Aflac 2007 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2007 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

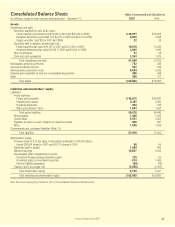

Consolidated Balance Sheets Aflac Incorporated and Subsidiaries

(In millions, except for share and per-share amounts) December 31, 2007 2006

Assets:

Investments and cash:

Securities available for sale, at fair value:

Fixed maturities (amortized cost $29,399 in 2007 and $27,099 in 2006) $ 30,511 $ 28,805

Perpetual debentures (amortized cost $4,272 in 2007 and $4,341 in 2006) 4,095 4,408

Equity securities (cost $16 in 2007 and 2006) 22 25

Securities held to maturity, at amortized cost:

Fixed maturities (fair value $16,191 in 2007 and $13,369 in 2006) 16,819 13,483

Perpetual debentures (fair value $3,934 in 2007 and $4,024 in 2006) 3,985 3,990

Other investments 61 58

Cash and cash equivalents 1,563 1,203

Total investments and cash 57,056 51,972

Receivables, primarily premiums 732 535

Accrued investment income 561 538

Deferred policy acquisition costs 6,654 6,025

Property and equipment, at cost less accumulated depreciation 496 458

Other 306 277

Total assets $ 65,805 $ 59,805

Liabilities and shareholders’ equity:

Liabilities:

Policy liabilities:

Future policy benefits $ 45,675 $ 40,841

Unpaid policy claims 2,455 2,390

Unearned premiums 693 645

Other policyholders’ funds 1,853 1,564

Total policy liabilities 50,676 45,440

Notes payable 1,465 1,426

Income taxes 2,531 2,462

Payables for return of cash collateral on loaned securities 808 807

Other 1,530 1,329

Commitments and contingent liabilities (Note 13)

Total liabilities 57,010 51,464

Shareholders’ equity:

Common stock of $.10 par value. In thousands: authorized 1,000,000 shares;

issued 658,604 shares in 2007 and 655,715 shares in 2006 66 66

Additional paid-in capital 1,054 895

Retained earnings 10,637 9,304

Accumulated other comprehensive income:

Unrealized foreign currency translation gains 129 54

Unrealized gains on investment securities 874 1,450

Pension liability adjustment (69) (78)

Treasury stock, at average cost (3,896) (3,350)

Total shareholders’ equity 8,795 8,341

Total liabilities and shareholders’ equity $ 65,805 $ 59,805

See the accompanying Notes to the Consolidated Financial Statements.

47

Annual Report for 2007