Aflac 2007 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2007 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68 There’s Only One Aflac

Weighted-Average

Grant-Date

(In thousands of shares) Shares Fair Value

Restricted stock at December 31, 2004 2 $ 39.98

Granted in 2005 274 39.55

Canceled in 2005 (6) 38.75

Vested in 2005 – –

Restricted stock at December 31, 2005 270 39.58

Granted in 2006 357 46.96

Canceled in 2006 (8) 42.92

Vested in 2006 (6) 38.75

Restricted stock at December 31, 2006 613 43.84

Granted in 2007 391 48.43

Canceled in 2007 (21) 45.88

Vested in 2007 (9) 42.06

Restricted stock at December 31, 2007 974 $ 45.65

As of December 31, 2007, total compensation cost not yet

recognized in our financial statements related to restricted

stock awards was $20 million, of which $9 million (492

thousand shares) was related to share-based awards with a

performance-based vesting condition. We expect to recognize

these amounts over a weighted-average period of

approximately 1.3 years. There are no other contractual terms

covering restricted stock awards once vested.

11. STATUTORY ACCOUNTING AND DIVIDEND

RESTRICTIONS

Our insurance subsidiary is required to report its results of

operations and financial position to state insurance regulatory

authorities on the basis of statutory accounting practices

prescribed or permitted by such authorities.

As determined on a U.S. statutory accounting basis, Aflac’s net

income was $1.8 billion in 2007, $1.7 billion in 2006 and $1.3

billion in 2005. Capital and surplus was $4.2 billion at both

December 31, 2007 and December 31, 2006.

Net assets of the insurance subsidiaries aggregated $9.1 billion

at December 31, 2007, on a GAAP basis, compared with $9.3

billion a year ago. Aflac Japan accounted for $6.0 billion, or

66.8%, of these net assets, compared with $5.7 billion, or

62.0%, at December 31, 2006.

Reconciliations of Aflac’s net assets on a GAAP basis to capital

and surplus determined on a U.S. statutory accounting basis as

of December 31 were as follows:

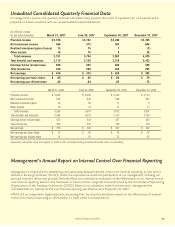

(In millions) 2007 2006

Net assets on GAAP basis $ 9,050 $ 9,266

Adjustment of carrying values of investments (1,283) (2,153)

Elimination of deferred policy acquisition costs (6,540) (5,922)

Adjustment to policy liabilities 1,928 1,526

Adjustment to deferred income taxes 1,813 2,124

Other, net (760) (655)

Capital and surplus on U.S. statutory accounting basis $ 4,208 $ 4,186

Aflac Japan must report its results of operations and financial

position to the Japanese Financial Services Agency (FSA) on a

Japanese regulatory accounting basis as prescribed by the FSA.

Capital and surplus (unaudited) of Aflac Japan, based on

Japanese regulatory accounting practices, aggregated $2.5

billion at December 31, 2007, and $2.6 billion at December 31,

2006. Japanese regulatory accounting practices differ in many

respects from U.S. GAAP. Under Japanese regulatory

accounting practices, policy acquisition costs are charged off

immediately; deferred income tax liabilities are recognized on

a different basis; policy benefit and claim reserving methods

and assumptions are different; the carrying value of securities

transferred to held to maturity is different; policyholder

protection corporation obligations are not accrued; and

premium income is recognized on a cash basis.

The Parent Company depends on its subsidiaries for cash flow,

primarily in the form of dividends and management fees.

Consolidated retained earnings in the accompanying financial

statements largely represent the undistributed earnings of our

insurance subsidiary. Amounts available for dividends,

management fees and other payments to the Parent Company

by its insurance subsidiary may fluctuate due to different

accounting methods required by regulatory authorities. These

payments are also subject to various regulatory restrictions

and approvals related to safeguarding the interests of

insurance policyholders. Our insurance subsidiary must

maintain adequate risk-based capital for U.S. regulatory

authorities and our Japan branch must maintain adequate

solvency margins for Japanese regulatory authorities.

Additionally, the maximum amount of dividends that can be

paid to the Parent Company by Aflac without prior approval

of Nebraska’s director of insurance is the greater of the net

gain from operations, which excludes net realized investment

gains, for the previous year determined under statutory

accounting principles, or 10% of statutory capital and surplus

as of the previous year-end. Dividends declared by Aflac

during 2008 in excess of $1.7 billion would require such

approval. Dividends declared by Aflac during 2007 were

$1.4 billion.

A portion of Aflac Japan earnings, as determined on a

Japanese regulatory accounting basis, can be repatriated each

year to Aflac U.S. after complying with solvency margin

provisions and satisfying various conditions imposed by

Japanese regulatory authorities for protecting policyholders.

Profit repatriations to the United States can fluctuate due to

changes in the amounts of Japanese regulatory earnings.

Among other items, factors affecting regulatory earnings

include Japanese regulatory accounting practices and

fluctuations in currency translation of Aflac Japan’s dollar-

denominated investments and related investment income into