Advance Auto Parts 2003 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2003 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In December 2002, the FASB issued SFAS No. 148,

“Accounting for Stock-Based Compensation—Transition

and Disclosure an Amendment of FASB Statement No. 123.”

This statement amends SFAS 123, “Accounting for Stock-

Based Compensation” to allow for alternative methods of

transition for a voluntary change to the fair value based

method of accounting for stock issued to employees, who

we refer to as team members. This statement also amends

FASB No. 123 to require disclosure of the accounting

method used for valuation in both annual and interim

financial statements. This statement permits an entity to

recognize compensation expense under the prospective

method, modified prospective method or the retroactive

restatement method. If an entity elects to adopt this state-

ment, fiscal years beginning after December 15, 2003

must include this change in accounting for team member

stock-based compensation. We have adopted the enhanced

disclosure requirements of SFAS No. 148 and accordingly

included the related disclosures in the footnotes to our

consolidated financial statements included elsewhere

in this Annual Report. We have concluded that we will

continue to account for team member stock-based compen-

sation in accordance with Accounting Principles Board

No. 25, “Accounting for Stock Issued to Employees.”

In July 2003 (as subsequently updated in November 2003),

the FASB released EITF Issue No. 03-10, “Application of

Issue No. 02-16 by Resellers to Sales Incentives Offered

to Customers by Manufacturers.” This EITF addresses

whether a reseller should account for consideration received

from a vendor that is a reimbursement by the vendor for

honoring the vendor’s sales incentives offered directly to

consumers in accordance with the guidance in EITF Issue

No. 02-16. For purposes of this Issue, the “vendor’s sales

incentive offered directly to consumers” is limited to a ven-

dor’s incentive (i) that can be tendered by a consumer at

resellers that accept manufacturer’s incentives in partial (or

full) of the price charged by the reseller for the vendor’s

product, (ii) for which the reseller receives a direct reim-

bursement from the vendor (or a clearinghouse authorized

by the vendor) based on the face amount of the incentive,

(iii) for which the terms of reimbursement to the reseller for

the vendor’s sales incentive offered to the consumer must

not be influenced by or negotiated in conjunction with any

other incentive arrangements between the vendor and the

reseller but, rather may only be determined by the terms

of the incentive offered to consumers and (iv) whereby

the reseller is subject to an agency relationship with the

vendor, whether expressed or implied, in the sales incen-

tive transaction between the vendor and the consumer. The

consensus is that sales incentives that meet all of such

criteria are not subject to the guidance in Issue No. 02-16.

The release is effective for fiscal periods beginning after

November 25, 2003. We are currently evaluating the effect

of this release and do not expect that the adoption will

have a material impact on our financial position or results

of operations.

In December 2003, the FASB issued SFAS No. 132R,

“Employers’ Disclosures about Pensions and Other Post-

retirement Benefits.” SFAS No. 132R amends the disclosure

requirements of SFAS No. 132 to require additional disclo-

sures about assets, obligations, cash flow and net periodic

benefit cost of defined benefit pension plans and other

defined postretirement plans. This statement is effective for

fiscal periods ending after December 15, 2003 and for

interim periods beginning after December 15, 2003. We

adopted this statement during the fourth quarter of fiscal

2003 and accordingly included the related disclosures in the

other benefits footnote.

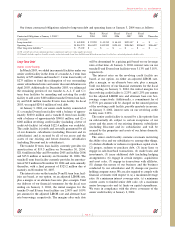

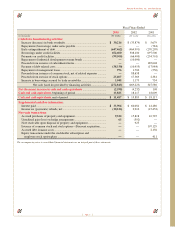

Quantitative and Qualitative Disclosures About Market Risks

We are exposed to cash flow risk due to changes in

interest rates with respect to our long-term debt. While we

cannot predict the impact interest rate movements will have

on our debt, exposure to rate changes is managed through

the use of fixed and variable rate debt and hedging activities.

Our variable rate debt is primarily vulnerable to movements

in the LIBOR rate. Our future exposure to interest rate risk

increased during 2003 due to the addition of variable rate debt

and redemption of our fixed rate senior subordinated notes

and senior discount debentures, all offset by decreased

interest rates, a reduction in overall debt levels and the

addition of two interest rate swaps.

In March 2003, we entered into two interest rate swap

agreements on an aggregate of $125 million of our variable

rate debt under our senior credit facility. The first swap

allows us to fix our LIBOR rate at 2.269% on $75 million

of variable rate debt for a term of 36 months. The second

swap allows us to fix our LIBOR rate at 1.79% on $50 mil-

lion of variable rate debt for a term of 24 months.

In September 2002, we entered into a hedge agreement in

the form of a zero-cost collar, which protects us against

interest rate fluctuations in the LIBOR rate on $150 million

of our variable rate debt under our senior credit facility. The

collar consists of an interest rate ceiling of 4.5% and an

interest floor of 1.56% for a term of 24 months. Under this

hedge, we will continue to pay interest at prevailing rates

plus any spread, as defined by our credit facility, but will be

reimbursed for any amounts paid on the LIBOR rate in

excess of the ceiling. Conversely, we will be required to pay

the financial institution that originated the collar if the

LIBOR rate is less than the 1.56% floor.

Page 21

Advance Auto Parts, Inc. and Subsidiaries