Aflac 2007 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2007 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

71

Annual Report for 2007

Stock Bonus Plan: Aflac U.S. maintains a stock bonus plan for

eligible U.S. sales associates. Plan participants receive shares of

Aflac Incorporated common stock based on their new

annualized premium sales and their first-year persistency of

substantially all new insurance policies. The cost of this plan,

which is included in deferred policy acquisition costs,

amounted to $45 million in 2007, $40 million in 2006 and $37

million in 2005.

13. COMMITMENTS AND CONTINGENT

LIABILITIES

We have three outsourcing agreements with IBM. The first

agreement provides mainframe computer operations and

support for Aflac Japan. It has a remaining term of eight years

and an aggregate remaining cost of ¥24.4 billion ($213 million

using the December 31, 2007, exchange rate). The second

agreement provides distributed computer operations and

support for Aflac Japan. It has a remaining term of eight years

and an aggregate remaining cost of ¥30.4 billion ($266 million

using the December 31, 2007, exchange rate). The third

agreement provides application maintenance and

development services for Aflac Japan. It has a remaining term

of five years and an aggregate remaining cost of ¥8.8 billion

($77 million using the December 31, 2007, exchange rate).

We have entered into two additional outsourcing agreements

to provide application maintenance and development services

for our Japanese operation. The first agreement with

Accenture has a remaining term of six years with an aggregate

remaining cost of ¥4.7 billion ($41 million using the

December 31, 2007, exchange rate). The second agreement

with NTT DATA has a remaining term of three years with an

aggregate remaining cost of ¥1.0 billion ($9 million using the

December 31, 2007, exchange rate).

We lease office space and equipment under agreements that

expire in various years through 2022. Future minimum lease

payments due under non-cancelable operating leases at

December 31, 2007, were as follows:

(In millions)

2008 $ 46

2009 22

2010 13

2011 11

2012 10

Thereafter 43

Total future minimum lease payments $ 145

In 2005, we announced a multiyear building project for

additional office space in Columbus, Georgia. The initial phase

was completed in 2007 at a cost of $27 million. The second

phase of the expansion is to be completed in 2009 and is

expected to cost approximately $48 million.

We are a defendant in various lawsuits considered to be in the

normal course of business. Members of our senior legal and

financial management teams review litigation on a quarterly

and annual basis. The final results of any litigation cannot be

predicted with certainty. Although some of this litigation is

pending in states where large punitive damages, bearing little

relation to the actual damages sustained by plaintiffs, have

been awarded in recent years, we believe the outcome of

pending litigation will not have a material adverse effect on

our financial position, results of operations, or cash flows.

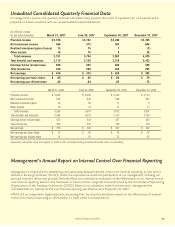

14. SUPPLEMENTARY INFORMATION

(In millions) 2007 2006 2005

Supplemental disclosures of

cash flow information:

Income taxes paid $ 416 $ 569 $ 360

Interest paid 26 15 21

Impairment losses included in realized investment

gains (losses) 22 1–

Noncash financing activities:

Capitalized lease obligations 194

Dividends declared (91) 91 –

Treasury stock issued for:

Associate stock bonus 38 35 33

Shareholder dividend reinvestment 19 15 11

Share-based compensation grants 221

15. SUBSEQUENT EVENTS

On February 4, 2008, we entered into an agreement for an

accelerated share repurchase (ASR) program with an affiliate

of Merrill Lynch, Pierce, Fenner & Smith Incorporated (Merrill

Lynch). Under the agreement, we purchased 12.5 million

shares of our outstanding common stock at $60.58 per share

for a total purchase price of $757 million. The repurchase was

funded with internal capital. The shares were acquired as a

part of previously announced share repurchase authorizations

by our board of directors and will be held in treasury. Under

the agreement, Merrill Lynch plans to purchase shares of our

common stock in the open market from time to time until it

has acquired a number of shares equivalent to the number of

shares we purchased from Merrill Lynch. At the end of this

period, we may receive, or may be required to remit, a

purchase price adjustment based upon the volume weighted

average price of our common stock during the ASR program

period. Under the terms of the ASR, we may elect to receive

or pay any settlement amount in cash or shares of our

common stock at our option. The completion and settlement

of the ASR program is expected to occur during the second

quarter of 2008, although the settlement may occur before

the second quarter at Merrill Lynch’s option.