Aflac 2007 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2007 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

61

Annual Report for 2007

issuer, but rank higher than equity securities. Although these

securities have no contractual maturity, the interest coupons

that were fixed at issuance subsequently change to a floating

short-term interest rate of 125 to more than 300 basis points

above an appropriate market index, generally by the 25th year

after issuance, thereby creating an economic maturity date.

The economic maturities of our investments in perpetual

debentures at December 31, 2007, were as follows:

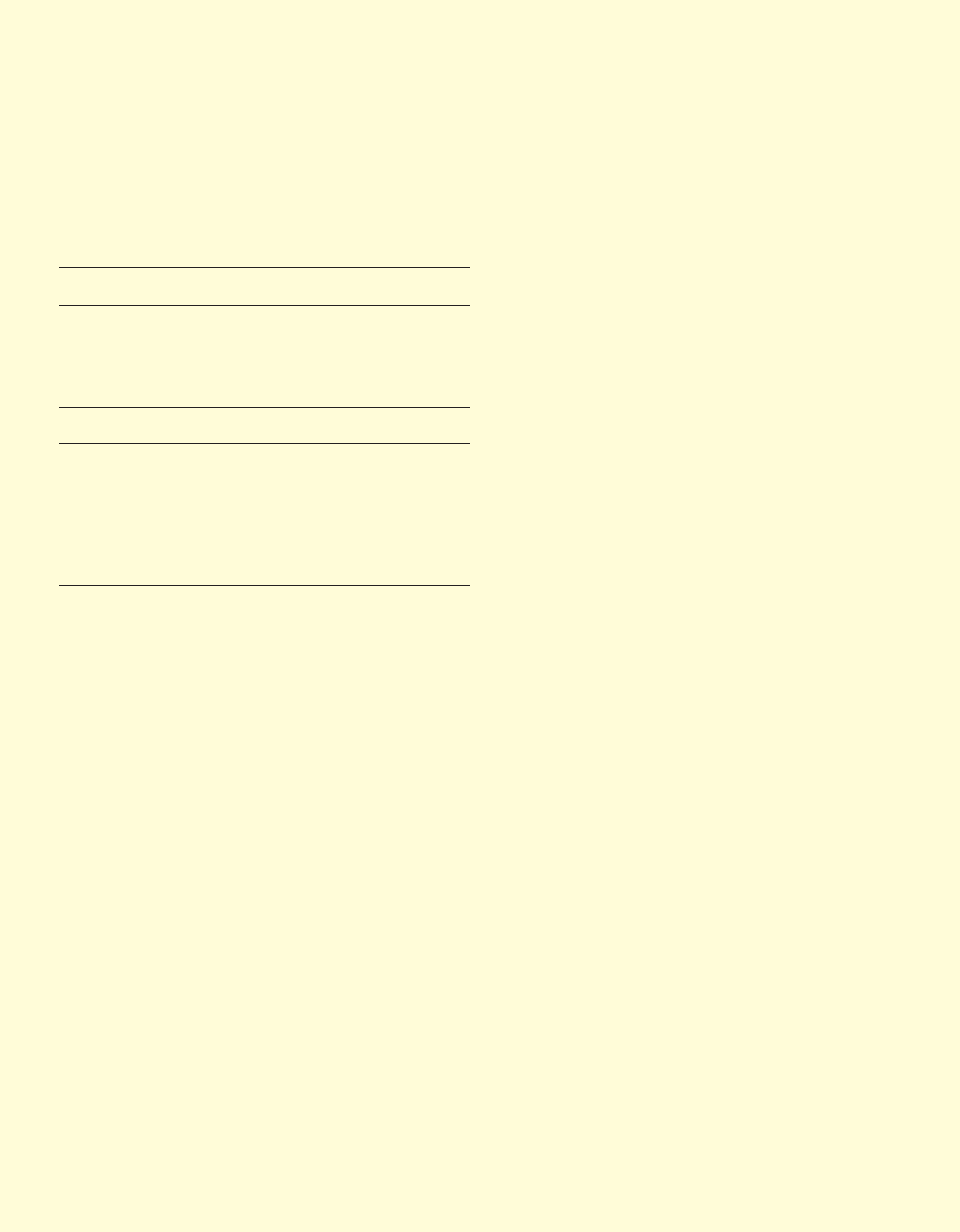

Aflac Japan Aflac U.S.

Amortized Fair Amortized Fair

(In millions) Cost Value Cost Value

Available for sale:

Due in one year or less $ 291 $ 298 $ – $ –

Due after one year through five years 61 111 15 16

Due after five years through 10 years 263 307 35 34

Due after 10 years through 15 years 268 250 – –

Due after 15 years 3,031 2,799 308 280

Total perpetual debentures

available for sale $ 3,914 $ 3,765 $ 358 $ 330

Held to maturity:

Due in one year or less $ 133 $ 134 $ – $ –

Due after one year through five years 788 816 – –

Due after five years through 10 years 1,567 1,628 – –

Due after 10 years through 15 years – – – –

Due after 15 years 1,497 1,356 – –

Total perpetual debentures

held to maturity $ 3,985 $ 3,934 $ – $ –

As part of our investment activities, we own investments in

qualified special purpose entities (QSPEs). At December 31,

2007, available-for-sale QSPEs totaled $3.2 billion at fair value

($3.3 billion at amortized cost, or 6.0% of total debt

securities), compared with $2.3 billion at fair value ($2.3 billion

at amortized cost, or 4.7% of total debt securities) at

December 31, 2006. We have no equity interests in any of the

QSPEs, nor do we have control over these entities. Therefore,

our loss exposure is limited to the cost of our investment.

We also own investments in variable interest entities (VIEs)

totaling $2.1 billion at fair value ($2.4 billion at amortized cost,

or 4.5% of total debt securities) at December 31, 2007. We

are the primary beneficiary of VIEs totaling $1.3 billion at fair

value ($1.6 billion at amortized cost) and have consolidated

our interests in these VIEs in accordance with FASB

Interpretation No. 46 (revised December 2003),

Consolidation of Variable Interest Entities. The activities of the

VIEs that we consolidate are limited to holding debt securities

and utilizing the cash flows from the debt securities to service

our investments therein. The terms of these debt securities

mirror the terms of the notes held by Aflac.

We have interests in VIEs in which we are not the primary

beneficiary and therefore are not required to consolidate

totaling $760 million at fair value ($853 million at amortized

cost) as of December 31, 2007. These interests primarily

consist of corporate collateralized debt obligations (CDOs).

The activities of these VIEs are limited to holding underlying

collateral, comprising investment-grade debt securities at the

time of issuance and credit default swap (CDS) contracts on

specific corporate entities and utilizing the cash flows from

the collateral and CDS contracts to service our investments

therein. All corporate entities covered by the CDS contracts

were investment grade at the time of issuance. Our remaining

VIEs that we are not required to consolidate consist of loans

to financing vehicles that are irrevocably and unconditionally

guaranteed by their corporate parents. These VIEs are used to

raise financing for their respective parent companies in the

international capital markets. The guarantors of these VIEs

were investment grade at the time of issuance.

The loss on any of our VIE investments would be limited to

its cost.

We lend fixed-maturity securities to financial institutions in

short-term security lending transactions. These short-term

security lending arrangements increase investment income

with minimal risk. Our security lending policy requires that the

fair value of the securities and/or cash received as collateral

be 102% or more of the fair value of the loaned securities. At

December 31, 2007, we had security loans outstanding with a

fair value of $790 million, and we held cash in the amount of

$808 million as collateral for these loaned securities. At

December 31, 2006, we had security loans outstanding with a

fair value of $780 million, and we held cash in the amount of

$807 million as collateral for these loaned securities.

During 2007, we reclassified an investment from held to

maturity to available for sale as a result of a deterioration in

the issuer’s creditworthiness. At the date of transfer, this

debt security had an amortized cost of $169 million. The

investment was subsequently sold at a realized gain of

$12 million.

During 2006, we reclassified an investment from held to

maturity to available for sale as a result of the issuer’s credit

rating downgrade. At the date of transfer, this debt security

had an amortized cost of $118 million and an unrealized loss

of $15 million.

During 2005, we reclassified an investment from held to

maturity to available for sale as a result of the issuer’s credit

rating downgrade. This debt security had an amortized cost of

$254 million and an unrealized loss of $46 million at the date

of transfer.