Advance Auto Parts 2003 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2003 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

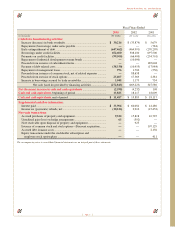

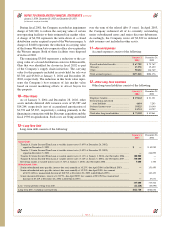

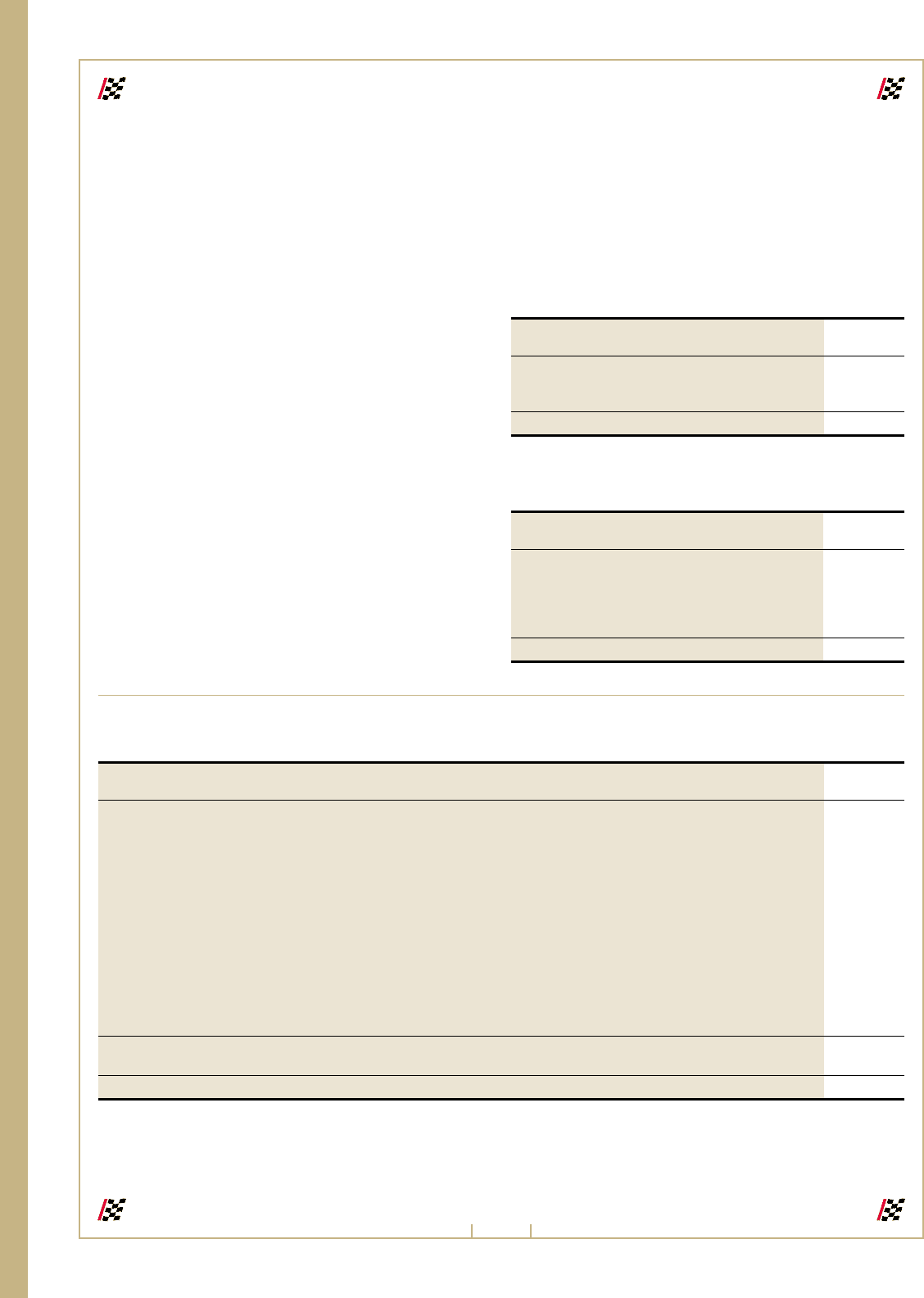

13—Long-Term Debt

Long-term debt consists of the following:

January 3, December 28,

2004 2002

Senior Debt:

Tranche A, Senior Secured Term Loan at variable interest rates (3.69% at December 28, 2002),

repaid on December 5, 2003........................................................................................................................................... $— $ 82,989

Tranche C, Senior Secured Term Loan at variable interest rates (3.69% at December 29, 2002),

repaid on December 5, 2003........................................................................................................................................... —248,099

Tranche D, Senior Secured Term Loan at variable interest rates (3.13% at January 3, 2004), due November 2006........ 100,000 —

Tranche E, Senior Secured Term Loan at variable interest rates (3.18% at January 3, 2004), due November 2007........ 340,000 —

Revolving facility at variable interest rates (3.38% at January 3, 2004), due November 2006......................................... 5,000 1,700

Subordinated Debt:

Senior subordinated notes payable, interest due semi-annually at 10.25%, due April 2008 (called March 2003) ........... —151,450

Senior subordinated notes payable, interest due semi-annually at 10.25%, due April 2008, face amount

of $174,365 less unamortized discount of $10,912 at December 28, 2002 (called March 2003) ................................. —163,453

Senior discount debentures, interest at 12.875%, due April 2009, face amount of $91,050 less unamortized

discount of $3,219 at December 28, 2002 (called March 2003).................................................................................... —87,831

445,000 735,522

Less: Current portion of long-term debt................................................................................................................................. (22,220) (10,690)

Long-term debt, excluding current portion............................................................................................................................. $422,780 $724,832

During fiscal 2001, the Company recorded an impairment

charge of $12,300, to reduce the carrying value of certain

non-operating facilities to their estimated fair market value.

A charge of $4,700 represents the write-down of a closed

distribution center acquired as part of the Western merger. A

charge of $4,600 represents the reduction in carrying value

of the former Western Auto corporate office also acquired in

the Western merger. Both of these facilities were disposed

of in fiscal 2002.

The remaining $3,000 represents a reduction to the car-

rying value of a closed distribution center in Jeffersonville,

Ohio that was identified for closure in fiscal 2002 as part

of the Company’s supply chain initiatives. The carrying

value for this property included in assets held for sale was

$5,700 and $5,800 at January 3, 2004 and December 28,

2002, respectively. The reduction in this book value repre-

sents the Company’s best estimate of fair market value

based on recent marketing efforts to attract buyers for

this property.

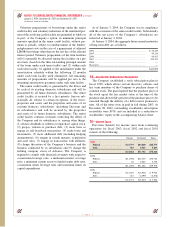

10—Other Assets

As of January 3, 2004 and December 28, 2002, other

assets include deferred debt issuance costs of $3,987 and

$14,244, respectively (net of accumulated amortization of

$1,793 and $5,837, respectively), relating primarily to the

financing in connection with the Discount acquisition and the

fiscal 1998 recapitalization. Such costs are being amortized

over the term of the related debt (5 years). In April 2003,

the Company redeemed all of its currently outstanding

senior subordinated notes and senior discount debentures.

Accordingly, the Company wrote off $9,822 in deferred

debt issuance cost included in other assets.

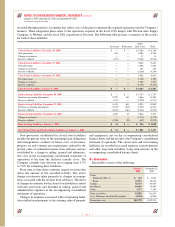

11—Accrued Expenses

Accrued expenses consist of the following:

January 3, December 28,

2004 2002

Payroll and related benefits....................... $ 67,788 $ 75,767

Warranty.................................................... 15,578 15,620

Other.......................................................... 90,452 116,789

Total accrued expenses.............................. $173,818 $208,176

12—Other Long-Term Liabilities

Other long-term liabilities consist of the following:

January 3, December 28,

2004 2002

Employee benefits..................................... $ 19,162 $ 21,321

Restructuring and closed

store liabilities....................................... 4,684 7,203

Deferred income taxes .............................. 39,525 10,140

Other.......................................................... 11,731 10,797

Total other long-term liabilities ................ $ 75,102 $ 49,461

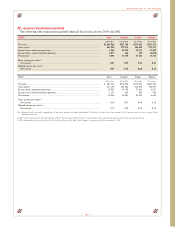

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

January 3, 2004, December 28, 2002 and December 29, 2001

(in thousands, except per share data)

Page 36