Advance Auto Parts 2003 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2003 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

price. Accordingly, the Company has not recognized

compensation expense on the issuance of its Fixed Options

because the exercise price equaled the fair market value of the

underlying stock on the grant date. The Company recorded

compensation expense related to its Performance Options

and Variable Options of $11,735 in non-cash stock option

compensation expense in the accompanying consolidated

statements of operations for the fiscal year ended December 29,

2001. No compensation expense was required for the fiscal

years ended January 3, 2004 and December 28, 2002.

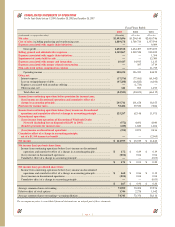

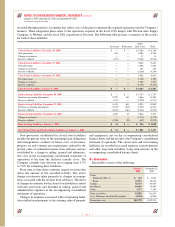

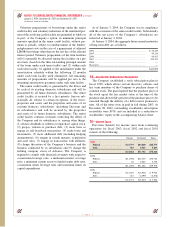

As required by SFAS No. 148, “Accounting for Stock-

Based Compensation—Transition and Disclosure an Amend-

ment of FASB Statement No. 123,” the following table

reflects the impact on net income and earnings per share as if

the Company had adopted the fair value based method of rec-

ognizing compensation costs as prescribed by SFAS No. 123.

2003 2002 2001

Net income, as reported

.........................

$124,935 $65,019 $11,442

Add: Total stock-based employee

compensation expense included in

reported net income, net of related

tax effects

..........................................

— — 7,076

Deduct: Total stock-based employee

compensation expense determined

under fair value based method for all

awards, net of related tax effects

........

(4,636) (1,894) (9,771)

Pro forma net income

............................

$120,299 $63,125 $ 8,747

Net income per share:

Basic, as reported

...............................

$ 1.71 $ 0.93 $ 0.20

Basic, pro forma

................................

1.65 0.90 0.15

Diluted, as reported

............................

1.67 0.90 0.20

Diluted, pro forma

.............................

1.61 0.87 0.15

For the above information, the fair value of each option

granted in the fiscal 2003 was estimated on the grant date

using the Black-Scholes option-pricing model with the

following assumptions: (i) weighted-average risk-free interest

rate of 3.12%; (ii) weighted-average expected life of

options of four years; (iii) expected dividend yield of zero

and (iv) weighted-average volatility of 41%.

For the above information, the fair value of each option

granted in the fiscal 2002 was estimated on the grant date

using the Black-Scholes option-pricing model with the fol-

lowing assumptions: (i) weighted-average risk-free interest

rate ranging from 4.45% to 3.12%; (ii) weighted-average

expected life of options of four years; (iii) expected dividend

yield of zero and (iv) weighted-average volatility of 17%.

For the above information, the fair value of each option

granted in fiscal 2001 was estimated on the grant date using

the Black-Scholes option-pricing model with the following

assumptions: (i) weighted-average risk-free interest rate

of 2.89%; (ii) weighted-average expected life of options

of three years; (iii) expected dividend yield of zero and

(iv) volatility of 60%.

Hedge Activities

In March 2003, the Company entered into two interest

rate swap agreements to limit its cash flow risk on an aggre-

gate of $125,000 of its variable rate debt. The first swap

allows the Company to fix its LIBOR rate at 2.269% on

$75,000 of debt for a term of 36 months. The second swap

allows the Company to fix its LIBOR rate at 1.79% on an

additional $50,000 of debt for a term of 24 months.

In September 2002, the Company entered into a hedge

agreement in the form of a zero-cost collar, which protects

the Company from interest rate fluctuations in the LIBOR

rate on $150,000 of its variable rate debt under its senior credit

facility. The collar consists of an interest rate ceiling at 4.5%

and an interest rate floor of 1.56% for a term of 24 months.

Under this hedge, the Company will continue to pay interest at

prevailing rates plus any spread, as defined by the Company’s

credit facility, but will be reimbursed for any amounts paid

on the LIBOR rate in excess of the ceiling. Conversely, the

Company will be required to pay the financial institution that

originated the collar if the LIBOR rate is less than the floor.

In accordance with SFAS No. 133, “Accounting for Deriv-

ative Instruments and Hedging Activities,” the fair value of the

hedge arrangement is recorded as an asset or liability in the

accompanying consolidated balance sheet at January 3, 2004.

The Company has adopted the “matched terms” accounting

method as provided by Derivative Implementation Group, or

DIG, Issue No. G20, “Assessing and Measuring the

Effectiveness of a Purchased Option Used in a Cash Flow

Hedge” for the zero-cost collar, and DIG Issue No. 9,

“Assuming No Ineffectiveness When Critical Terms of the

Hedging Instrument and the Hedge Transaction Match in a

Cash Flow Hedge” for the interest rate swaps. Accordingly,

the Company has matched the critical terms of each hedge

instrument to the hedged debt and used the anticipated termi-

nal value of zero to assume the hedges have no ineffective-

ness. In addition, the Company will record all adjustments to

the fair value of the hedge instruments in accumulated other

comprehensive income (loss) through the maturity date of

the applicable hedge arrangement. The fair value at January 3,

2004 was an unrecognized loss of $433 and $96 on the interest

rate collar and swaps, respectively. At December 28, 2002,

the fair value of the interest rate collar was an unrecognized

loss of $592. Any amounts received or paid under these

hedges will be recorded in the statement of operations as

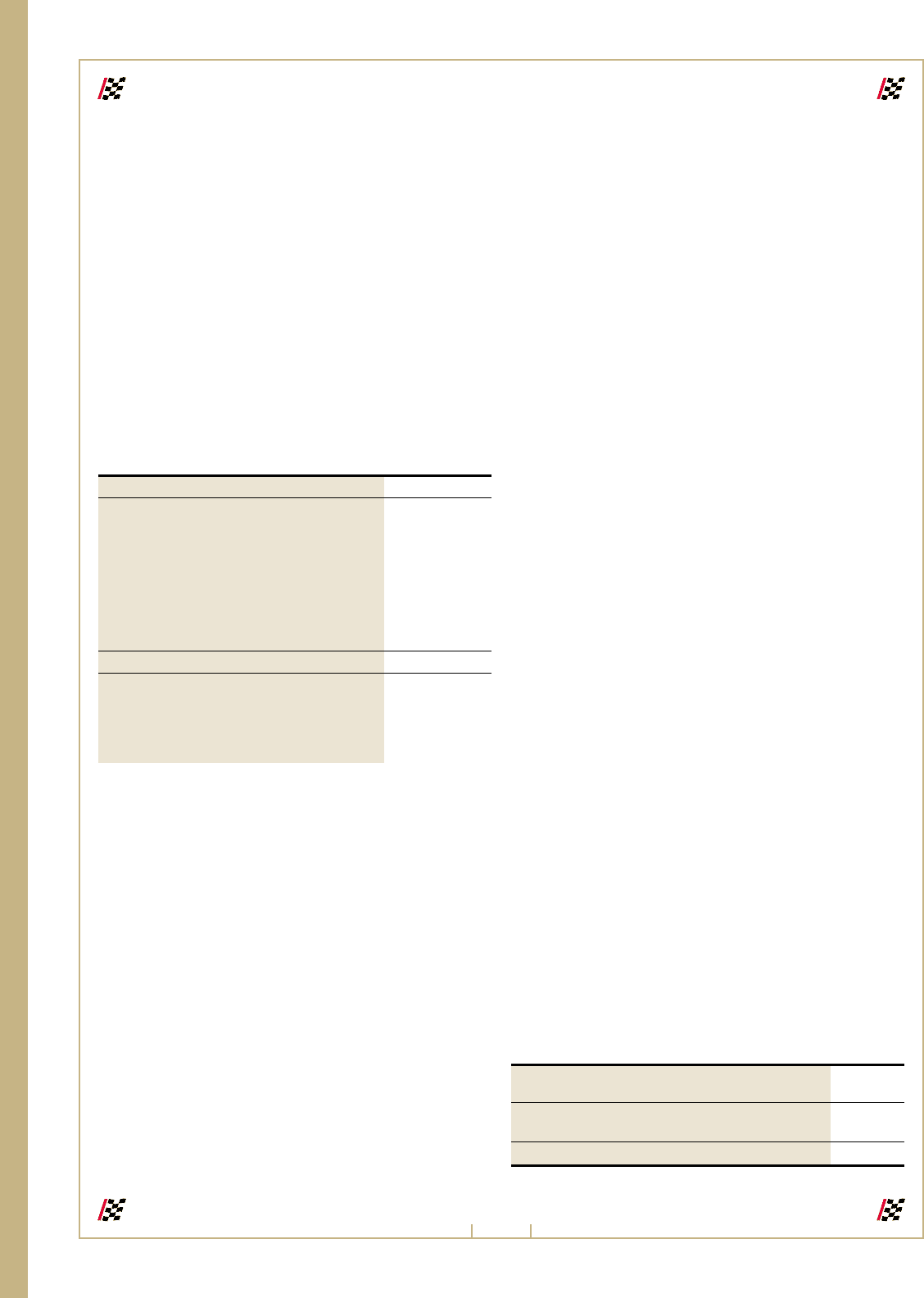

earned or incurred. Comprehensive income for the fiscal years

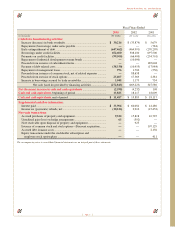

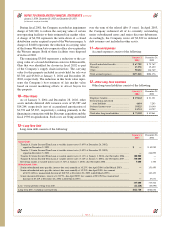

ended January 3, 2004 and December 28, 2002 is as follows:

January 3, December 28,

2004 2002

Net income

...................................................... $124,935 $65,019

Unrealized gain (loss) on hedge arrangements

... 63 (592)

Comprehensive income

.................................... $124,998 $64,427

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

January 3, 2004, December 28, 2002 and December 29, 2001

(in thousands, except per share data)

Page 30