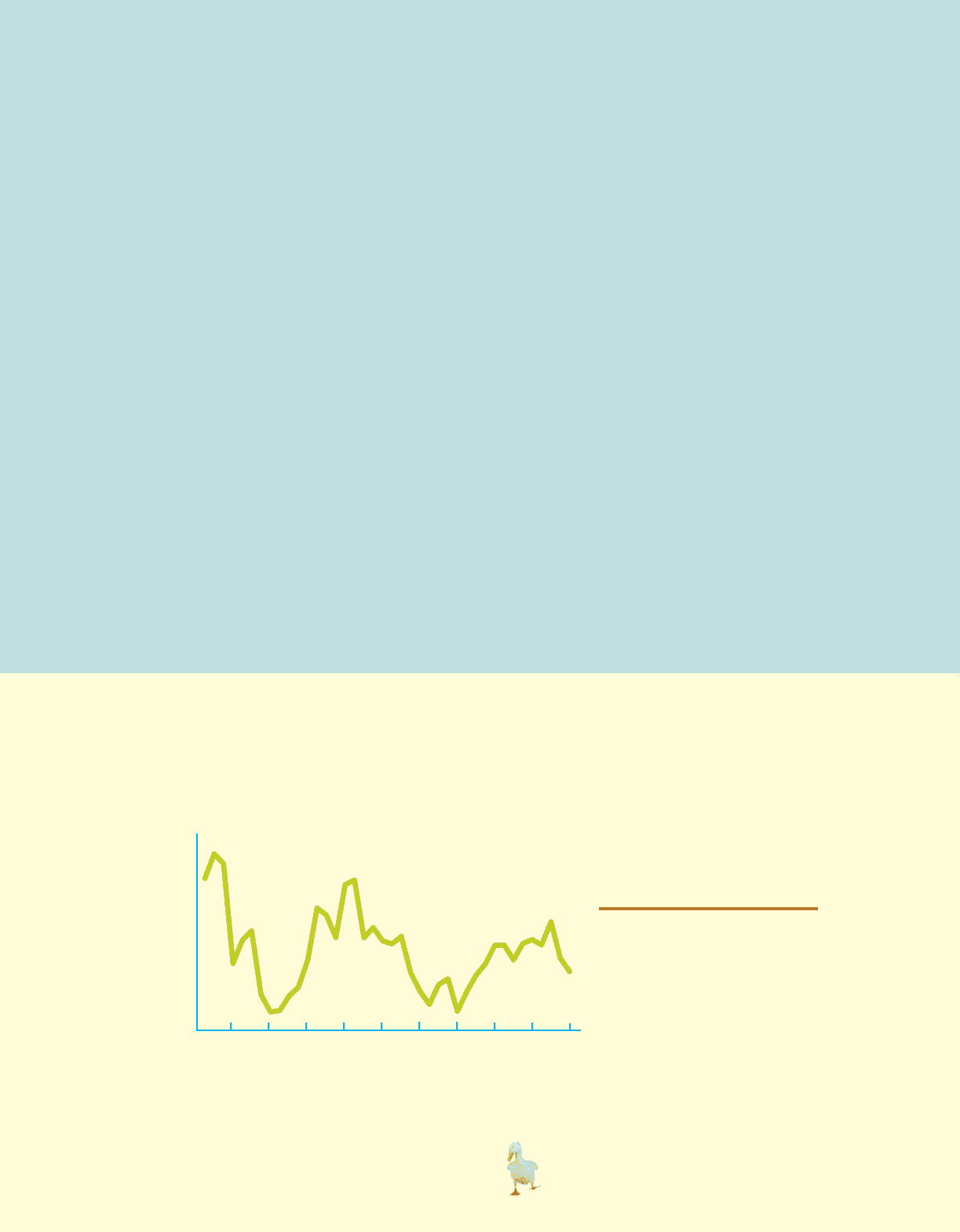

98 99 00 01 02 03 04 05 06 07

100

110

120

130

¥140

Yen/Dollar

Exchange Rate

(Closing rates)

The average yen/dollar

exchange rate weakened 1.4%

in 2007, which modestly

suppressed Aflac Japan’s

growth rates in dollar terms.

There’s Only One Aflac