Advance Auto Parts 2003 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2003 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

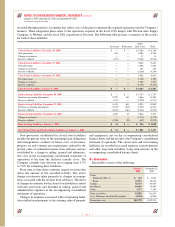

For each of the Company’s option grants during fiscal years 2003, 2002 and 2001, the Company granted options at

prices consistent with the market price of its stock on each respective grant date. Information related to the Company’s

options by range of exercise prices is as follows:

Weighted-Average

Number Weighted-Average Remaining Contractual Number Weighted Price of

of Shares Exercise Price of Life of Outstanding of Shares Exercise Price of

Outstanding Outstanding Shares Shares (in Years) Exercisable Exercisable Shares

$ 5.00–$ 9.99 ..................................................... 1,144 $ 8.35 3.0 1,140 $ 8.35

$10.00–$19.99 ..................................................... 2,016 11.39 4.4 1,776 11.38

$20.00–$29.99 ..................................................... 2,141 20.94 5.6 348 22.48

$30.00–$39.99 ..................................................... 110 37.00 6.7 — —

5,411 $15.05 4.7 3,264 $11.51

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

January 3, 2004, December 28, 2002 and December 29, 2001

(in thousands, except per share data)

Page 44

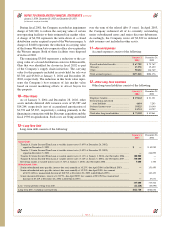

As permitted under SFAS No. 123, “Accounting for

Stock-Based Compensation,” the Company accounts for its

stock options using the intrinsic value method prescribed in

Accounting Principles Board Opinion No. 25, “Accounting

for Stock Issued to Employees,” or APB No. 25. Under

APB No. 25, compensation cost for stock options is meas-

ured as the excess, if any, of the market price of the

Company’s common stock at the measurement date over

the exercise price. Accordingly, the Company has not

recognized compensation expense on the issuance of its

Fixed Options because the exercise price equaled the fair

market value of the underlying stock on the grant date.

The excess of the fair market value per share over the

exercise price per share for the Performance Options and

Variable Options, up to the above-mentioned amendment in

December 2001, was recorded as outstanding stock options

in additional paid-in capital. The Company recorded

compensation expense related to the Performance Options

and Variable Options of $11,735 (including the charge

discussed above) in non-cash stock option compensation

expense in the accompanying consolidated statements of

operations for the fiscal year ended December 29, 2001. No

compensation expense was required for the fiscal years

ended January 3, 2004 and December 28, 2002.

During fiscal 2002, the Company established an

employee stock purchase plan under which all eligible team

members may purchase common stock at 85% of fair market

value (determined quarterly) through payroll deductions.

There are annual limitations on team member purchases of

either $25,000 per team member or ten percent of compen-

sation, whichever is less. Under the plan, team members

purchased 147 and 28 shares in fiscal years 2003 and 2002,

respectively. In May 2002, the Company registered 1,400

shares with the Securities and Exchange Commission to be

issued under the plan.

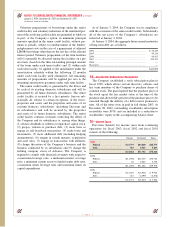

21—Fair Value of Financial Instruments

The carrying amount of cash and cash equivalents,

receivables, bank overdrafts, accounts payable, borrowings

secured by receivables and current portion of long-term

debt approximates fair value because of the short maturity

of those instruments. The carrying amount for variable rate

long-term debt approximates fair value for similar issues

available to the Company. The fair value of all fixed rate

long-term debt was determined based on current market

prices, which approximated $435,240 (carrying value of

$402,733) at December 28, 2002. There was no fixed rate

long-term debt outstanding at January 3, 2004 as a result of

the redemption completed in April 2003.