Advance Auto Parts 2003 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2003 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

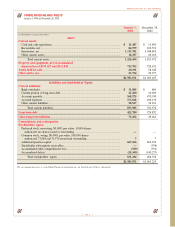

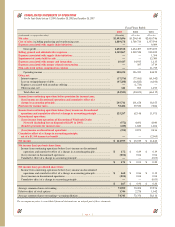

The table below presents principal cash flows and related weighted-average interest rates on our long-term debt

outstanding at January 3, 2004, by expected maturity dates. Additionally, the table includes the notional amounts of our

debt hedged and the impact of the anticipated average pay and receive rates of our hedges through their maturity dates.

Expected maturity dates approximate contract terms. Weighted-average variable rates are based on implied forward rates

in the yield curve at January 3, 2004, as adjusted by the limitations of the hedge agreement. Implied forward rates should

not be considered a predictor of actual future interest rates.

Fiscal Fiscal Fiscal Fiscal Fiscal Fair Market

2004 2005 2006 2007 2008 Total Liability

(dollars in thousands)

Long-term debt:

Variable rate............................................................ $ 22,220 $ 49,210 $48,413 $325,157 $— $445,000 $445,000

Weighted-average interest rate ............................... 4.1% 5.3% 6.4% 7.1% 0.0% 5.4% —

Interest rate swap:

Variable to fixed...................................................... $125,000 $125,000 $75,000 $ — $— $125,000 $ 96

Average pay rate..................................................... 0.8% — — — — 0.8% —

Average receive rate ............................................... — 0.2% 1.0% — — 0.4% —

Interest rate collar:

Variable to fixed...................................................... $150,000 $ — $ — $ — $— $150,000 $ 433

Average pay rate..................................................... 0.3% — — — — 0.3% —

Average receive rate ............................................... — — — — — — —

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (continued)

Page 22

Forward-Looking Statements

Certain statements in this report are “forward-looking

statements” within the meaning of Section 27A of the

Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934, which are usually identified by

the use of words such as “will,” “anticipates,” “believes,”

“estimates,” “expects,” “projects,” “forecasts,” “plans,”

“intends,” “should” or similar expressions. We intend those

forward-looking statements to be covered by the safe harbor

provisions for forward-looking statements contained in the

Private Securities Litigation Reform Act of 1995 and are

included in this statement for purposes of complying with

these safe harbor provisions.

These forward-looking statements reflect current views

about our plans, strategies and prospects, which are based

on the information currently available and on current

assumptions.

Although we believe that our plans, intentions and

expectations as reflected in or suggested by those forward-

looking statements are reasonable, we can give no assur-

ance that the plans, intentions or expectations will be

achieved. Listed below and discussed elsewhere in this

report are some important risks, uncertainties and contin-

gencies which could cause our actual results, performance

or achievements to be materially different from the

forward-looking statements made in this report. These

risks, uncertainties and contingencies include, but are not

limited to, the following:

• our ability to expand our business;

• the implementation of our business strategies and goals;

• integration of our previous and future acquisitions;

• a decrease in demand for our products;

• competitive pricing and other competitive pressures;

• our relationships with our vendors;

• our involvement as a defendant in litigation or incurrence

of judgements, fines or legal costs;

• deterioration in general economic conditions;

• our ability to meet debt obligations and adhere to the restric-

tions and covenants imposed under our senior credit facility;

• our critical accounting policies; and

• other statements that are not of historical fact made through-

out this report, including in the sections entitled “Manage-

ment’s Discussion and Analysis of Financial Condition

and Results of Operations” and “Risk Factors” found in

our Form 10-K filed on March 12, 2004 with the

Securities and Exchange Commission.

We assume no obligations to update publicly any forward-

looking statements, whether as a result of new information,

future events or otherwise. In evaluating forward-looking

statements, you should consider these risks and uncertainties,

together with the other risks described from time to time in

our other reports and documents filed with the Securities

and Exchange Commission, and you should not place

undue reliance on those statements.