Advance Auto Parts 2003 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2003 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

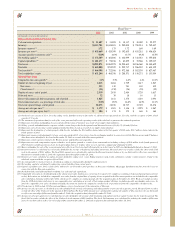

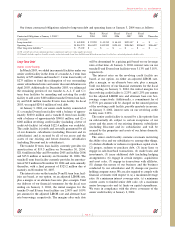

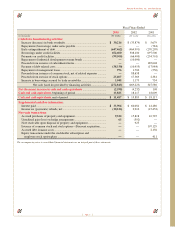

Our future contractual obligations related to long-term debt and operating leases at January 3, 2004 were as follows:

Fiscal Fiscal Fiscal Fiscal Fiscal

Contractual Obligations at January 3, 2004(1) Total 2004 2005 2006 2007 2008 Thereafter

(in thousands)

Long-term debt.................................................................... $ 445,000 $ 22,220 $ 49,210 $ 48,413 $325,157 $ — $ —

Operating leases .................................................................. $1,018,270 $163,822 $142,520 $125,411 $108,963 $90,667 $386,887

Other long-term liabilities(2) ................................................ $ 75,102 $ — $ — $ — $ — $ — $ —

(1) We currently do not have minimum purchase commitments under our vendor supply agreements.

(2) Primarily includes employee benefits accruals, restructuring and closed store liabilities and deferred income taxes for which no contractual payment schedule exists.

Page 19

Advance Auto Parts, Inc. and Subsidiaries

Long-Term Debt

Senior Credit Facility

In March 2003, we added incremental facilities under our

senior credit facility in the form of a tranche A-1 term loan

facility of $75 million and tranche C-1 term loan facility of

$275 million to fund the redemption of our outstanding

senior subordinated notes and senior discount debentures in

April 2003. Additionally in December 2003, we refinanced

the remaining portion of our tranche A, A-1, C and C-1

term loan facilities by amending and restating the credit

facility to add a new $100 million tranche D term loan facil-

ity and $340 million tranche E term loan facility. In fiscal

2003, we repaid $291.0 million of total debt.

At January 3, 2004, our senior credit facility consisted of

(1) a tranche D term loan facility with a balance of approx-

imately $100.0 million and a tranche E term loan facility

with a balance of approximately $340.0 million, and (2) a

$160 million revolving credit facility (including a letter of

credit sub facility) (of which $122.4 million was available).

The credit facility is jointly and severally guaranteed by all

of our domestic subsidiaries (including Discount and its

subsidiaries) and is secured by all of our assets and the

assets of our existing and future domestic subsidiaries

(including Discount and its subsidiaries).

The tranche D term loan facility currently provides for

amortization of $19.3 million on November 30, 2004,

$21.6 million in May and November 2005 and in May 2006

and $15.8 million at maturity on November 30, 2006. The

tranche E term loan facility currently provides for amortiza-

tion of $2.9 million in November 30, 2004 and semi-annually

thereafter, with a final payment of $325.2 million due at

maturity on November 30, 2007.

The interest rates on the tranche D and E term loan facil-

ities are based, at our option, on an adjusted LIBOR rate,

plus a margin, or an alternate base rate, plus a margin. Until

our delivery of our financial statements for the fiscal year

ending on January 3, 2004, the initial margins for the

tranche D and E term loan facilities are 2.00% and 1.00%

per annum for the adjusted LIBOR rate and alternate base

rate borrowings, respectively. The margins after such date

will be determined by a pricing grid based on our leverage

ratio at that time. At January 3, 2004, interest rates on our

tranche D and E term loan facilities were 3.13% and 3.18%,

respectively.

The interest rates on the revolving credit facility are

based, at our option, on either an adjusted LIBOR rate,

plus a margin, or an alternate base rate, plus a margin.

Until our delivery of our financial statements for the fiscal

year ending on January 3, 2004, the initial margins for

the revolving credit facility is 2.25% and 1.25% per annum

for the adjusted LIBOR rate and alternate base rate bor-

rowings, respectively. Additionally, a commitment fee of

0.375% per annum will be charged on the unused portion

of the revolving credit facility, payable quarterly in arrears.

At January 3, 2004, interest rates on our revolving credit

facility were 3.38%.

The senior credit facility is secured by a first priority lien

on substantially all, subject to certain exceptions, of our

assets and the assets of our existing domestic subsidiaries

(including Discount and its subsidiaries) and will be

secured by the properties and assets of our future domestic

subsidiaries.

The senior credit facility contains covenants restricting

the ability of us and our subsidiaries to, among other things,

(1) declare dividends or redeem or repurchase capital stock,

(2) prepay, redeem or purchase debt, (3) incur liens or

engage in sale-leaseback transactions, (4) make loans and

investments, (5) incur additional debt (including hedging

arrangements), (6) engage in certain mergers, acquisitions

and asset sales, (7) engage in transactions with affiliates,

(8) change the nature of our business and the business

conducted by our subsidiaries and (9) change our passive

holding company status. We are also required to comply with

financial covenants with respect to (a) a maximum leverage

ratio, (b) a minimum interest coverage ratio, (c) a minimum

current assets to funded senior debt ratio, (d) a maximum

senior leverage ratio and (e) limits on capital expenditures.

We were in compliance with the above covenants of the

senior credit facility at January 3, 2004.