Aflac 2007 Annual Report Download

Download and view the complete annual report

Please find the complete 2007 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report for 2007

SM

Table of contents

-

Page 1

Annual Report for 2007 SM -

Page 2

... our products have helped policyholders following a life-interrupting medical event. Aflac insurance products help protect the entire family against financial hardship by quickly paying cash directly to the policyholder. We have tens of thousands of sales associates and employees who provide service... -

Page 3

... Aflac from other companies to show that "There's Only One Aflac." Aflac policies help fill the gaps other insurance can create. In a recent commercial, we contrast Aflac to the competition, represented by the orangutan depicted on the cover, by emphasizing the customer-driven benefits our products... -

Page 4

... products, including: Accident/disability Cancer indemnity Short-term disability Intensive care Hospital indemnity Sickness indemnity Long-term care Specified health event Fixed-benefit dental Vision Life insurance products, including: Term life Whole life Juvenile life Who Buys It At the worksite... -

Page 5

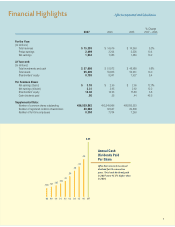

...,966 82,647 7,704 498,893,553 80,808 7,263 $.80 .55 .44 .38 .30 .23 .128 .147 .167 .193 Annual Cash Dividends Paid Per Share Aflac has increased its annual dividend for 25 consecutive years. Total cash dividends paid in 2007 were 45.5% higher than in 2006. 98 99 00 01 02 03 04 05 06 07 1 -

Page 6

... expect to increase cash dividends at a rate faster than earnings growth going forward. Repurchasing Aflac shares has also been an effective means for enhancing our per-share earnings growth. We repurchased 11.1 million shares in 2007, bringing the total number of shares we have acquired since 1994... -

Page 7

... competing medical products. At the same time, consumer skepticism of the insurance industry lingered due to the highly publicized revelations of claims payment errors among life insurers. Along with each member of the life insurance industry, Aflac was required by Japan's Financial Services Agency... -

Page 8

... programs for every level of our sales team, from new associates to seasoned sales management. Remaining in step with a rapidly changing health care environment is also a priority that benefits our customers and our sales associates. In August 2007, we introduced our newest cancer insurance product... -

Page 9

...technology to leverage our resources and better respond to our agents' and customers' needs. And we believe we will continue to develop new ways to further tap into the vast potential of the U.S. market. officers to all officers, managers, employees, and particularly our sales force, we incorporate... -

Page 10

... - recovery after a serious illness or accident. And we're always working on ways to get that simple message across to more consumers through new products, effective agents and focused advertising campaigns. How do you expect the claims payment issue in Japan to impact the industry in general, and... -

Page 11

... new bank channel. In the near term to long term, we need to focus on building the size of our sales force through recruiting and improving their productivity through training. And I'm hopeful that offering our cancer product through Japan Post will help How has the current subprime lending crisis... -

Page 12

... half of the year. As we expected, sales turned positive in the second half of the year, and we again retained the distinction of being the number one seller of both cancer life and medical insurance policies in Japan. Our persistency was again strong and stable, and our new money investment yields... -

Page 13

Below, three-year-old Daisuke Ajima enjoys a day at the park with his mother, Tomoko Ajima (left), and their Aflac sales agent Mieko Okamoto (right). Although Daisuke is too young to understand exactly how his family's Aflac medical, cancer, and ordinary life products provide financial security and ... -

Page 14

... to shoulder a larger financial burden for health care. In fact, copayments have tripled over the last 12 years for most of the population, driving consumers to seek private insurance to help bear rising out-ofpocket expenses. Aflac's product line provides a means to fill that need. We still believe... -

Page 15

...Fuji, about two hours' drive west of Tokyo, provides the perfect setting for members of Aflac Japan's horseback riding club to enjoy the great outdoors during their free time. Kazunori Sumita (front), an Aflac Japan employee of nine years who currently works in Aflac Insurance Services, began riding... -

Page 16

... throughout Japan, providing a significant opportunity for us to reach new consumers. Policies and Riders In Force* Annualized Premiums In Force** Total New Annualized Premiums** Total Number of Agencies Aflac Japan Sales Results A 2.5% increase in the second half of the year helped Aflac Japan... -

Page 17

... him that their Aflac policies helped provide financial security when they needed it most. Just like Aflac's advertising in the United States, our advertising in Japan features the Aflac Duck. As a sales agent, Teruhisa counts on the support of the Aflac Duck to help open doors and close sales. 13 -

Page 18

...the Aflac Contact Center in 2007 based on the type of inbound or outbound call to better serve our customers. We are also enabling our sales office employees to spend more time on sales-related business activities by centralizing inquiries from our field force to the associate support center. Solid... -

Page 19

... our customers and shareholders very well. of Japanese consumers to help them cope with the increasing burden of out-of-pocket health care costs. • Promote our brand position - We will capitalize on our market-leading status to attract consumers and distinguish our products while emphasizing... -

Page 20

... that we offer consumers needed coverage. We advanced our sales force in terms of size and effectiveness through recruiting and training at every level. We launched new television commercials and print ads that used the Aflac Duck to better communicate how our products help people when they need... -

Page 21

... upon the expertise he delivers with empathy and compassion. Throughout all of his years of helping patients, he has heard many of his patients express the same glowing sentiment: Aflac paid their cancer claim quickly and without hassle, which allowed them to focus on recovery without worrying about... -

Page 22

...on how Aflac and its products can help consumers. The Aflac Duck even became part of the NASCAR nation through our sponsorship As medical director of the Aflac Cancer Center and Blood Disorders Service of Children's Healthcare of Atlanta, Dr. William G. Woods leads his specialized staff in treating... -

Page 23

...-American Baseball Classic, a showcase of some of the nation's best high school athletes, have been donated to children's hospitals and other pediatric cancer research organizations. Technology Efficiencies - A Virtual Aflac Office Anywhere As technology improves and sales associates and consumers... -

Page 24

... her customers, and the Aflac Duck is a big fan of her work. When a car accident disrupted her life in April 2007, she found that her Aflac accident policy provided financial relief when she needed it with cash benefits she was able to use at her discretion. She says that her Aflac sales agent filed... -

Page 25

...' appreciation for Aflac's ability to provide timely help when they need it most. We have a large and effective sales force that specializes in distributing products through the worksite. Our more than 402,000 payroll accounts represent less than 7% of the six million small businesses in the United... -

Page 26

... and shareholders' equity: Policy liabilities Notes payable Income taxes Other liabilities Shareholders' equity Total liabilities and shareholders' equity Supplemental Data Stock price range: Yen/dollar exchange rate at year-end Weighted-average yen/dollar exchange rate for the year High Low Close... -

Page 27

Aflac Incorporated and Subsidiaries 2003 $ 9,921 1,787 (301) - 40 11,447 7,529 2,720 10,249 1,198 430 $ 768 $ 2002 $ 8,595 1,614 (14) - 62 10,257 6,589 2,... 23.60 ¥ 102.40 113.96 $ 22.66 11.35 21.94 ¥ 115.70 130.89 $ 14.47 9.38 12.78 ¥ 130.10 121.07 Annual Report for 2007 23 -

Page 28

... care and health insurance delivery assessments for insurance company insolvencies competitive conditions in the United States and Japan new product development and customer response to new products and new marketing initiatives ability to attract and retain qualified sales associates and employees... -

Page 29

... annualized premiums being under the alternative commission schedule, which pays a higher commission on first-year premiums and lower commissions on renewal premiums. This schedule is very popular with our new agents as it helps them with cash flow for personal and business needs as they build their... -

Page 30

...Aflac Japan Aflac U.S. process of payment as well as an estimate of (In millions) 2007 2006 2005 2007 2006 2005 those claims that have been incurred but Deferred policy acquisition costs $ 4,269 $ 3,857 $ 3,624 $ 2,385 $ 2,168 $ 1,966 have not yet been reported to us. We Annualized premiums in force... -

Page 31

...the Aflac U.S. unpaid policy claims liability to the future policy benefits liability for our accident/disability, short-term disability, dental and specified health event lines of business. For the accident/disability line of business, a very small portion of the benefits in one of our policy forms... -

Page 32

... took advantage of tax loss carryforwards and also resulted in an improvement in overall portfolio credit quality and investment income. Future Policy Benefits (In millions of dollars and billions of yen) 2007 2006 2005 Aflac U.S. Growth rate Aflac Japan Growth rate Consolidated Growth rate Yen... -

Page 33

... year results in relation to the prior year, while yen strengthening has the effect of magnifying current year results in relation to the prior year. As a result, we view foreign currency translation as a financial reporting issue for Aflac and not an economic event to our Company or shareholders... -

Page 34

...policies remain in force. For Aflac Japan, total new annualized premium sales are determined by applications written during the reporting period. For Aflac U.S., total new annualized premium sales are determined by applications that are accepted during the reporting period. Premium income, or earned... -

Page 35

...would have been Aflac Japan. reported had yen/dollar exchange rates remained unchanged from the prior year. Ratios to total revenues in dollars: 2007 2006 2005 Benefits and claims Operating expenses: Amortization of deferred policy acquisition costs Insurance commissions Insurance and other expenses... -

Page 36

... market for stand-alone medical insurance as well as continued declines in the sales of Rider MAX and ordinary life products. The following table presents Aflac Japan's total new annualized premium sales for the years ended December 31. In Dollars (In millions of dollars and billions of yen) Cancer... -

Page 37

...recent years, the ability to sustain such expansion remains uncertain. Japan's system of compulsory public health care insurance provides medical coverage to every Japanese citizen. These public medical expenditures are covered by a combination of premiums paid by insureds and their employers, taxes... -

Page 38

... to total revenues: 2007 2006 2005 Japan Post Network Co. operates the 24,000 post offices located throughout Japan, providing a significant opportunity Benefits and claims 52.9% 53.9% 54.2% Operating expenses: for us to reach new consumers. AFLAC U.S. SEGMENT Aflac U.S. Pretax Operating Earnings... -

Page 39

... The following table details the contributions to total new annualized premium sales by major product category for the years ended December 31. 2007 Accident/disability coverage Cancer expense insurance Hospital indemnity products Fixed-benefit dental coverage Other Total 51% 18 14 6 11 100% 2006 52... -

Page 40

... reporting which is done annually. The exchange rates prevailing at the purposes, are summarized as follows (translated at end-oftime of repatriation will differ from the exchange rates period exchange rates) for the years ended December 31: prevailing at the time the yen profits were earned... -

Page 41

...seek to achieve this objective through a diversified portfolio of fixed-income investments that 37 Yen-denominated debt securities Policy benefits and related expenses to be paid in future years Premiums to be received in future years on policies in force 13 14 10 13 13 10 Annual Report for 2007 -

Page 42

... issuance and market conditions, including credit events and the interest rate environment, affect liquidity regardless of type of issuance. We routinely assess the fair value of all of our investments. This process includes evaluating quotations provided by outside securities pricing sources and... -

Page 43

... position as well as current market pricing and other factors, such as the issuer's or security's inclusion on a credit rating downgrade watch list. Split-rated securities as of December 31, 2007, represented .7% of total debt securities at amortized cost and were as follows: Split-Rated Securities... -

Page 44

... The following table presents the 10 largest unrealized loss positions in our portfolio as of December 31, 2007. Credit Rating Amortized Cost Fair Value Unrealized Loss (In millions) SLM Corp. CSAV Nordea Bank KBC Group Credit Suisse Group Ford Motor Credit Ahold Erste Bank Royal Bank of Scotland... -

Page 45

... stronger yen at year-end increased reported deferred policy acquisition costs by $178 million. Deferred policy acquisition costs of Aflac U.S. increased 10.0%. The increase in deferred policy acquisition costs was primarily driven by total new annualized premium sales. Annual Report for 2007 41 -

Page 46

... letters of credit, guarantees or standby repurchase obligations. CAPITAL RESOURCES AND LIQUIDITY Aflac provides the primary sources of liquidity to the Parent Company through dividends and management fees. Aflac paid dividends to the Parent Company in the amount of $1.4 billion in 2007, compared... -

Page 47

... our remaining tax credit carryforwards. Future cash provided by operating activities will also be reduced by the payout of lump-sum benefits to policyholders on a closed * Liability amounts are those reported on the consolidated balance sheet as of December 31, 2007. block of business. The majority... -

Page 48

... year-end. In addition, the Nebraska insurance department must approve service arrangements and other transactions within the affiliated group of companies. These regulatory limitations are not expected to affect the level of management fees or dividends paid by Aflac to the Parent Company. A life... -

Page 49

... Japan's solvency margin ratio significantly exceeds regulatory minimums. Payments are made from Aflac Japan to the Parent Company for management fees and to Aflac U.S. for allocated expenses and remittances of earnings. During 2007, Aflac Japan paid $32 million to the Parent Company for management... -

Page 50

...Years Ended December 31, Revenues: Premiums, principally supplemental health insurance Net investment income Realized investment gains (losses) Other income Total revenues Benefits and expenses: Benefits and claims Acquisition and operating expenses: Amortization of deferred policy acquisition costs... -

Page 51

... benefits Unpaid policy claims Unearned premiums Other policyholders' funds Total policy liabilities Notes payable Income taxes Payables for return of cash collateral on loaned securities Other Commitments and contingent liabilities (Note 13) Total liabilities Shareholders' equity: Common stock... -

Page 52

... during year, net of income taxes Pension liability adjustment during year, net of income taxes Adoption of SFAS 158, net of income taxes Balance, end of year Treasury stock: Balance, beginning of year Purchases of treasury stock Cost of shares issued Balance, end of year Total shareholders' equity... -

Page 53

... financing activities: Purchases of treasury stock Proceeds from borrowings Principal payments under debt obligations Dividends paid to shareholders Change in investment-type contracts, net Treasury stock reissued Other, net Net cash used by financing activities Effect of exchange rate changes on... -

Page 54

... Japan). Most of Aflac's policies are individually underwritten and marketed through independent agents. Our insurance operations in the United States and our branch in Japan service the two markets for our insurance business. Aflac Japan accounted for 71% of the Company's total revenues in 2007... -

Page 55

...and with the approval of state insurance regulatory authorities. Insurance premiums for health and life policies are recognized ratably as earned income over the premium payment periods of the policies. When revenues are reported, the related amounts of benefits and expenses are charged against such... -

Page 56

... not reported as an asset or liability. Deferred Policy Acquisition Costs: The costs of acquiring new business are deferred and amortized with interest over the premium payment periods in proportion to the ratio of annual premium income to total anticipated premium income. Anticipated premium income... -

Page 57

...is computed by dividing net earnings by the weighted-average number of shares outstanding for the period plus the shares representing the dilutive effect of share-based awards. New Accounting Pronouncements: In December 2007, the FASB issued Statement of Financial Accounting Standards (SFAS) No. 160... -

Page 58

...Securities and Exchange Commission (SEC) issued Staff Accounting Bulletin No. 108 (SAB 108). SAB 108 addresses quantifying the financial statement effects of misstatements, specifically, how the effects of uncorrected errors from prior years must be considered in quantifying misstatements in current... -

Page 59

...Total Aflac Japan Aflac U.S.: Earned premiums: Accident/disability Cancer expense Other health Life insurance Net investment income Other income Total Aflac U.S. Other business segments Total business segments Realized investment gains (losses) Corporate Intercompany eliminations Total revenues 2007... -

Page 60

... Receivables: Receivables consist primarily of monthly insurance premiums due from individual policyholders or their employers for payroll deduction of premiums. At December 31, 2007, $395 million, or 53.9% of total receivables, were related to Aflac Japan's operations, compared with $221 million... -

Page 61

... Unrealized Losses Fair Value (In millions) Securities available for sale, carried at fair value: Fixed maturities: Yen-denominated: Government and guaranteed $ Mortgage- and asset-backed securities Public utilities Sovereign and supranational Banks/financial institutions Other corporate Total yen... -

Page 62

... billion at fair value), or 2.6% of total debt securities a year ago. Each of the below-investment-grade securities was investment-grade at the time of purchase and was subsequently downgraded by credit rating agencies. These securities are held in the available-for-sale portfolio. As of December 31... -

Page 63

...-temporarily impaired at December 31, 2007. Included in the unrealized losses on other corporate fixedmaturity securities is an unrealized loss of $33 million on Aflac 2006 Total Fair Value Unrealized Losses Less than 12 months Fair Value Unrealized Losses 12 months or longer Fair Value Unrealized... -

Page 64

..., as of December 31. (In years) Yen-denominated debt securities Policy benefits and related expenses to be paid in future years Premiums to be received in future years on policies in force 2007 13 14 10 2006 13 13 10 Currently, when our debt securities mature, the proceeds may be reinvested at... -

Page 65

... parent companies in the international capital markets. The guarantors of these VIEs were investment grade at the time of issuance. The loss on any of our VIE investments would be limited to its cost. We lend fixed-maturity securities to financial institutions in short-term security lending... -

Page 66

... percentage to the total industry obligation payable in future years. The carrying amounts for cash and cash equivalents, receivables, accrued investment income, accounts payable, cash collateral and payables for security transactions approximated their fair values due to the short-term nature of... -

Page 67

... Total paid Effect of foreign exchange rate changes on unpaid claims Unpaid supplemental health claims, end of year Unpaid life claims, end of year Total liability for unpaid policy claims Other amortization expense in 2005 included the write-down of previously capitalized systems development costs... -

Page 68

...2009 2010 2011 2012 Thereafter Total We were in compliance with all of the covenants of our notes payable at December 31, 2007. No events of default or defaults occurred during 2007 and 2006. 8. INCOME TAXES The components of income tax expense (benefit) applicable to pretax earnings for the years... -

Page 69

... gains (losses) arising during year Reclassification adjustment for realized (gains) losses included in net earnings Total income tax expense (benefit) allocated to other comprehensive income Additional paid-in capital (exercise of stock options) Adoption of SFAS 158 Total income taxes 2007 $ 865... -

Page 70

... the payment of interest and penalties as of December 31, 2007, compared with $29 million a year ago. As of December 31, 2007, there were no material uncertain tax positions for which the total amounts of unrecognized tax benefits will significantly increase or decrease within the next twelve months... -

Page 71

...-average remaining term of 4.6 years. The total intrinsic value of stock options exercised during the year ended December 31, 2007, was $154 million, compared with $62 million in 2006 and $114 million in 2005. We received cash from the exercise of stock options in the amount of $52 million in 2007... -

Page 72

...-average period of approximately 1.3 years. There are no other contractual terms covering restricted stock awards once vested. Aflac Japan must report its results of operations and financial position to the Japanese Financial Services Agency (FSA) on a Japanese regulatory accounting basis as... -

Page 73

...of SFAS 158 Service cost Interest cost Actuarial loss (gain) Benefits paid Effect of foreign exchange rate changes Benefit obligation, end of year Plan assets: Fair value of plan assets, beginning of year Adoption of SFAS 158 Actual return on plan assets Employer contribution Benefits paid Effect of... -

Page 74

... for the Japanese and U.S. pension plans for the years ended December 31 were as follows: 2007 (In millions) Components of net periodic benefit cost: Service cost Interest cost Expected return on plan assets Amortization of net loss Net periodic benefit cost Japan U.S. Japan 2006 U.S. Japan 2005... -

Page 75

... receive shares of Aflac Incorporated common stock based on their new annualized premium sales and their first-year persistency of substantially all new insurance policies. The cost of this plan, which is included in deferred policy acquisition costs, amounted to $45 million in 2007, $40 million in... -

Page 76

... 31, 2007 and 2006, and the related consolidated statements of earnings, shareholders' equity, cash flows, and comprehensive income for each of the years in the three-year period ended December 31, 2007. These consolidated financial statements are the responsibility of the Company's management. Our... -

Page 77

... 31, 2007 $3,395 604 (1) 20 4,018 3,433 585 203 $ 382 $ .79 .78 Premium income $ 3,156 Net investment income 566 Realized investment gains (losses) 13 Other income 16 Total revenues 3,751 Total benefits and expenses 3,115 Earnings before income taxes Total income tax Net earnings Net earnings per... -

Page 78

... Public Company Accounting Oversight Board (United States), the consolidated balance sheets of Aflac Incorporated and subsidiaries as of December 31, 2007 and 2006, and the related consolidated statements of earnings, shareholders' equity, cash flows, and comprehensive income for each of the years... -

Page 79

... events, and an e-mail alert notification service that can automatically notify investors each time Aflac issues a press release or files with the United States Securities and Exchange Commission (SEC). The Investors page of aflac.com also provides a convenient way to view, download and print annual... -

Page 80

... He also held various positions at the Dai-ichi Kangyo Bank, Ltd., including senior managing director and managing executive officer. He joined Aflac's board in 2007. Michael H. Armacost, 70, Shorenstein Distinguished Fellow at Stanford University's Asia-Pacific Research Center, retired in June 2002... -

Page 81

...Human Resources, Human Resources Support, General Affairs John A. Moorefield, Senior Vice President; Chief Information Officer © 2008 Aflac Incorporated. All rights reserved. Aflac®, Aflac University ® and SmartApp® are registered trademarks of American Family Life Assurance Company of Columbus... -

Page 82

... stock purchase plans, dividends, lost stock certificates, etc., should be directed to the Shareholder Services Department at 800.235.2667 - option 2. Registrar Synovus Trust Company P.O. Box 23024 Columbus, Georgia 31902-3024 In Japan contact: Ken Kyo Investor Relations Support Department...