Aflac 2007 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2007 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

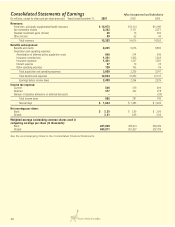

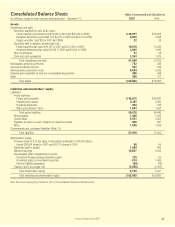

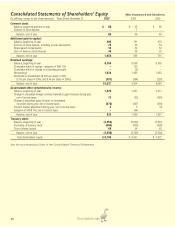

43

Annual Report for 2007

The distribution of payments for future policy benefits is an

estimate of all future benefit payments for policies in force as

of December 31, 2007. These projected values contain

assumptions for future policy persistency, mortality and

morbidity. The distribution of payments for unpaid policy

claims includes assumptions as to the timing of policyholders

reporting claims for prior periods and the amount of those

claims. Actual amounts and timing of both future policy

benefits and unpaid policy claims payments may differ

significantly from the estimates above. We anticipate that the

future policy benefit liability of $45.7 billion at December 31,

2007, along with future net premiums and investment income,

will be sufficient to fund future policy benefit payments.

Consolidated Cash Flows

We translate cash flows for Aflac Japan’s yen-denominated

items into U.S. dollars using weighted-average exchange rates.

In years when the yen weakens, translating yen into dollars

causes fewer dollars to be reported. When the yen

strengthens, translating yen into dollars causes more dollars to

be reported. The following table summarizes consolidated

cash flows by activity for the years ended December 31.

Operating Activities

The following table summarizes operating cash flows by

source for the years ended December 31.

We expect cash provided by operating activities in the future to

decline as a result of increased U.S. federal tax payments.

U.S. cash tax payments are expected to increase in

2008 because we fully utilized our remaining tax

credit carryforwards. Future cash provided by

operating activities will also be reduced by the payout

of lump-sum benefits to policyholders on a closed

block of business. The majority of these benefit

payouts will begin in 2008 and will conclude in 2012.

We anticipate paying out approximately $450 million

over the five-year period.

Investing Activities

Operating cash flow is primarily used to purchase debt

securities to meet future policy obligations. The following

table summarizes investing cash flows by source for the years

ended December 31.

Cash used by investing activities for Aflac U.S. and other

operations in 2005 included the January 2005 return of cash

collateral from the security lending activities of Aflac U.S. at

the end of 2004 (approximately $2.6 billion).

Prudent portfolio management dictates that we attempt to

match the duration of our assets with the duration of our

liabilities. Currently, when our debt securities mature, the

proceeds may be reinvested at a yield below that required for

the accretion of policy benefit liabilities on policies issued in

earlier years. However, the long-term nature of our business

and our strong cash flows provide us with the ability to

minimize the effect of mismatched durations and/or yields

identified by various asset adequacy analyses. When market

opportunities arise, we dispose of selected debt securities that

are available for sale to improve the duration matching of our

assets and liabilities, improve future investment yields, and/or

rebalance our portfolio. As a result, dispositions before

maturity can vary significantly from year to year. Dispositions

before maturity were approximately 4% of the annual average

investment portfolio of debt securities available for sale during

the year ended December 31, 2007, compared with 7% in

2006 and 11% in 2005. Dispositions before maturity in 2006

Distribution of Payments by Period

Total Total Less Than One to Four to After

(In millions) *Liability* Payments One Year Three Years Five Years Five Years

Future policy benefits liability $ 45,675 $ 229,269 $ 7,014 $ 13,949 $ 13,412 $ 194,894

Unpaid policy claims liability 2,455 2,455 1,866 363 128 98

Long-term debt – principal 1,457 1,457 – 800 569 88

Long-term debt – interest 5 72 22 29 14 7

Policyholder protection corporation 151 151 23 51 59 18

Operating service agreements N/A ** 606 96 178 149 183

Operating lease obligations N/A ** 145 46 35 21 43

Capitalized lease obligations 8 8 3 4 1 –

Total contractual obligations $ 49,751 $ 234,163 $ 9,070 $ 15,409 $ 14,353 $ 195,331

* Liability amounts are those reported on the consolidated balance sheet as of December 31, 2007.

** Not applicable

Liabilities for unrecognized tax benefits in the amount of $34 million have been excluded from the tabular disclosure above because the timing of

cash payment is not reasonably estimable.

Consolidated Cash Flows by Activity

(In millions) 2007 2006

2005

Operating activities $ 4,656 $ 4,397 $ 4,433

Investing activities (3,654) (4,057) (6,692)

Financing activities (655) (434) (196)

Exchange effect on cash and cash equivalents 13 – (61)

Net change in cash and cash equivalents $ 360 $ (94) $ (2,516)

Net Cash Provided by Operating Activities

(In millions)

2007 2006

2005

Aflac Japan $ 3,573 $ 3,437 $ 3,691

Aflac U.S. and other operations 1,083 960 742

Total $ 4,656 $ 4,397 $ 4,433

Net Cash Used by Investing Activities

(In millions)

2007 2006

2005

Aflac Japan $ (3,231) $ (3,372) $ (3,574)

Aflac U.S. and other operations (423) (685) (3,118)

Total $ (3,654) $ (4,057) $ (6,692)