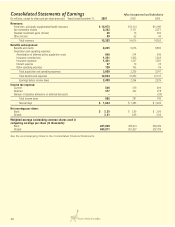

Aflac 2007 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2007 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

Annual Report for 2007

The fair value of our investments in debt securities can fluctuate

as a result of changes in interest rates, foreign currency

exchange rates, and credit issues. Declines in fair value resulted

from changes in interest rates, yen/dollar exchange rates, and

issuer credit status, as well as increasing risk premiums. However,

we believe that it would be inappropriate to recognize

impairment charges because we believe the changes in fair value

are temporary. Based on our evaluation and analysis of specific

issuers in accordance with our impairment policy, impairment

charges recognized in 2007 were $23 million, before taxes.

Impairment charges in 2006 and 2005 were immaterial.

Realized losses on debt securities, as a result of sales and

impairment charges, were as follows for the year ended

December 31, 2007:

Cash, cash equivalents and short-term investments totaled

$1.6 billion, or 2.7% of total investments and cash, as of

December 31, 2007, compared with $1.2 billion, or 2.3%, at

December 31, 2006.

For additional information concerning our investments, see

Notes 3 and 4 of the Notes to the Consolidated Financial

Statements.

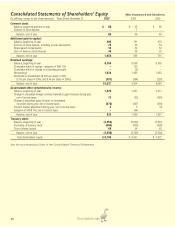

Deferred Policy Acquisition Costs

The following table presents deferred policy acquisition costs

by segment for the years ended December 31.

Aflac Japan’s deferred policy acquisition costs increased 10.7%

(6.1% increase in yen). The stronger yen at year-end increased

reported deferred policy acquisition costs by $178 million.

Deferred policy acquisition costs of Aflac U.S. increased 10.0%.

The increase in deferred policy acquisition costs was primarily

driven by total new annualized premium sales.

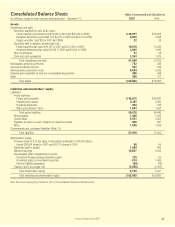

Policy Liabilities

The following table presents policy liabilities by segment for

the years ending December 31.

Aflac Japan’s policy liabilities increased 11.5% (6.9% increase

in yen). The stronger yen at year-end increased reported

policy liabilities by $1.9 billion. Policy liabilities of Aflac U.S.

increased 11.4%. The increase in total policy liabilities is the

result of the growth and aging of our in-force business.

Notes Payable

Notes payable totaled $1.5 billion at December 31, 2007,

compared with $1.4 billion at December 31, 2006. The ratio of

debt to total capitalization (debt plus shareholders’ equity,

excluding the unrealized gains and losses on investment

securities) was 15.6% as of December 31, 2007, compared with

17.2% a year ago. See Note 7 of the Notes to the Consolidated

Financial Statements for additional information.

Benefit Plans

Aflac U.S. and Aflac Japan have various benefit plans. For

additional information on our U.S. and Japanese plans, see Note

12 of the Notes to the Consolidated Financial Statements.

Policyholder Protection Corporation

The Japanese insurance industry has a policyholder protection

system that provides funds for the policyholders of insolvent

insurers. In 2005, legislation was enacted extending the

framework of the Life Insurance Policyholder Protection

Corporation (LIPPC), which included government fiscal

measures supporting the LIPPC through March 2009. These

measures do not contemplate additional industry assessments

through March 2009 absent an event requiring LIPPC funds.

The likelihood and timing of future assessments, if any, cannot

be determined at this time.

Hedging Activities

Aflac has limited hedging activities. Our primary exposure to

be hedged is our investment in Aflac Japan, which is affected

by changes in the yen/dollar exchange rate. To mitigate this

exposure, we have taken the following courses of action. First,

Aflac Japan maintains a portfolio of dollar-denominated

securities, which serve as an economic currency hedge of a

portion of our investment in Aflac Japan. Second, we have

Realized Losses on Debt Securities

Realized

(In millions)

Proceeds Loss

Investment-grade securities, length of consecutive unrealized loss:

Less than six months $ 163 $ 1

Six months to 12 months 52 3

Over 12 months 60 2

Below-investment-grade securities, length of consecutive unrealized loss:

Less than six months – 20

Over 12 months – 2

Total $ 275 $ 28

(In millions)

2007 2006

Aflac Japan $ 4,269 $ 3,857

Aflac U.S. 2,385 2,168

Total $ 6,654 $ 6,025

Increase over prior year 10.4% 7.8%

(In millions)

2007 2006

Aflac Japan $ 44,694 $ 40,072

Aflac U.S. 5,979 5,365

Other business segments 33

Total $ 50,676 $ 45,440

Increase over prior year 11.5% 7.3%