Aflac 2007 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2007 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48 There’s Only One Aflac

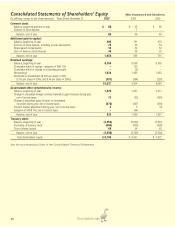

Consolidated Statements of Shareholders’ Equity Aflac Incorporated and Subsidiaries

(In millions, except for per-share amounts) Years Ended December 31, 2007 2006 2005

Common stock:

Balance, beginning and end of year $66 $65 $65

Exercise of stock options –1–

Balance, end of year 66 66 65

Additional paid-in capital:

Balance, beginning of year 895 791 676

Exercise of stock options, including income tax benefits 74 32 54

Share-based compensation 39 34 32

Gain on treasury stock reissued 46 38 29

Balance, end of year 1,054 895 791

Retained earnings:

Balance, beginning of year 9,304 8,048 6,785

Cumulative effect of change - adoption of SAB 108 –139 –

Cumulative effect of change in accounting principle –(2) –

Net earnings 1,634 1,483 1,483

Dividends to shareholders ($.615 per share in 2007,

$.735 per share in 2006, and $.44 per share in 2005) (301) (364) (220)

Balance, end of year 10,637 9,304 8,048

Accumulated other comprehensive income:

Balance, beginning of year 1,426 1,957 2,611

Change in unrealized foreign currency translation gains (losses) during year,

net of income taxes 75 (23) (145)

Change in unrealized gains (losses) on investment

securities during year, net of income taxes (576) (467) (500)

Pension liability adjustment during year, net of income taxes 93 (9)

Adoption of SFAS 158, net of income taxes –(44) –

Balance, end of year 934 1,426 1,957

Treasury stock:

Balance, beginning of year (3,350) (2,934) (2,561)

Purchases of treasury stock (606) (470) (438)

Cost of shares issued 60 54 65

Balance, end of year (3,896) (3,350) (2,934)

Total shareholders’ equity $ 8,795 $ 8,341 $ 7,927

See the accompanying Notes to the Consolidated Financial Statements.