Aflac 2007 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2007 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

Annual Report for 2007

of the interest rate swaps in either other assets or other

liabilities on the balance sheet. We report the changes in fair

value of the interest rate swaps in other comprehensive

income as long as they are deemed effective. Should any

portion of the swap be deemed ineffective, that value would

be reported in other income in the consolidated statements of

earnings.

Policyholder Protection Corporation and State Guaranty

Association Assessments: In Japan, the government has

required the insurance industry to contribute to a policyholder

protection corporation. We recognize a charge for our

estimated share of the industry’s obligation once it is

determinable. We review the estimated liability for

policyholder protection corporation contributions on an

annual basis and report any adjustments in Aflac Japan’s

expenses.

In the United States, each state has a guaranty association that

supports insolvent insurers operating in those states. To date,

our state guaranty association assessments have not been

material.

Treasury Stock: Treasury stock is reflected as a reduction of

shareholders’ equity at cost. We use the weighted-average

purchase cost to determine the cost of treasury stock that is

reissued. We include any gains and losses in additional paid-in

capital when treasury stock is reissued.

Earnings Per Share: We compute basic earnings per share

(EPS) by dividing net earnings by the weighted-average

number of unrestricted shares outstanding for the period.

Diluted EPS is computed by dividing net earnings by the

weighted-average number of shares outstanding for the

period plus the shares representing the dilutive effect of

share-based awards.

New Accounting Pronouncements: In December 2007, the

FASB issued Statement of Financial Accounting Standards

(SFAS) No. 160, Noncontrolling Interests in Consolidated

Financial Statements - an amendment of ARB No. 51 (SFAS

160). The purpose of SFAS 160 is to improve relevance,

comparability, and transparency of the financial information in

consolidated financial statements of reporting entities that

hold noncontrolling interests in one or more subsidiaries. SFAS

160 is effective for fiscal years beginning on or after

December 15, 2008, with earlier adoption prohibited. We do

not expect the adoption of this standard to have any effect on

our financial position or results of operations.

In February 2007, the FASB issued SFAS No. 159, The Fair

Value Option for Financial Assets and Financial Liabilities –

including an amendment of FASB Statement No. 115 (SFAS

159). SFAS 159 allows entities to choose to measure many

financial instruments and certain other items at fair value. The

majority of the provisions of this standard apply only to

entities that elect the fair value option (FVO). The FVO may

be applied to eligible items on an instrument-by-instrument

basis; is irrevocable unless a new election date occurs; and may

only be applied to an entire financial instrument, and not

portions thereof. This standard requires a business enterprise

to report unrealized gains and losses on items for which the

FVO has been elected in earnings at each subsequent

reporting date. SFAS 159 is effective for fiscal years beginning

after November 15, 2007, with earlier application permitted

under limited circumstances. We do not expect the adoption

of this standard to have a material effect on our financial

position or results of operations.

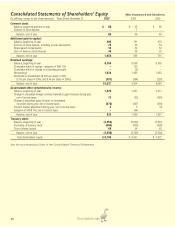

In September 2006, the FASB issued SFAS No. 158, Employers’

Accounting for Defined Benefit Pension and Other

Postretirement Plans, an amendment of FASB Statements No.

87, 88, 106, and 132(R) (SFAS 158). We adopted the

recognition and measurement date provisions of this standard

effective December 31, 2006. In the consolidated statements

of shareholders’ equity for the year ended December 31,

2006, we included in 2006 other comprehensive income, a

cumulative transition adjustment, net of income taxes, of $44

million from the adoption of SFAS 158. This cumulative effect

adjustment was properly included in the rollforward of

accumulated other comprehensive income for the year, but it

should not have been included in other comprehensive

income for the year. Total comprehensive income for the year,

not including the transition adjustment for SFAS 158, was

$996 million. Management concluded that the transition

adjustment was not material to the financial statements taken

as a whole. We have adjusted other comprehensive income

for the year ended December 31, 2006, to properly reflect the

transition adjustment as a direct charge to accumulated other

comprehensive income. The effect of recording the transition

adjustment through other comprehensive income and the

subsequent adjustment to reflect the amounts as a direct

charge to accumulated other comprehensive income did not

have any impact on the consolidated statements of earnings,

the consolidated balance sheets, the consolidated statements

of shareholders’ equity or the consolidated statements of cash

flows for any periods presented.

In September 2006, the FASB issued SFAS No. 157, Fair Value

Measurements (SFAS 157). SFAS 157 defines fair value,

establishes a framework for measuring fair value under GAAP,

and expands disclosures about fair value measurements. This

standard applies to other accounting pronouncements that

require or permit fair value measurements, the FASB having

previously concluded in those accounting pronouncements